Question

Wellington Corp. has outstanding accounts receivable totaling 2.54 million as of December 31 and sales on credit during the year of 12.8 million. There is

Wellington Corp. has outstanding accounts receivable totaling €2.54 million as of December 31 and sales on credit during the year of €12.8 million. There is also a debit balance of €6,000 in the allowance for doubtful accounts. If the company estimates that 1% of its net credit sales will be uncollectible, what will be the balance in the allowance for doubtful accounts after the year-end adjustment to record bad debt expense?

a. € 25,400

b. € 31,400

(c.) €122,000

d. €134,000

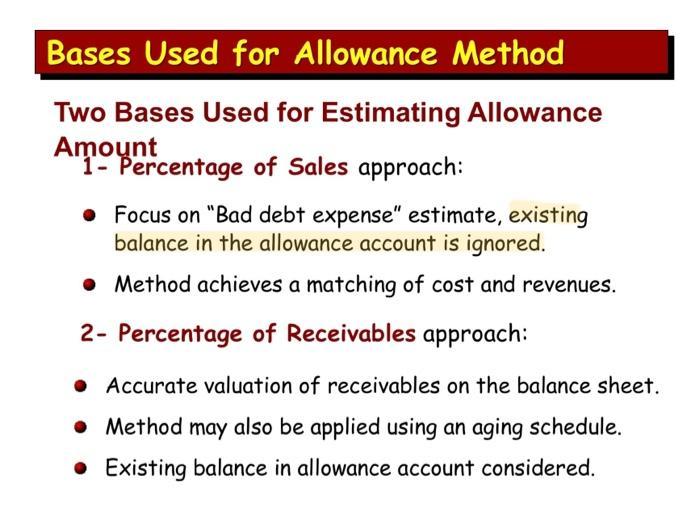

MY QUESTION IS why doesn't this question account for this highlighted text in the slide?

Bases Used for Allowance Method Two Bases Used for Estimating Allowance Amount 1- Percentage of Sales approach: . Focus on "Bad debt expense" estimate, existing balance in the allowance account is ignored. Method achieves a matching of cost and revenues. 2- Percentage of Receivables approach: Accurate valuation of receivables on the balance sheet. Method may also be applied using an aging schedule. Existing balance in allowance account considered.

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above questio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started