Answered step by step

Verified Expert Solution

Question

1 Approved Answer

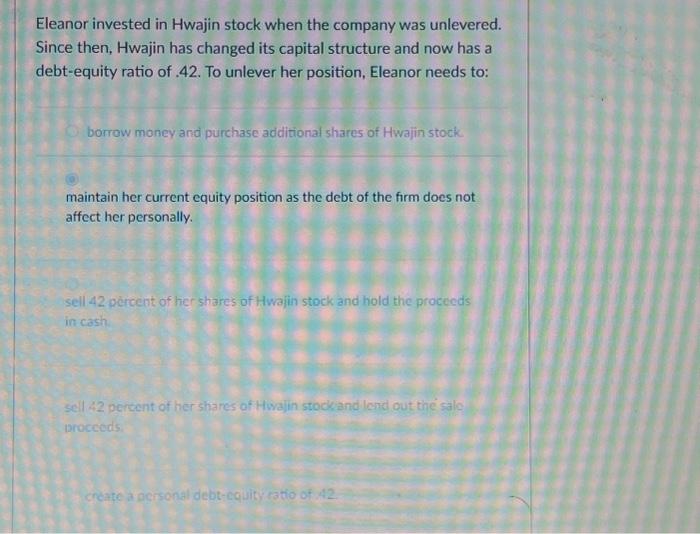

wEleanor invested in Hwajin stock when the company was unlevered. Since then, Hwajin has changed its capital structure and now has a debt-equity ratio of

wEleanor invested in Hwajin stock when the company was unlevered. Since then, Hwajin has changed its capital structure and now has a debt-equity ratio of .42. To unlever her position, Eleanor needs to: borrow money and purchase additional shares of Hwajin stock. maintain her current equity position as the debt of the firm does not affect her personally. sell 42 percent of her shares of Hwajin stock and hold the proceeds in cash sell 42 percent of her shares of Hwajin stock and lend out the sale proceeds create a personal debt-equity ratio of 42.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started