Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Davey Portnoy is an investment management professional who used to work at a successful hedge fund firm based in Toronto. The hedge fund made

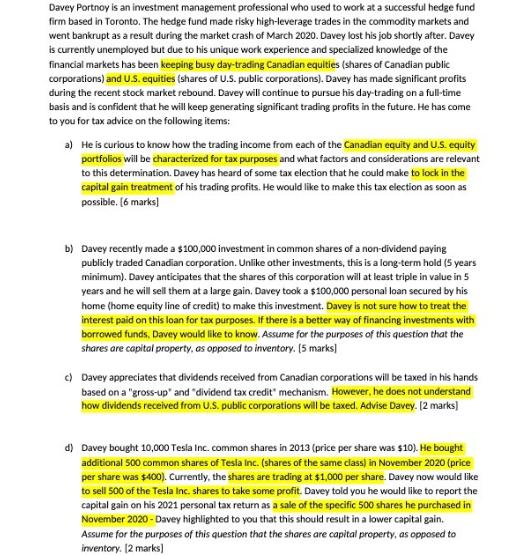

Davey Portnoy is an investment management professional who used to work at a successful hedge fund firm based in Toronto. The hedge fund made risky high-leverage trades in the commodity markets and went bankrupt as a result during the market crash of March 2020. Davey lost his job shortly after. Davey is currently unemployed but due to his unique work experience and specialized knowledge of the financial markets has been keeping busy day-trading Canadian equities (shares of Canadian public corporations) and U.S. equities (shares of U.S. public corporations). Davey has made significant profits during the recent stock market rebound. Davey will continue to pursue his day-trading on a full-time basis and is confident that he will keep generating significant trading profits in the future. He has come to you for tax advice on the following items: a) He is curious to know how the trading income from each of the Canadian equity and U.S. equity portfolios will be characterized for tax purposes and what factors and considerations are relevant to this determination. Davey has heard of some tax election that he could make to lock in the capital gain treatment of his trading profits. He would like to make this tax election as soon as possible. [6 marks] b) Davey recently made a $100,000 investment in common shares of a non-dividend paying publicly traded Canadian corporation. Unlike other investments, this is a long-term hold (5 years minimum). Davey anticipates that the shares of this corporation will at least triple in value in 5 years and he will sell them at a large gain. Davey took a $100,000 personal loan secured by his home (home equity line of credit) to make this investment. Davey is not sure how to treat the interest paid on this loan for tax purposes. If there is a better way of financing investments with borrowed funds, Davey would like to know. Assume for the purposes of this question that the shares are capital property, as opposed to inventory. [5 marks] c) Davey appreciates that dividends received from Canadian corporations will be taxed in his hands based on a "gross-up" and "dividend tax credit" mechanism. However, he does not understand how dividends received from U.S. public corporations will be taxed. Advise Davey. [2 marks] d) Davey bought 10,000 Tesla Inc. common shares in 2013 (price per share was $10). He bought additional 500 common shares of Tesla Inc. (shares of the same class) in November 2020 (price per share was $400). Currently, the shares are trading at $1,000 per share. Davey now would like to sell 500 of the Tesla Inc. shares to take some profit. Davey told you he would like to report the capital gain on his 2021 personal tax return as a sale of the specific 500 shares he purchased in November 2020-Davey highlighted to you that this should result in a lower capital gain. Assume for the purposes of this question that the shares are capital property, as opposed to inventory. [2 marks]

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a The trading income from both the Canadian equity and US equity portfolios will be characterized as business income for tax purposes since Davey is actively daytrading and generating profits on a ful...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started