Question

Well Tool, Inc., a manufacturer of welding tools, divided its manufacturing process into two Departments - Machining and Finishing. The estimated overhead costs for

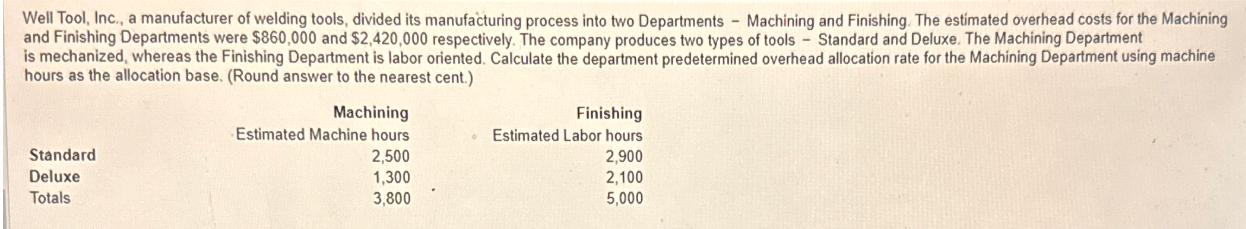

Well Tool, Inc., a manufacturer of welding tools, divided its manufacturing process into two Departments - Machining and Finishing. The estimated overhead costs for the Machining and Finishing Departments were $860,000 and $2,420,000 respectively. The company produces two types of tools - Standard and Deluxe. The Machining Department is mechanized, whereas the Finishing Department is labor oriented. Calculate the department predetermined overhead allocation rate for the Machining Department using machine hours as the allocation base. (Round answer to the nearest cent.) Standard Deluxe Totals Machining Estimated Machine hours 2,500 1,300 3,800 Finishing Estimated Labor hours 2,900 2,100 5,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Financial and Managerial Accounting

Authors: Tracie L. Nobles, Brenda L. Mattison, Ella Mae Matsumura

5th edition

9780133851281, 013385129x, 9780134077321, 133866297, 133851281, 9780133851298, 134077326, 978-0133866292

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App