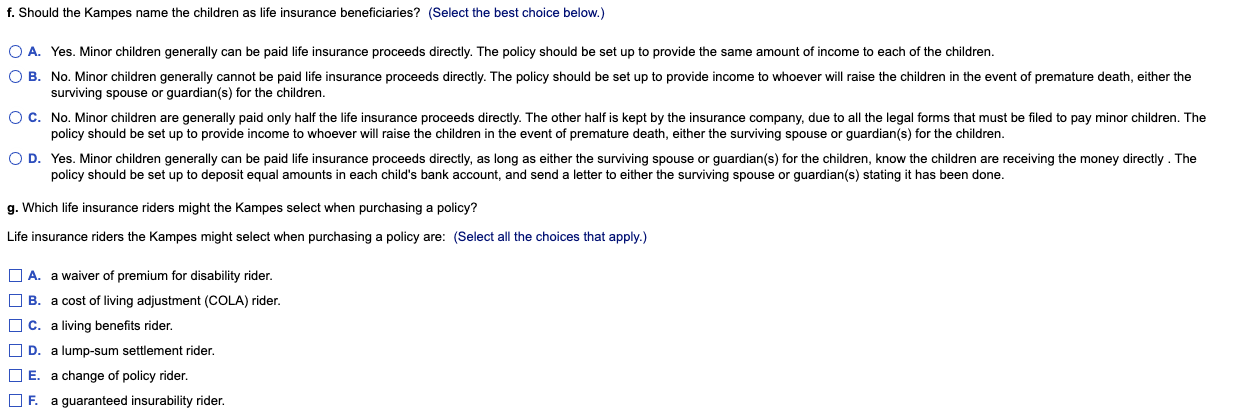

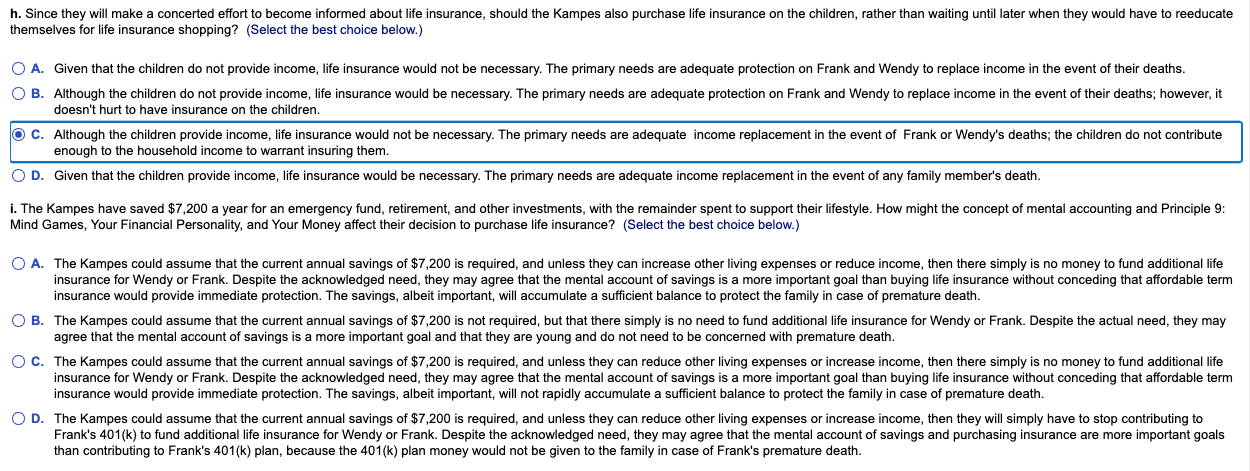

Wendy and Frank Kampe, 30 and 35, are considering the purchase of life insurance. Wendy doesn't have any coverage whereas Frank has a $145,000 group policy at work. The Kampes have two young children, ages 3 and 5. Wendy earns $28,000 annually from a part-time home-based business. Frank's annual salary is $53,000. From their income, they save $7,200 a year. The rest goes for expenses. The couple estimates that the children will be financially dependent, except for college costs, for about another 15 years. Once the children are in college, Wendy assumes their annual expenses will be $61,568. In preparation for a visit with their insurance agent, the Kampes have estimated the following expenses if Frank were to die They also anticipate, should Frank die, receiving $8,100 a year in Social Security survivor's benefits until the youngest child turns 18, and $5,000 annually in pension funds, until Wendy turns 80. Wendy projects her gross annual income to be $39,000 after her business expansion. Once the children are self-supporting, Wendy wants to plan a spousal life income, that is, funds to make up the difference between her income and pension benefits and her expenses, for 15 more years, from age 45 to 60. Lastly, she wants to plan on $31,000 a year in retirement income for another 20 years, from age 60 to 80. She anticipates receiving a 5 percent after-tax, after-inflation return on their investments. To date, the Kampes have accumulated a total of $106,000 of assets, not including $46,000 of home equity. Their assets include $10,000 in emergency funds, $12,000 in IRA funds for Wendy, $33,000 in other investments, and $51,000 in Frank's 401(k) plan. a. What method should the Kampes use to determine how much insurance they need? f. Should the Kampes name the children as life insurance beneficiaries? (Select the best choice below.) O A. Yes. Minor children generally can be paid life insurance proceeds directly. The policy should be set up to provide the same amount of income to each of the children. OB. No. Minor children generally cannot be paid life insurance proceeds directly. The policy should be set up to provide income to whoever will raise the children in the event of premature death, either the surviving spouse or guardian(s) for the children. O C. No. Minor children are generally paid only half the life insurance proceeds directly. The other half is kept by the insurance company, due to all legal forms that must be filed to pay minor children. The policy should be set up to provide income to whoever will raise the children in the event of premature death, either the surviving spouse or guardian(s) for the children. OD. Yes. Minor children generally can be paid life insurance proceeds directly, as long as either the surviving spouse or guardian(s) for the children, know the children are receiving the money directly. The policy should be set up to deposit equal amounts in each child's bank account, and send a letter to either the surviving spouse or guardian(s) stating it has been done. g. Which life insurance riders might the Kampes select when purchasing a policy? Life insurance riders the Kampes might select when purchasing a policy are: (Select all the choices that apply.) A. a waiver of premium for disability rider. B. a cost of living adjustment (COLA) rider. c. a living benefits rider. D. a lump-sum settlement rider. E. a change of policy rider. OF. a guaranteed insurability rider. h. Since they will make a concerted effort to become informed about life insurance, should the Kampes also purchase life insurance on the children, rather than waiting until later when they would have to reeducate themselves for life insurance shopping? (Select the best choice below.) O A. Given that the children do not provide income, life insurance would not be necessary. The primary needs are adequate protection on Frank and Wendy to replace income in the event of their deaths. O B. Although the children do not provide income, life insurance would be necessary. The primary needs are adequate protection on Frank and Wendy to replace income in the event of their deaths; however, it doesn't hurt to have insurance on the children. O C. Although the children provide income, life insurance would not be necessary. The primary needs are adequate income replacement in the event of Frank or Wendy's deaths; the children do not contribute enough to the household income to warrant insuring them. OD. Given that the children provide income, life insurance would be necessary. The primary needs are adequate income replacement in the event of any family member's death. i. The Kampes have saved $7,200 a year for an emergency fund, retirement, and other investments, with the remainder spent to support their lifestyle. How might the concept of mental accounting and Principle 9: Mind Games, Your Financial Personality, and Your Money affect their decision to purchase life insurance? (Select the best choice below.) O A. The Kampes could assume that the current annual savings of $7,200 is required, and unless they can increase other living expenses or reduce income, then there simply is no money to fund additional life insurance for Wendy or Frank. Despite the acknowledged need, they may agree that the mental account of savings is a more important goal than buying life insurance without conceding that affordable term insurance would provide immediate protection. The savings, albeit important, will accumulate a sufficient balance to protect the family in case of premature death. OB. The Kampes could assume that the current annual savings of $7,200 is not required, but that there simply is no need to fund additional life insurance for Wendy or Frank. Despite the actual need, they may agree that the mental account of savings is a more important goal and that they are young and do not need to be concerned with premature death. OC. The Kampes could assume that the current annual savings of $7,200 is required, and unless they can reduce other living expenses or increase income, then there simply is no money to fund additional life insurance for Wendy or Frank. Despite the acknowledged need, they may agree that the mental account of savings is a more important goal than buying life insurance without conceding that affordable term insurance would provide immediate protection. The savings, albeit important, will not rapidly accumulate a sufficient balance to protect the family in case of premature death. OD. The Kampes could assume that the current annual savings of $7,200 is required, and unless they can reduce other living expenses or increase income, then they will simply have to stop contributing to Frank's 401(k) to fund additional life insurance for Wendy or Frank. Despite the acknowledged need, they may agree that the mental account of savings and purchasing insurance are more important goals than contributing to Frank's 401(k) plan, because the 401(k) plan money would not be given to the family in case of Frank's premature death. Wendy and Frank Kampe, 30 and 35, are considering the purchase of life insurance. Wendy doesn't have any coverage whereas Frank has a $145,000 group policy at work. The Kampes have two young children, ages 3 and 5. Wendy earns $28,000 annually from a part-time home-based business. Frank's annual salary is $53,000. From their income, they save $7,200 a year. The rest goes for expenses. The couple estimates that the children will be financially dependent, except for college costs, for about another 15 years. Once the children are in college, Wendy assumes their annual expenses will be $61,568. In preparation for a visit with their insurance agent, the Kampes have estimated the following expenses if Frank were to die They also anticipate, should Frank die, receiving $8,100 a year in Social Security survivor's benefits until the youngest child turns 18, and $5,000 annually in pension funds, until Wendy turns 80. Wendy projects her gross annual income to be $39,000 after her business expansion. Once the children are self-supporting, Wendy wants to plan a spousal life income, that is, funds to make up the difference between her income and pension benefits and her expenses, for 15 more years, from age 45 to 60. Lastly, she wants to plan on $31,000 a year in retirement income for another 20 years, from age 60 to 80. She anticipates receiving a 5 percent after-tax, after-inflation return on their investments. To date, the Kampes have accumulated a total of $106,000 of assets, not including $46,000 of home equity. Their assets include $10,000 in emergency funds, $12,000 in IRA funds for Wendy, $33,000 in other investments, and $51,000 in Frank's 401(k) plan. a. What method should the Kampes use to determine how much insurance they need? f. Should the Kampes name the children as life insurance beneficiaries? (Select the best choice below.) O A. Yes. Minor children generally can be paid life insurance proceeds directly. The policy should be set up to provide the same amount of income to each of the children. OB. No. Minor children generally cannot be paid life insurance proceeds directly. The policy should be set up to provide income to whoever will raise the children in the event of premature death, either the surviving spouse or guardian(s) for the children. O C. No. Minor children are generally paid only half the life insurance proceeds directly. The other half is kept by the insurance company, due to all legal forms that must be filed to pay minor children. The policy should be set up to provide income to whoever will raise the children in the event of premature death, either the surviving spouse or guardian(s) for the children. OD. Yes. Minor children generally can be paid life insurance proceeds directly, as long as either the surviving spouse or guardian(s) for the children, know the children are receiving the money directly. The policy should be set up to deposit equal amounts in each child's bank account, and send a letter to either the surviving spouse or guardian(s) stating it has been done. g. Which life insurance riders might the Kampes select when purchasing a policy? Life insurance riders the Kampes might select when purchasing a policy are: (Select all the choices that apply.) A. a waiver of premium for disability rider. B. a cost of living adjustment (COLA) rider. c. a living benefits rider. D. a lump-sum settlement rider. E. a change of policy rider. OF. a guaranteed insurability rider. h. Since they will make a concerted effort to become informed about life insurance, should the Kampes also purchase life insurance on the children, rather than waiting until later when they would have to reeducate themselves for life insurance shopping? (Select the best choice below.) O A. Given that the children do not provide income, life insurance would not be necessary. The primary needs are adequate protection on Frank and Wendy to replace income in the event of their deaths. O B. Although the children do not provide income, life insurance would be necessary. The primary needs are adequate protection on Frank and Wendy to replace income in the event of their deaths; however, it doesn't hurt to have insurance on the children. O C. Although the children provide income, life insurance would not be necessary. The primary needs are adequate income replacement in the event of Frank or Wendy's deaths; the children do not contribute enough to the household income to warrant insuring them. OD. Given that the children provide income, life insurance would be necessary. The primary needs are adequate income replacement in the event of any family member's death. i. The Kampes have saved $7,200 a year for an emergency fund, retirement, and other investments, with the remainder spent to support their lifestyle. How might the concept of mental accounting and Principle 9: Mind Games, Your Financial Personality, and Your Money affect their decision to purchase life insurance? (Select the best choice below.) O A. The Kampes could assume that the current annual savings of $7,200 is required, and unless they can increase other living expenses or reduce income, then there simply is no money to fund additional life insurance for Wendy or Frank. Despite the acknowledged need, they may agree that the mental account of savings is a more important goal than buying life insurance without conceding that affordable term insurance would provide immediate protection. The savings, albeit important, will accumulate a sufficient balance to protect the family in case of premature death. OB. The Kampes could assume that the current annual savings of $7,200 is not required, but that there simply is no need to fund additional life insurance for Wendy or Frank. Despite the actual need, they may agree that the mental account of savings is a more important goal and that they are young and do not need to be concerned with premature death. OC. The Kampes could assume that the current annual savings of $7,200 is required, and unless they can reduce other living expenses or increase income, then there simply is no money to fund additional life insurance for Wendy or Frank. Despite the acknowledged need, they may agree that the mental account of savings is a more important goal than buying life insurance without conceding that affordable term insurance would provide immediate protection. The savings, albeit important, will not rapidly accumulate a sufficient balance to protect the family in case of premature death. OD. The Kampes could assume that the current annual savings of $7,200 is required, and unless they can reduce other living expenses or increase income, then they will simply have to stop contributing to Frank's 401(k) to fund additional life insurance for Wendy or Frank. Despite the acknowledged need, they may agree that the mental account of savings and purchasing insurance are more important goals than contributing to Frank's 401(k) plan, because the 401(k) plan money would not be given to the family in case of Frank's premature death