Answered step by step

Verified Expert Solution

Question

1 Approved Answer

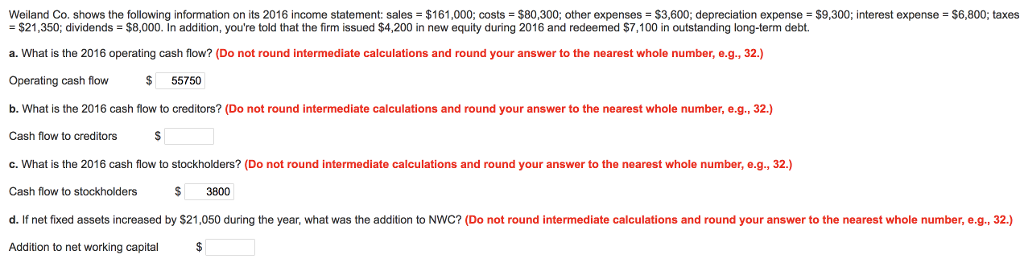

Weiland Co. shows the following information on its 2016 income statement: sales = $161,000; costs = $80,300; other expenses = $3,600; depreciation expense = $9,300;

Weiland Co. shows the following information on its 2016 income statement: sales = $161,000; costs = $80,300; other expenses = $3,600; depreciation expense = $9,300; interest expense = $6,800; taxes = $21,350; dividends = $8,000. In addition, you're told that the firm issued $4,200 in new equity during 2016 and redeemed $7,100 in outstanding long-term debt.

Weiland Co. shows the following information on its 2016 income statement: sales $161,000; costs $80,300; other expenses $3,600; depreciation expense $9,300; interest expense $6,800; taxes = $21,350; dividends-$8,000. In addition, you're told that the firm issued $4,200 in new equity during 2016 and redeemed $7,100 in outstanding long-term debt. a. What is the 2016 operating cash flow? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Operating cash flow55750 b. What is the 2016 cash flow to creditors? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Cash flow to creditors c. What is the 2016 cash flow to stockholders? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Cash flow to stockholders 3800 d. If net fixed assets increased by $21,050 during the year, what was the addition to NWC? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Addition to net working captalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started