Answered step by step

Verified Expert Solution

Question

1 Approved Answer

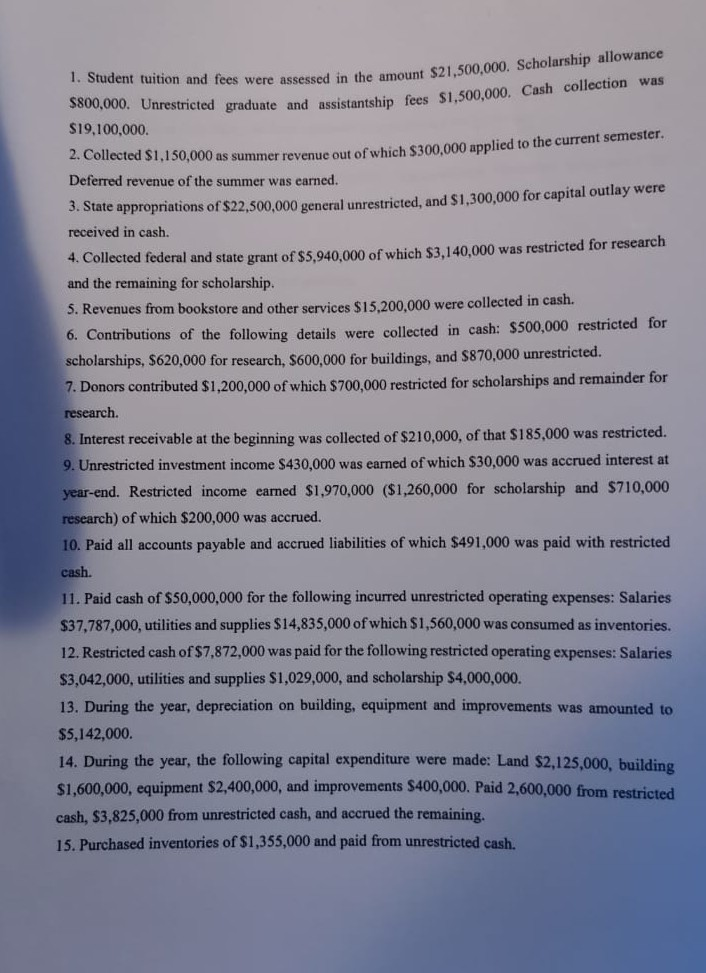

were assessed in the amount $21,500,000. Scholarship allowance tship fees $1,500,000. Cash collection was 1. Student tuition and fees $800,000. Unrestricted graduate and assistan S19,100,000

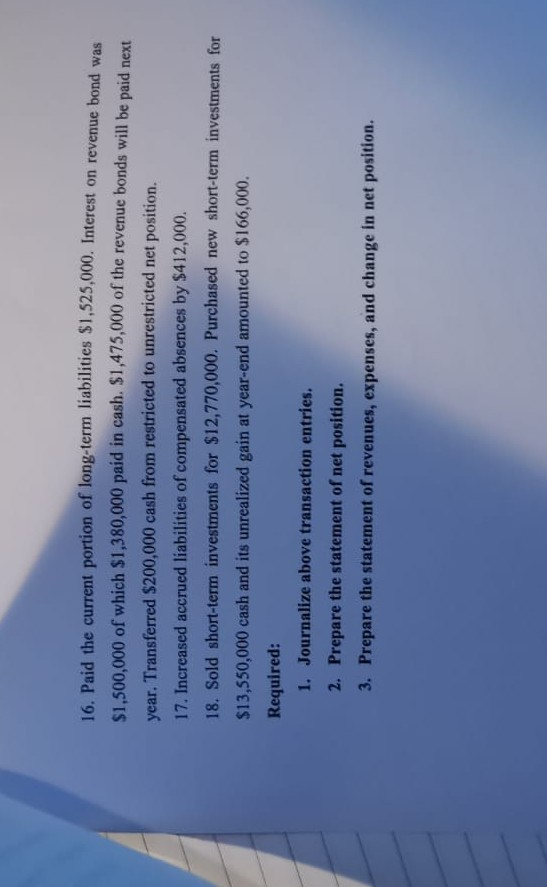

were assessed in the amount $21,500,000. Scholarship allowance tship fees $1,500,000. Cash collection was 1. Student tuition and fees $800,000. Unrestricted graduate and assistan S19,100,000 2. Collected $1,150,000 as summer revenue out of which $300,000 appli Deferred revenue of the summer was earned 3. Stat received in cash. ed to the current semester e appropriations of $22,500,000 general unrestricted, and $1,300,000 for capital outlay were ollected federal and state grant of $5,940,000 of which $3,140,000 was restricted for research and the remaining for scholarship. Revenues from bookstore and other services $15.200,000 were collected in cash. 6. Contributions of the following scholarships, $620,000 for research, S600,000 for buildings, and $870,000 unrestricted. 7. Donors contributed $1,200,000 of which $700,000 restricted for scholarships and remainder for research. 8. Interest receivable at the beginning was collected of s210,000, of that $185,000 was restricted 9. Unrestricted investment income $430,000 was earned of which $30,000 was accrued interest at year-end. Restricted income earned $1,970,000 ($1,260,000 for scholarship and $710,000 research) of which $200,000 was accrued. 10. Paid all accounts payable and acrued liabilities of which $491,000 was paid with restricted cash. 11. Paid cash of $50,000,000 for the following incurred unrestricted operating expenses: Salaries $37,787,000, utilities and supplies $14,835,000 of which $1,560,000 was consumed as inventories. 12. Restricted cash of $7,872,000 was paid for the following restricted operating expenses: Salaries $3,042,000, utilities and supplies S1,029,000, and scholarship $4,000,000 13. During the year, depreciation on building, equipment and improvements was amounted to $5,142,000 14. During the year, the following capital expenditure were made: Land $2,125,000, building $1,600,000, equipment $2,400,000, and improvements $400,000. Paid 2,600,000 from restricted cash, $3,825,000 from unrestricted cash, and accrued the remaining. 15. Purchased inventories of $1,355,000 and paid from unrestricted cash. details were collected in cash: $500,000 restricted for 16. Paid the current portion of long-term liabilities S1,525,000. Interest on revenue bond was $1,500,000 of which $1,380,000 paid in cash. $1,475,000 of the revenue bonds will be paid next year. Transferred $200,000 cash from restricted to unrestricted net position. 17. Increased accrued liabilities of compensated absences by $412,000. 18. Sold short-term investments for $12,770,000. Purchased new short-term investments for $13,550,000 cash and its unrealized gain at year-end amounted to $166,000 Required: 1. Journalize above transaction entries. 2. Prepare the statement of net position. 3. Prepare the statement of revenues, expenses, and change in net position. were assessed in the amount $21,500,000. Scholarship allowance tship fees $1,500,000. Cash collection was 1. Student tuition and fees $800,000. Unrestricted graduate and assistan S19,100,000 2. Collected $1,150,000 as summer revenue out of which $300,000 appli Deferred revenue of the summer was earned 3. Stat received in cash. ed to the current semester e appropriations of $22,500,000 general unrestricted, and $1,300,000 for capital outlay were ollected federal and state grant of $5,940,000 of which $3,140,000 was restricted for research and the remaining for scholarship. Revenues from bookstore and other services $15.200,000 were collected in cash. 6. Contributions of the following scholarships, $620,000 for research, S600,000 for buildings, and $870,000 unrestricted. 7. Donors contributed $1,200,000 of which $700,000 restricted for scholarships and remainder for research. 8. Interest receivable at the beginning was collected of s210,000, of that $185,000 was restricted 9. Unrestricted investment income $430,000 was earned of which $30,000 was accrued interest at year-end. Restricted income earned $1,970,000 ($1,260,000 for scholarship and $710,000 research) of which $200,000 was accrued. 10. Paid all accounts payable and acrued liabilities of which $491,000 was paid with restricted cash. 11. Paid cash of $50,000,000 for the following incurred unrestricted operating expenses: Salaries $37,787,000, utilities and supplies $14,835,000 of which $1,560,000 was consumed as inventories. 12. Restricted cash of $7,872,000 was paid for the following restricted operating expenses: Salaries $3,042,000, utilities and supplies S1,029,000, and scholarship $4,000,000 13. During the year, depreciation on building, equipment and improvements was amounted to $5,142,000 14. During the year, the following capital expenditure were made: Land $2,125,000, building $1,600,000, equipment $2,400,000, and improvements $400,000. Paid 2,600,000 from restricted cash, $3,825,000 from unrestricted cash, and accrued the remaining. 15. Purchased inventories of $1,355,000 and paid from unrestricted cash. details were collected in cash: $500,000 restricted for 16. Paid the current portion of long-term liabilities S1,525,000. Interest on revenue bond was $1,500,000 of which $1,380,000 paid in cash. $1,475,000 of the revenue bonds will be paid next year. Transferred $200,000 cash from restricted to unrestricted net position. 17. Increased accrued liabilities of compensated absences by $412,000. 18. Sold short-term investments for $12,770,000. Purchased new short-term investments for $13,550,000 cash and its unrealized gain at year-end amounted to $166,000 Required: 1. Journalize above transaction entries. 2. Prepare the statement of net position. 3. Prepare the statement of revenues, expenses, and change in net position

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started