Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wellvet Partners is renowned for its provision of currency hedging services to international clients. Recently, Square Corporation, a US-based firm, approached them for advice

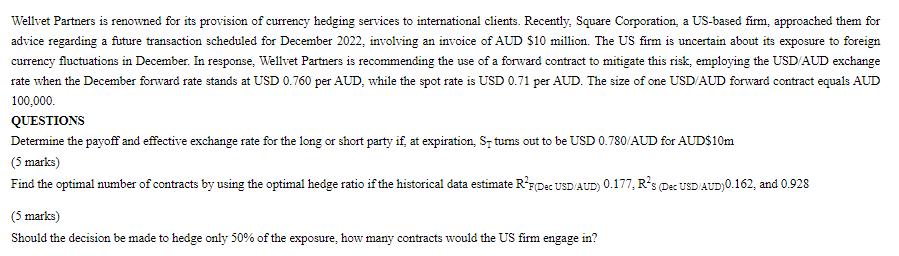

Wellvet Partners is renowned for its provision of currency hedging services to international clients. Recently, Square Corporation, a US-based firm, approached them for advice regarding a future transaction scheduled for December 2022, involving an invoice of AUD $10 million. The US firm is uncertain about its exposure to foreign currency fluctuations in December. In response, Wellvet Partners is recommending the use of a forward contract to mitigate this risk, employing the USD/AUD exchange rate when the December forward rate stands at USD 0.760 per AUD, while the spot rate is USD 0.71 per AUD. The size of one USD/AUD forward contract equals AUD 100,000. QUESTIONS Determine the payoff and effective exchange rate for the long or short party if, at expiration, S. tums out to be USD 0.780/AUD for AUD$10m (5 marks) Find the optimal number of contracts by using the optimal hedge ratio if the historical data estimate RF (Dec USD/AUD) 0.177, Rs (Dec USD AUD) 0.162, and 0.928 (5 marks) Should the decision be made to hedge only 50% of the exposure, how many contracts would the US firm engage in?

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Lets address each of your questions step by step 1 Determine the payoff and effective exchange rate for the long or short party if at expiration S tur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started