Question

Welcome to your new job as an Analyst with Lexi Holdings, an investment firm with a wide range of investment holdings! Your first assignment is

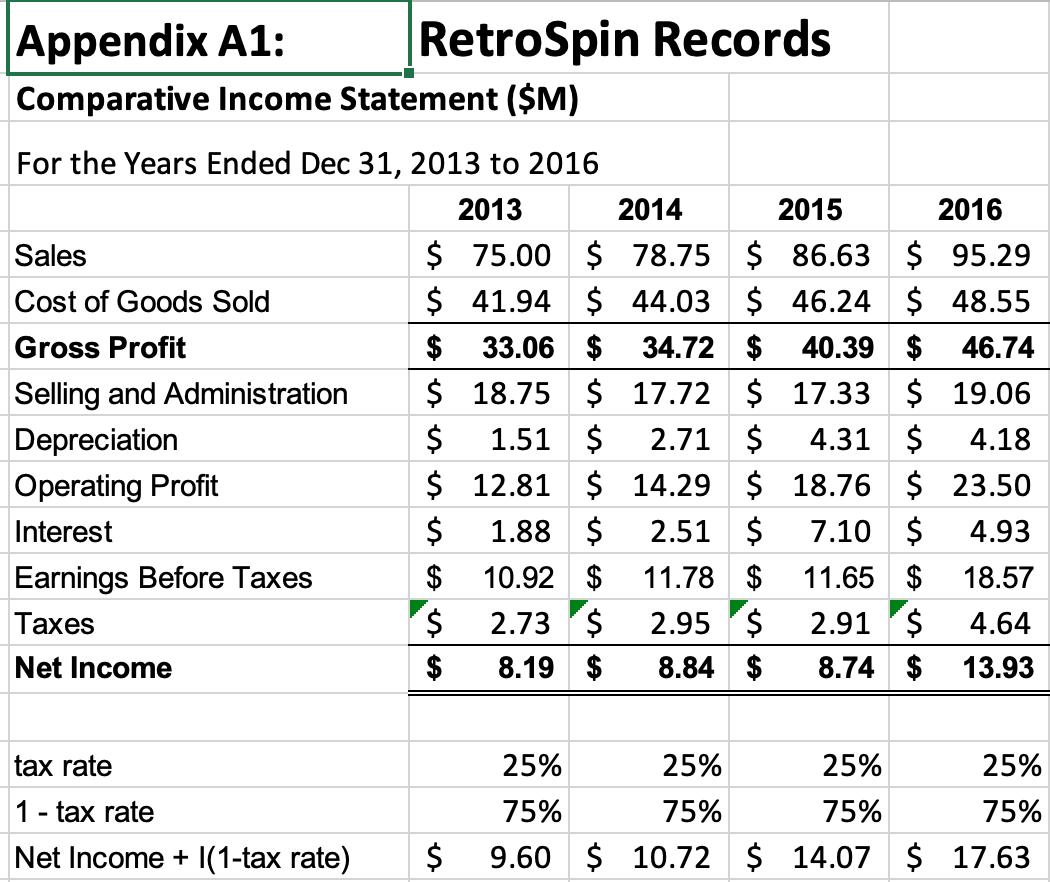

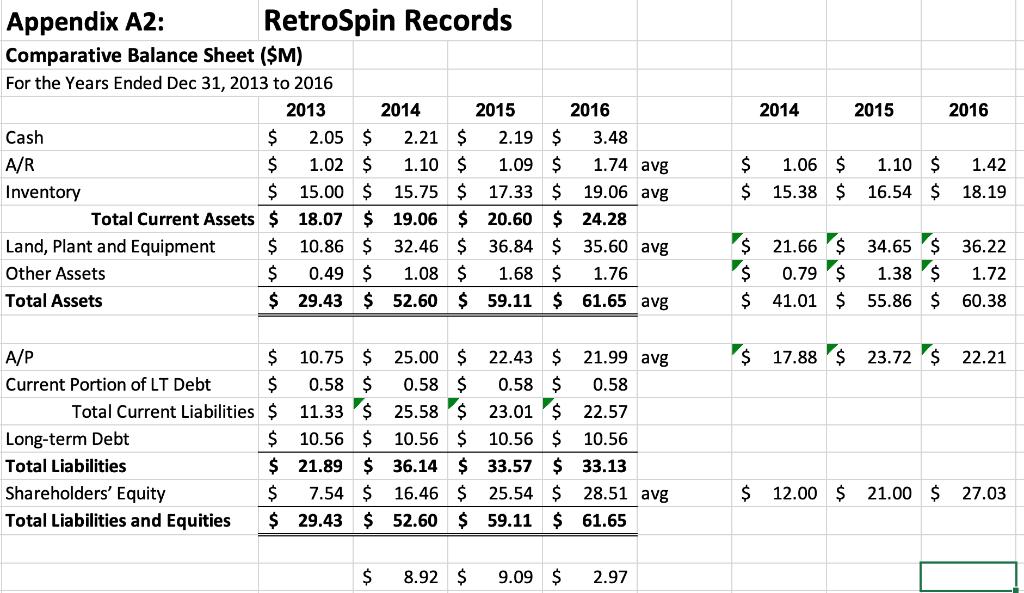

Welcome to your new job as an Analyst with Lexi Holdings, an investment firm with a wide range of investment holdings! Your first assignment is to assess RetroSpin. Your new boss, Wally Oliver, hands you a multi-year Income Statement (Appendix A1) and multi-year Balance Sheet (Appendix A2) for RetroSpin Records.

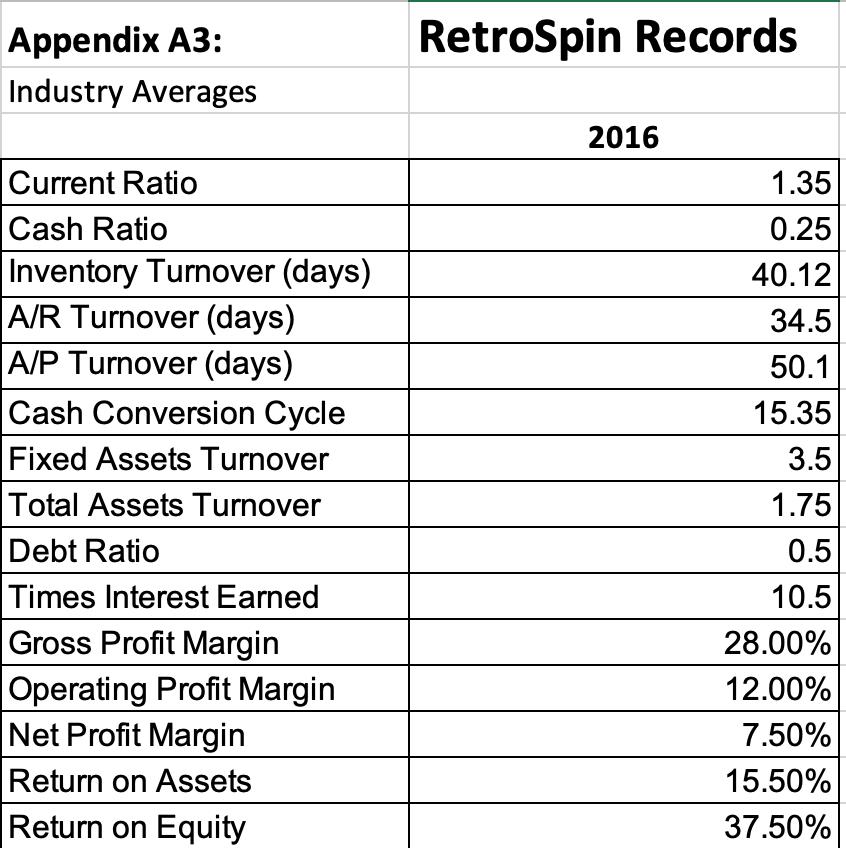

RetroSpin is record store, wholly owned by Lexi Holdings, catering to music enthusiasts who prefer vinal records over digital music or other music formats. RetroSpin brought on a new CEO in Jan 1, 2015. Your boss asks you to assess whether or not RetroSpin is doing well under the new CEO. Your job is to calculate and interpret important financial ratios and to make comments on how things have changed since the new CEO came on board. You are also required to compare RetroSpin to others in the industry. Appendix A3 contains industry average information.

Please use the information in Appendix A1 to A3 to calculate the following ratios:

- Current ratio

- Account Receivable ratio (or days receivable)

- Accounts Payable ratio (or days payable)

- Debt ratio

- Gross Profit margin

- Operating Profit margin

- Net Profit margin

- Return on Assets

- Return on Equity

Calculate each of the ratios above for 2014, 2015 and 2016. Interpret your calculations: what does this information mean? How is the company doing under the new CEO? (You should compare things before and after the CEO came on board). How is the company doing relative to the industry?

Appendix A1: Comparative Income Statement ($M) For the Years Ended Dec 31, 2013 to 2016 2013 Sales Cost of Goods Sold Gross Profit Selling and Administration RetroSpin Records Depreciation Operating Profit Interest Earnings Before Taxes Taxes Net Income tax rate 1 - tax rate Net Income + I(1-tax rate) 2015 2016 78.75 $ 86.63 $ 95.29 44.03 $ 46.24 $ 48.55 $ 33.06 $ 34.72 $ 40.39 $ 46.74 $18.75 $ 17.72 $ 17.33 $ 19.06 1.51 $ 2.71 $ 4.31 $ 4.18 12.81 $ $ 18.76 $ 23.50 1.88 $ 2.51 $ 7.10 $ 4.93 10.92 $ 11.78 $ 11.65 $ 18.57 2.73 $ 2.95 $ 2.91 $ 4.64 8.19 $ 8.84 $ 8.74 $ 13.93 $ $ 41.94 75.00 $ $ $ $ $ $ $ $ 2014 14.29 25% 25% 25% 75% 75% 75% $ 9.60 $ 10.72 $ 14.07 $ 25% 75% 17.63

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started