Question

Wells Printing is considering the purchase of a new printing press. The total installed cost of the press is $2.19 million. This outlay would be

Wells Printing is considering the purchase of a new printing press. The total installed cost of the press is $2.19 million. This outlay would be partially offset by the sale of an existing press. The old press has zero book value, cost $1.09 million 10 years ago, and can be sold currently for $1.15 million before taxes. As a result of acquisition of the new press, sales in each of the next 5 years are expected to be $1.66 million higher than with the existing press, but product costs (excluding depreciation) will represent 54% of sales. The new press will not affect the firm's net working capital requirements. The new press will be depreciated under MACRS using a 5-year recovery period. The firm is subject to a 40% tax rate. Wells Printing's cost of capital is 11.2%.

a. Determine the initial investment required by the new press.

b. Determine the operating cash inflows attributable to the new press. (Note: Be sure to consider the depreciation in year 6.)

c. Determine the payback period.

d. Determine the net present value (NPV) and the internal rate of return (IRR) related to the proposed new press.

e. Make a recommendation to accept or reject the new press, and justify your answer.

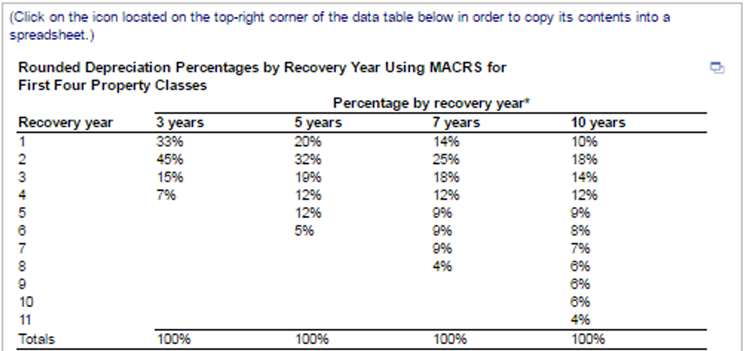

These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to sooty the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention.

(Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Recovery year 1 8479AWNI 2 3 6 9 10 11 Totals 3 years 33% 45% 15% 7% 100% 5 years 20% 32% 19% 12% 12% 5% Percentage by recovery year* 7 years 100% 14% 25% 18% 12% 9% 9% 9% 4% 100% 10 years 10% 18% 14% 12% 9% 8% 7% 6% 6% 6% 4% 100%

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a initial investment required by the press Cost Salvage1tax rate 2190000 1150000060 150000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started