Answered step by step

Verified Expert Solution

Question

1 Approved Answer

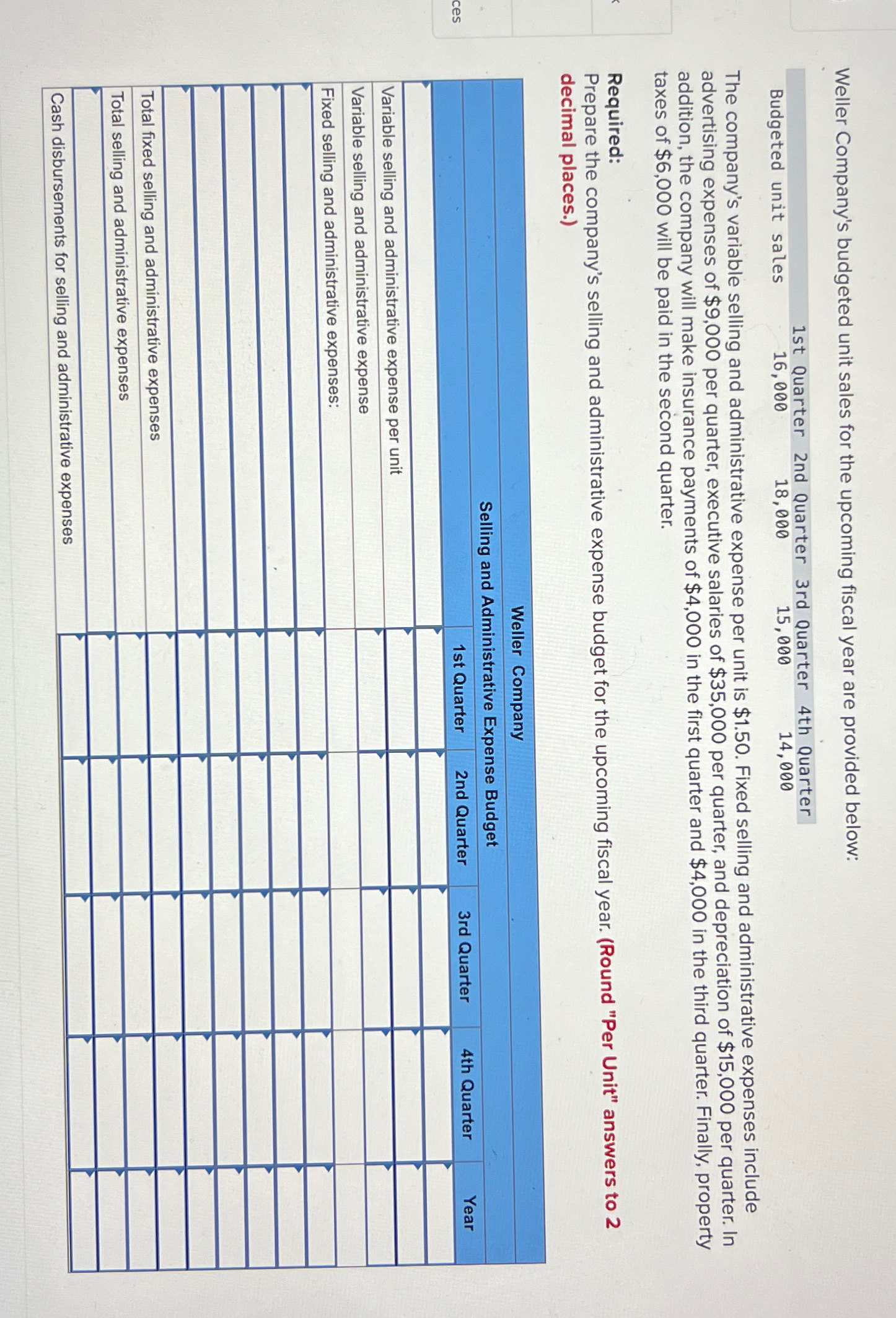

Weller Company's budgeted unit sales for the upcoming fiscal year are provided below: table [ [ , 1 st Quarter, 2 nd Quarter, 3

Weller Company's budgeted unit sales for the upcoming fiscal year are provided below:

tablest Quarter,nd Quarter,rd Quarter,th QuarterBudgeted unit sales,

The company's variable selling and administrative expense per unit is $ Fixed selling and administrative expenses include advertising expenses of $ per quarter, executive salaries of $ per quarter, and depreciation of $ per quarter. In addition, the company will make insurance payments of $ in the first quarter and $ in the third quarter. Finally, property taxes of $ will be paid in the second quarter.

Required:

Prepare the company's selling and administrative expense budget for the upcoming fiscal year. Round "Per Unit" answers to decimal places.

tableWeller CompanySelling and Administrative Expense Budgetst Quarter,nd Quarter,rd Quarter,th Quarter,YearVariable selling and administrative expense per unittableVariable selling and administrative expense per unitVariable selling and administrative expensetableVariable selling and administrative expenseFixed selling and administrative expenses:Total fixed selling and administrative expensestableTotal fixed selling and administrative expensesTotal selling and administrative expensesCash disbursements for selling and administrative expenses,,,,,n

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started