Question

Wells Fargo Bank: The Fake Accounts Scandal Discuss and analyze the issues of leadership, culture, motivation, and ethics involved in the fake account scandal at

Wells Fargo Bank: The Fake Accounts Scandal

Discuss and analyze the issues of leadership, culture, motivation, and ethics involved in the fake account scandal at Wells Fargo. How could Wells Fargo have operated/acted differently in the face of earlier instances of unethical practice. What role did organizational leaders like Stumpf and Tolstedt play in the course of the scandal and its resolution. Will the measures taken be effective, why or why not? And how could Wells Fargo better handle and mitigate such issues going forward?

Goals;

Connections to Theoretical and Empirical Research. Makes appropriate, insightful, and powerful connections between the issues and problems in the case and relevant theory and empirical data; effectively integrates multiple sources of knowledge with case information

Analysis and Evaluation. Presents a balanced, in-depth, and critical assessment of the facts of the case in light of relevant empirical and theoretical research; develops insightful and well-supported conclusions using reasoned, sound, and informed judgments

Action Plan. Effectively weighs and assesses a variety of alternative actions that address the multiple issues central to the case; proposes detailed plans of action; action plans are realistic and contain thorough and well-reasoned justifications

Evaluation of Consequences. Objectively and critically reflects upon alternative plans of action; effectively identifies, thoroughly discusses, and insightfully evaluates the implications and consequences resulting from the proposed action plans; identified consequences are tied to the key issues central to the case

Your responses should be no longer than three type-written pages, double-spaced, with 1 margins, using size 12 Times New Roman

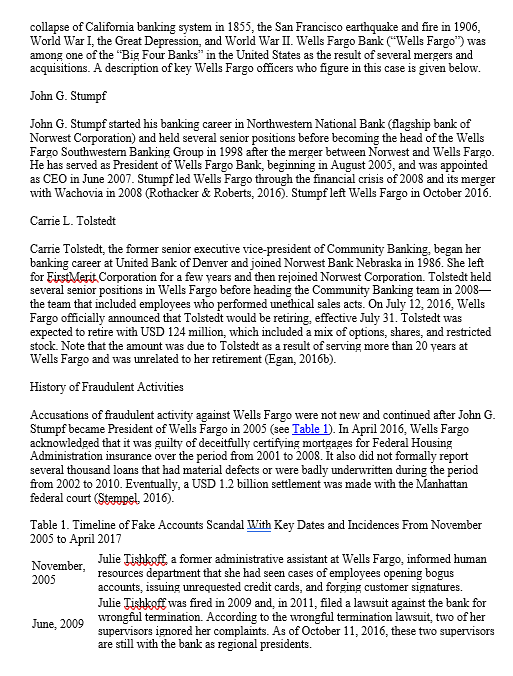

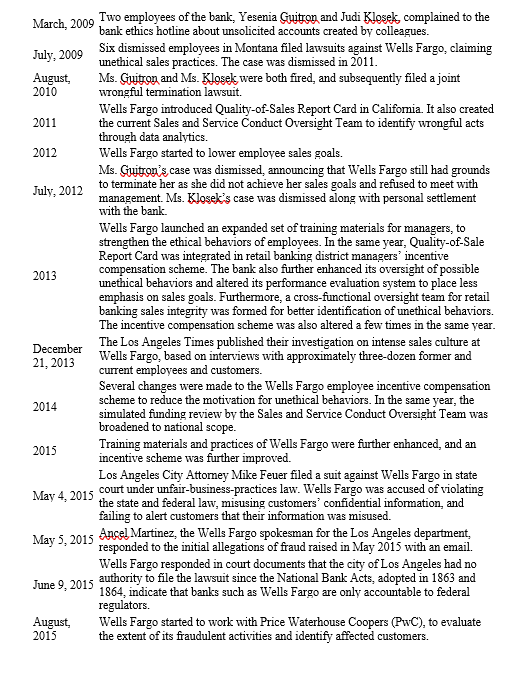

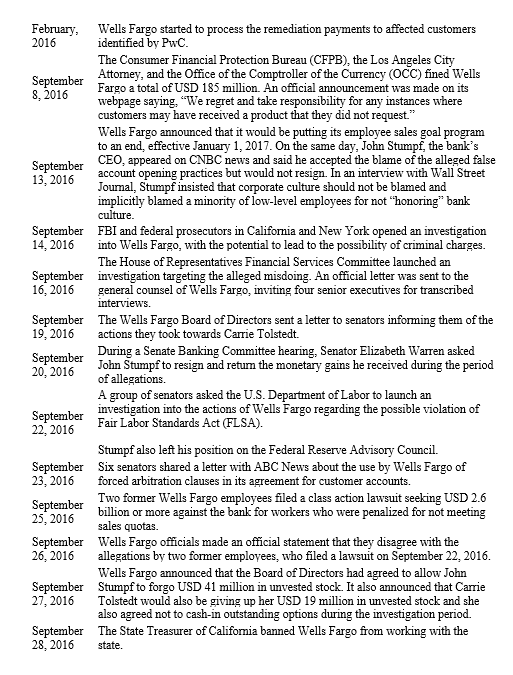

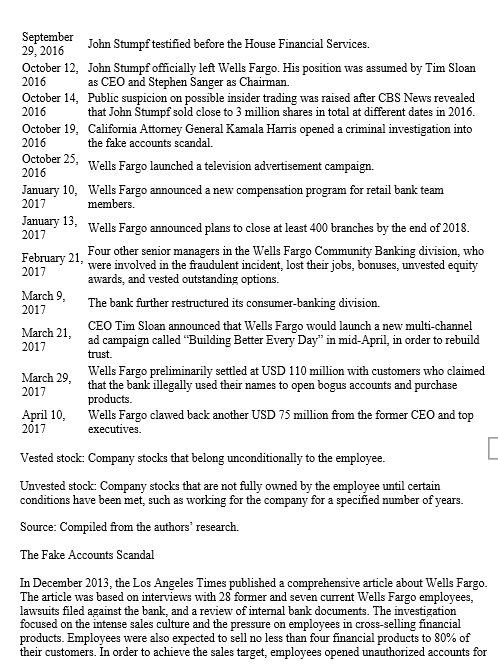

Abstract Wells Fargo Bank ("Wells Fargo") was once the world's largest bank by market capitalization with a net worth of USD 301.6 billion in 2015-USD 40 billion more than J. P. Morgan Chase. It was a U.S. bank headquartered in San Francisco, Califormia, that provided banking, mortgage, investing, credit card, insurance, and consumer and commercial financial services. In September 2016, Wells Fargo was fined USD 185 million by three government authorities for unauthorized creation of 2 million bank accounts and credit cards between May 2011 and July 2015 . This incident led to the questioning of company practices as well as a public scandal. The case raises the issue of what the management did to address the fake accounts scandal and what they could have done differently. Students can also debate who should be held responsible for the fake accounts scandal. Case Learning Outcomes By the end of this case study, students should be able to 1. comprehend how incentive schemes can influence employee behavior and lead to unexpected outcomes; 2. analyze whether actions taken by Wells Fargo were effective; and 3. understand the need for managers to deal with corporate scandals and crises in a timely and effective manner. Background Henry Wells and William Fargo founded Wells Fargo \& Co. in 1852 in San Francisco and Sacramento. Since then, Wells Fargo \& Co. experienced many adverse events including the collapse of California banking system in 1855, the San Francisco earthquake and fire in 1906, World War I, the Great Depression, and World War II. Wells Fargo Bank ("Wells Fargo") was among one of the "Big Four Banks" in the United States as the result of several mergers and acquisitions. A description of key Wells Fargo officers who figure in this case is given below. John G. Stumpf John G. Stumpf started his banking career in Northwestern National Bank (flagship bank of Norwest Corporation) and held several senior positions before becoming the head of the Wells Fargo Southwestern Banking Group in 1998 after the merger between Norwest and Wells Fargo. He has served as President of Wells Fargo Bank, beginning in August 2005, and was appointed as CEO in June 2007. Stumpf led Wells Fargo through the financial crisis of 2008 and its merger with Wachovia in 2008 (Rothacker \& Roberts, 2016). Stumpf left Wells Fargo in October 2016. Carrie L. Tolstedt Carrie Tolstedt, the former senior executive vice-president of Community Banking, began her banking career at United Bank of Denver and joined Norwest Bank Nebraska in 1986. She left for Firstalerit Corporation for a few years and then rejoined Norwest Corporation. Tolstedt held several senior positions in Wells Fargo before heading the Community Banking team in 2008the team that included employees who performed unethical sales acts. On July 12, 2016, Wells Fargo officially announced that Tolstedt would be retiring, effective July 31 . Tolstedt was expected to retire with USD 124 million, which included a mix of options, shares, and restricted stock. Note that the amount was due to Tolstedt as a result of serving more than 20 years at Wells Fargo and was unrelated to her retirement (Egan, 2016b). History of Fraudulent Activities Accusations of fraudulent activity against Wells Fargo were not new and continued after John G. Stumpf became President of Wells Fargo in 2005 (see Table 1). In April 2016, Wells Fargo acknowledged that it was guilty of deceitfully certifying mortgages for Federal Housing Administration insurance over the period from 2001 to 2008 . It also did not formally report several thousand loans that had material defects or were badly underwritten during the period from 2002 to 2010 . Eventually, a USD 1.2 billion settlement was made with the Manhattan federal court (Stempel, 2016). Table 1. Timeline of Fake Accounts Scandal With Key Dates and Incidences From November 2005 to April 2017 November, Julie Tishkoff, a former administrative assistant at Wells Fargo, informed human 2005 resources department that she had seen cases of employees opening bogus accounts, issuing unrequested credit cards, and forging customer signatures. Julie Tishkeff was fired in 2009 and, in 2011, filed a lawsuit against the bank for June, 2009 wrongful termination. According to the wrongful termination lawsuit, two of her supervisors ignored her complaints. As of October 11, 2016, these two supervisors are still with the bank as regional presidents. March, 2009 Two employees of the bank, Yesenia Guitron and Judi Klosek, complained to the bank ethics hotline about unsolicited accounts created by colleagues. July, 2009 Six dismissed employees in Montana filed lawsuits against Wells Fargo, claiming unethical sales practices. The case was dismissed in 2011. August, Ms. Guitron and Ms. Klosel were both fired, and subsequently filed a joint 2010 wrongful termination lawsuit. Wells Fargo introduced Quality-of-Sales Report Card in Califormia. It also created 2011 the current Sales and Service Conduct Oversight Team to identify wrongful acts through data analytics. 2012 Wells Fargo started to lower employee sales goals. Ms. Guitron's, case was dismissed, announcing that Wells Fargo still had grounds July, 2012 to terminate her as she did not achieve her sales goals and refused to meet with management. Ms. Kloselis's case was dismissed along with personal settlement with the bank. Wells Fargo launched an expanded set of training materials for managers, to strengthen the ethical behaviors of employees. In the same year, Quality-of-Sale Report Card was integrated in retail banking district managers' incentive compensation scheme. The bank also further enhanced its oversight of possible unethical behaviors and altered its performance evaluation system to place less emphasis on sales goals. Furthermore, a cross-functional oversight team for retail banking sales integrity was formed for better identification of unethical behaviors. The incentive compensation scheme was also altered a few times in the same year. December The Los Angeles Times published their investigation on intense sales culture at 21,2013 Wells Fargo, based on interviews with approximately three-dozen former and current employees and customers. Several changes were made to the Wells Fargo employee incentive compensation scheme to reduce the motivation for unethical behaviors. In the same year, the simulated funding review by the Sales and Service Conduct Oversight Team was broadened to national scope. 2015 Training materials and practices of Wells Fargo were further enhanced, and an incentive scheme was further improved. Los Angeles City Attomey Mike Feuer filed a suit against Wells Fargo in state May 4, 2015 court under unfair-business-practices law. Wells Fargo was accused of violating failing to alert customers that their information was misused. May 5, 2015 Ancel Martinez, the Wells Fargo spokesman for the Los Angeles department, responded to the initial allegations of fraud raised in May 2015 with an email. Wells Fargo responded in court documents that the city of Los Angeles had no June 9,2015 authority to file the lawsuit since the National Bank Acts, adopted in 1863 and 1864 , indicate that banks such as Wells Fargo are only accountable to federal regulators. August, Wells Fargo started to work with Price Waterhouse Coopers (PwC), to evaluate 2015 the extent of its fraudulent activities and identify affected customers. February, Wells Fargo started to process the remediation payments to affected customers 2016 identified by PwC. The Consumer Financial Protection Bureau (CFPB), the Los Angeles City Attomey, and the Office of the Comptroller of the Currency (OCC) fined Wells September Fargo a total of USD 185 million. An official announcement was made on its 8, 2016 webpage saying. "We regret and take responsibility for any instances where customers may have received a product that they did not request." Wells Fargo announced that it would be putting its employee sales goal program to an end, effective January 1, 2017. On the same day, John Stumpf, the bank's September CEO, appeared on CNBC news and said he accepted the blame of the alleged false 13, 2016 account opening practices but would not resign. In an interview with Wall Street Joumal, Stumpf insisted that corporate culture should not be blamed and implicitly blamed a minority of low-level employees for not "honoring" bank culture. September FBI and federal prosecutors in California and New York opened an investigation 14, 2016 into Wells Fargo, with the potential to lead to the possibility of criminal charges. The House of Representatives Financial Services Committee launched an September investigation targeting the alleged misdoing. An official letter was sent to the 16, 2016 general counsel of Wells Fargo, inviting four senior executives for transcribed interviews. September The Wells Fargo Board of Directors sent a letter to senators informing them of the 19, 2016 actions they took towards Carrie Tolstedt. September During a Senate Banking Committee hearing, Senator Elizabeth Warren asked 20,2016 John Stumpf to resign and retum the monetary gains he received during the period of allegations. A group of senators asked the U.S. Department of Labor to launch an September investigation into the actions of Wells Fargo regarding the possible violation of 22, 2016 Fair Labor Standards Act (FLSA). Stumpf also left his position on the Federal Reserve Advisory Council. September Six senators shared a letter with ABC News about the use by Wells Fargo of 23, 2016 forced arbitration clauses in its agreement for customer accounts. September Two former Wells Fargo employees filed a class action lawsuit seeking USD 2.6 25,2016 billion or more against the bank for workers who were penalized for not meeting sales quotas. September Wells Fargo officials made an official statement that they disagree with the 26, 2016 allegations by two former employees, who filed a lawsuit on September 22, 2016. Wells Fargo announced that the Board of Directors had agreed to allow John September Stumpf to forgo USD 41 million in unvested stock. It also announced that Carrie 27,2016 Tolstedt would also be giving up her USD 19 million in unvested stock and she also agreed not to cash-in outstanding options during the investigation period. September The State Treasurer of Califormia banned Wells Fargo from working with the 28,2016 state. September John Stumpf testified before the House Financial Services. 29,2016 October 12, John Stumpf officially left Wells Fargo. His position was assumed by Tim Sloan 2016 as CEO and Stephen Sanger as Chairman. October 14, Public suspicion on possible insider trading was raised after CBS News revealed 2016 that John Stumpf sold close to 3 million shares in total at different dates in 2016. October 19, California Attorney General Kamala Harris opened a criminal investigation into 2016 the fake accounts scandal. October 25, Wells Fargo launched a television advertisement campaign. 2016 January 10, Wells Fargo announced a new compensation program for retail bank team 2017 members. January 13, Wells Fargo announced plans to close at least 400 branches by the end of 2018 . February 21, Four other senior managers in the Wells Fargo Community Banking division, who 2017 were involved in the fraudulent incident, lost their jobs, bonuses, unvested equity awards, and vested outstanding options. March 9, The bank further restructured its consumer-banking division. March 21, CEO Tim Sloan announced that Wells Fargo would launch a new multi-channel 2017 ad campaign called "Building Better Every Day" in mid-April, in order to rebuild trust. March 29, Wells Fargo preliminarily settled at USD 110 million with customers who claimed 2017 , that the bank illegally used their names to open bogus accounts and purchase April 10, Wells Fargo clawed back another USD 75 million from the former CEO and top 2017 executives. Vested stock: Company stocks that belong unconditionally to the employee. Unvested stock: Company stocks that are not fully owned by the employee until certain conditions have been met, such as working for the company for a specified number of years. Source: Compiled from the authors' research. The Fake Accounts Scandal In December 2013, the Los Angeles Times published a comprehensive article about Wells Fargo. The article was based on interviews with 28 former and seven current Wells Fargo employees, lawsuits filed against the bank, and a review of intemal bank documents. The investigation focused on the intense sales culture and the pressure on employees in cross-selling financial products. Employees were also expected to sell no less than four financial products to 80% of their customers. In order to achieve the sales target, employees opened unauthorized accounts for customers, created credit card accounts, and even resorted to asking family members to open ghost accounts. Top Wells Fargo executives were expected to meet the "Great 8 " target selling an average of eight different financial products per household, which drove employees to resort to unethical and fraudulent sales practices (Whitehouse, 2015). Some former Wells Fargo employees claimed that managers trained them in ways to inflate the sales figures. Furthermore, a former fraud analyst in Wells Fargo Bank reported that she was asked to leave her job after reporting fraudulent practices of sales staff. Instead of taking disciplinary or investigative actions on unethical sales staff, the bank officials reprimanded her for not seeing the big picture (Hudson, 2016). Publication of an investigation by the Los Angeles Times, brought responses from several former Wells Fargo employees and customers. For example, one employee left because she was "fed up with the pressure to 'perform,' the shadiness of branches, the lack of integrity, and management's failure for accountability" (Reckard, 2013). And Wells Fargo customers complained that they were issued with credit cards and/or were issued new accounts without their explicit approval (Reckard, 2013). In May 2015, an unfair-business-practices lawsuit was filed by the Los Angeles City Attomey against Wells Fargo to seek remedies for customers in the state. Wells Fargo was accused of driving employees to misuse customers' confidential information, creating unapproved accounts, and charging fraudulent fees, thus violating Califomia's Unfair Competition Law. Bankers falsely told customers that in order to open a checking account they had to obtain a savings account, credit card, and other financial products. Some bankers even impersonated customers and registered online banking accounts for them, and falsely told customers that no monthly fees would be needed for these additional accounts. These sales tactics resulted in the opening of approximately 1.5 million deposit accounts and 564,433 credit card accounts without the permission of the customers concerned (Egan, 2016a). Past Controversies of Similar Incidents Several similar cases of unethical sales practices had been reported before 2011. In 2005, a former administrative assistant at Wells Fargo informed the human resources department that she had seen cases of employees opening bogus accounts, issuing unrequested credit cards, and forging customer signatures. However, she was fired in 2009 and had filed suit against the bank in 2011 for wrongful termination. In 2009, six dismissed employees in Montana also filed lawsuit against Wells Fargo, claiming unethical sales practices. Four years later, two Wells Fargo employees called the ethics hotline set up by the bank to complain about unsolicited accounts created by colleagues. As before, these employees were fired and, as a result, filed a joint wrongful termination lawsuit against the bank (Kingston \& Cowley, 2016). Past Actions Taken by Wells Fargo In 2011, Wells Fargo had put in place a Quality-of-Sale Report Card to deter and detect wrongful employee behaviors. Wells Fargo also created a Sales and Service Conduct Oversight Team to filter out fraudulent activities through data analytics. Between 2012 and 2015, Wells Fargo had lowered its branch-based employee sales goal by as much as 30%, in an effort to reduce the motivation for employees to perform fraudulent activities. In 2013, Wells Fargo introduced an expanded set of training materials for managers with the purpose of strengthening ethical behavior among employees. The Quality-of-Sale Report Card was integrated into the incentive compensation scheme operated by retail banking district managers and the Wells Fargo performance evaluation system was amended to place less emphasis on sales goals. From 2013 to 2015 , Wells Fargo continued to enhance its oversight of sales integrity issues and revise its incentive compensation scheme to reduce incidences of employees performing unethical acts. Furthermore, between 2011 and 2015 , the bank had laid off approximately 1% of its workforce annually as a result of sales practices violations (Committee of Financial services, 2016). During the scandal period, Wells Fargo reported its social commitments towards customers and stakeholders in its annual corporate social responsibility (CSR) report. For instance, the Wells Fargo interim report in 2014 focused on the importance of corporate social responsibility in its culture. In the 2016 "Shaping our CSR priorities" report (Wells Fargo, 2016), the bank showed it had been actively collecting customer feedback and measuring customer experience so as to better understand and satisfy customer needs. Wells Fargo Management's Initial Response Ancel Martinez, the Wells Fargo spokesman for the Los Angeles department, responded to the initial allegations of fraud in May 2015 , stating "we will vigorously defend ourselves against these allegations." Wells Fargo affirmed this in a public statement: "Wells Fargo's culture is focused on the best interest of its customers and creating a supportive, caring and ethical environment for our team members. This includes... our commitment to customers receiving only the products and services they need and will benefit from" (Whitehouse, 2015). Response by Government Bureaus to Wells Fargo The suit filed by the Los Angeles City Attorney spurred investigations by the Consumer Financial Protection Bureau (CFPB)-a U.S. government agency, and the Office of the Comptroller of the Currency (OCC) - an independent bureau of the U.S. Department of the Treasury. According to the lawsuit, the bank also had failed to notify affected customers when they discovered the sales team violations. As a result, the city sought a civil penalty of USD 2,500 for each infringement of California's Unfair Competition Law (Reckard, 2015). Investigations by the Office of the Comptroller of the Currency The OCC detected several fraudulent sales activities at Wells Fargo. These included the unauthorized creation of deposit or credit card accounts, transfer of funds, and credit inquiries. Throughout their investigation, the OCC discovered several causes of these fraudulent activities. First, the Community Banking division of Wells Fargo had a misaligned incentive compensation program. Second, the bank lacked programs to identify and prevent fraudulent sales activities. Third, the bank had inadequate audit coverage because it did not take into account an enterprisewide view of its sales practices. Fourth, the bank lacked a customer complaint monitoring process (Whitehouse, 2015). Investigations by Consumer Financial Protection Bureau The CFPB investigation produced similar findings to the OCC probe. Their analysis revealed that Wells Fargo staff had opened approximately 1.5 million unauthorized deposit accounts. Funds from customers' authorized accounts were then transferred to temporarily finance the new unauthorized accounts, which allowed employees to be rewarded for opening new accounts, thus meeting the company sales quota. But these actions by Wells Fargo staff also meant that customers were sometimes charged overdraft fees or penalties for inadequate funds, since the transfer of funds reduced the balance of their original accounts. Staff also falsely applied for approximately 565,000 credit card accounts without customer permission. As a result, some customers were charged annual fees, or related finance or interest charges. Furthermore, some employees applied for, or activated, debit cards and also created fake email addresses, and then enrolled customers in the online-banking program without their authorization. As a result of discovering this, the Office of the Comptroller of the Currency (OCC) ordered the bank to pay a USD 35 million civil penalty (Assembly Banking and Finance Committee, 2016). Consumer Financial Protection Bureau (CFPB) Enforcement Under the Dodd-Frank Wall Street Reform and Consumer Protection Act (legislation passed in the United States in 2010 as a response to the financial crisis of 2008, and commonly known as the Dodd-Frank Act), CFPB was authorized to take action against organizations breaching consumer financial laws. As a result, in 2016, the CFPB took several actions against Wells Fargo. First, the bank was asked to provide full refunds due to affected customers without requiring any action from the customers themselves. Second, the Wells Fargo operating procedures had to be reviewed by extemal consultants in order to prevent future improper activities. Third, the bank was ordered to pay a USD 100 million penalty to the CFPB Civil Penalty Fund, the largest penalty ever imposed by CFPB. Fourth, despite the initial claim by the bank that, under federal law, the City of Los Angeles had no authority to sue Wells Fargo, the bank settled with the city for a USD 50 million fine and USD 5 million for customer remediation. Several other requirements were imposed for the settlement with the City of Los Angeles, including sending stipulated written notices to credit card and deposit accounts holders in California, establishing certain procedures and policies promoting transparency, hiring an independent third party consulting firm to identify affected customers with direct monetary loss exceeding USD 1, and reimbursing identified customers within 90 days from the settlement date. A mediation process for affected current or past customers was also established. The bank was to send a notice to the customer about the mediation program within 60 days of a complaint being made at any branch in California or through the bank's feedback toll-free number. Bi-annual internal audit checking on the bank's compliance with the obligations of the settlement was required for at least two years after the settlement (Assembly Banking and Finance Committee, 2016). Aftermath of Verdict Subsequent Response by Well Fargo In September 2016, after the settlements with the three government authorities, Wells Fargo issued an official announcement at its webpage and announced its commitment to take responsibility for the unsolicited accounts. Wells Fargo also confirmed that it had dismissed approximately 5,300 employees who were involved in related fraudulent activities (Merle, 2016). In a September 2016 Wall Street Journal interview, Stumpf said, "There was no incentive to do bad things." He insisted that corporate culture should not be blamed and implicitly blamed a minority of low-level employees for not "honoring" the bank's culture (Belljware, 2016). In October 2016, Wells Fargo eliminated the employee sales goals program that was believed to have been the main cause of the fake accounts scandal. Consequences for John G. Stumpf and the Wells Fargo Management Team In September 2016, Wells Fargo announced that Stumpf would forgo his USD 41 million in unvested stock, voluntarily, and would not receive a salary. Similarly, Tolstedt gave up her USD 19 million in unvested stock and her ability to cash in outstanding options during the investigation period. Neither Stumpf nor Tolstedt would receive their 2016 bonuses. Four other senior managers in the Wells Fargo Community Banking division who had been involved in the fake accounts scandal lost their jobs as well as their bonuses, unvested equity awards, and vested outstanding options (McGrath, 2017). Consequences for the Company In addition to the USD 185 million penalties, Wells Fargo was given a year-long sanction by the California State Treasurer, terminating all state investment in Wells Fargo securities, the contract of Wells Fargo as a broker-dealer and as the managing underwriter on negotiated sales of California state bonds. Wells Fargo also announced plans to close at least 400 branches by the end of 2018 (Egan, 2017). The number of new checking accounts fell by 44% in November 2016 and 40% in January 2017 , compared with a year earlier. Furthermore, credit card applications dropped by 43% in December 2016 (Wiegzner, 2017) compared with the previous year and, in February 2017 , applications for credit cards were 55% lower than for the same period the previous year (Dugan, 2017). The Community Banking unit, the retail division of Wells Fargo, also reported 5\% lower revenue in the fourth quarter of 2016 and a 14% decrease in profit compared with the previous year. Although the bank still managed to earm a stable USD 21.6 billion in revenue in the fourth quarter of 2016, its profits dropped by almost 6%, to USD 5.3 billion. Other than the financial impact to the firm, the scandal also deeply scarred Wells Fargo's reputation. Negative perception of Wells Fargo increased from 15% before the settlement to 52% after the settlement. It was predicted that the scandal could cost the firm as much as USD 212 billion in deposits and USD 8 billion in sales over one-and-a-half years (Shen, 2016)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started