Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Welles Fargo Bank, based in Los Angeles, California, can borrow 8 million U.S. dollars (USD) at 4% annualized. It can then invest in either

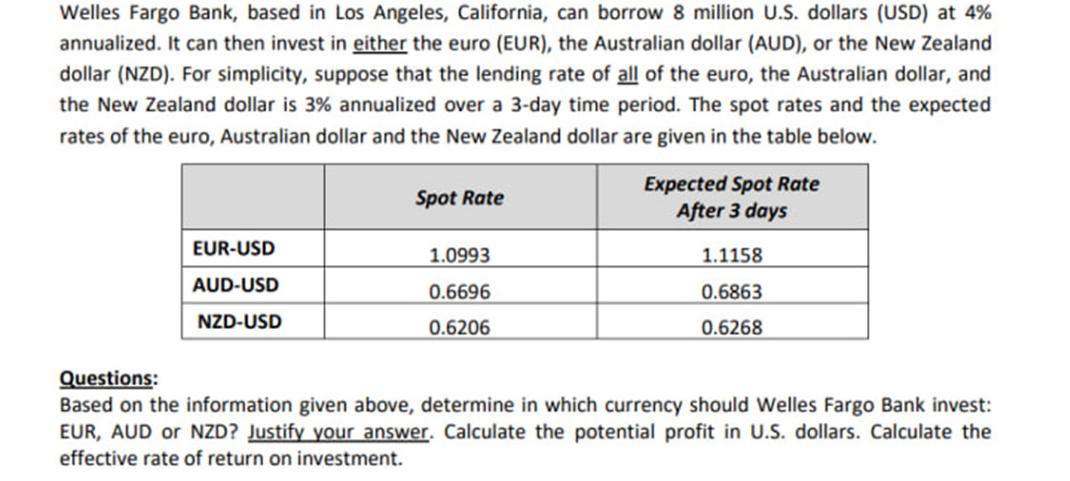

Welles Fargo Bank, based in Los Angeles, California, can borrow 8 million U.S. dollars (USD) at 4% annualized. It can then invest in either the euro (EUR), the Australian dollar (AUD), or the New Zealand dollar (NZD). For simplicity, suppose that the lending rate of all of the euro, the Australian dollar, and the New Zealand dollar is 3% annualized over a 3-day time period. The spot rates and the expected rates of the euro, Australian dollar and the New Zealand dollar are given in the table below. Spot Rate EUR-USD AUD-USD NZD-USD 1.0993 0.6696 0.6206 Expected Spot Rate After 3 days 1.1158 0.6863 0.6268 Questions: Based on the information given above, determine in which currency should Welles Fargo Bank invest: EUR, AUD or NZD? Justify your answer. Calculate the potential profit in U.S. dollars. Calculate the effective rate of return on investment.

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To determine in which currency Wells Fargo Bank should invest we need to calculate the potential profit in US dollars for each currency option EUR AUD ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started