Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Weld Corporation is constructing a plant for its own use. Weld capitalizes interest on an annual basis. The following expenditures are made during the

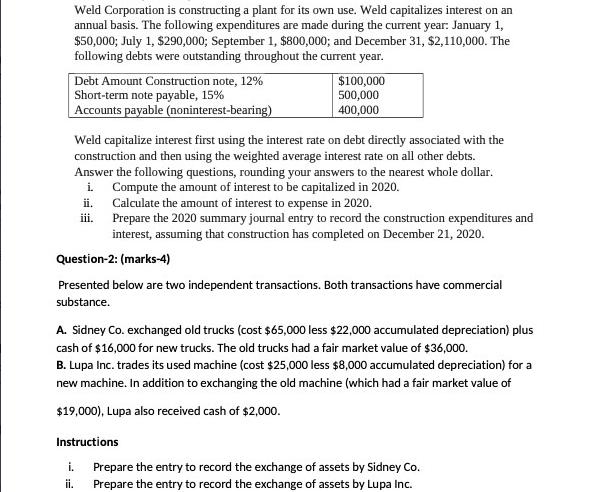

Weld Corporation is constructing a plant for its own use. Weld capitalizes interest on an annual basis. The following expenditures are made during the current year: January 1, $50,000; July 1, $290,000; September 1, $800,000; and December 31, $2,110,000. The following debts were outstanding throughout the current year. Debt Amount Construction note, 12% Short-term note payable, 15% Accounts payable (noninterest-bearing) Weld capitalize interest first using the interest rate on debt directly associated with the construction and then using the weighted average interest rate on all other debts. Answer the following questions, rounding your answers to the nearest whole dollar. i. Compute the amount of interest to be capitalized in 2020. ii. iii. $100,000 500,000 400,000 Question-2: (marks-4) Presented below are two independent transactions. Both transactions have commercial substance. Calculate the amount of interest to expense in 2020. Prepare the 2020 summary journal entry to record the construction expenditures and interest, assuming that construction has completed on December 21, 2020. A. Sidney Co. exchanged old trucks (cost $65,000 less $22,000 accumulated depreciation) plus cash of $16,000 for new trucks. The old trucks had a fair market value of $36,000. B. Lupa Inc. trades its used machine (cost $25,000 less $8,000 accumulated depreciation) for a new machine. In addition to exchanging the old machine (which had a fair market value of $19,000), Lupa also received cash of $2,000. Instructions i. ii. Prepare the entry to record the exchange of assets by Sidney Co. Prepare the entry to record the exchange of assets by Lupa Inc.

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution I Weighted average expenditure 30000x121...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started