Answered step by step

Verified Expert Solution

Question

1 Approved Answer

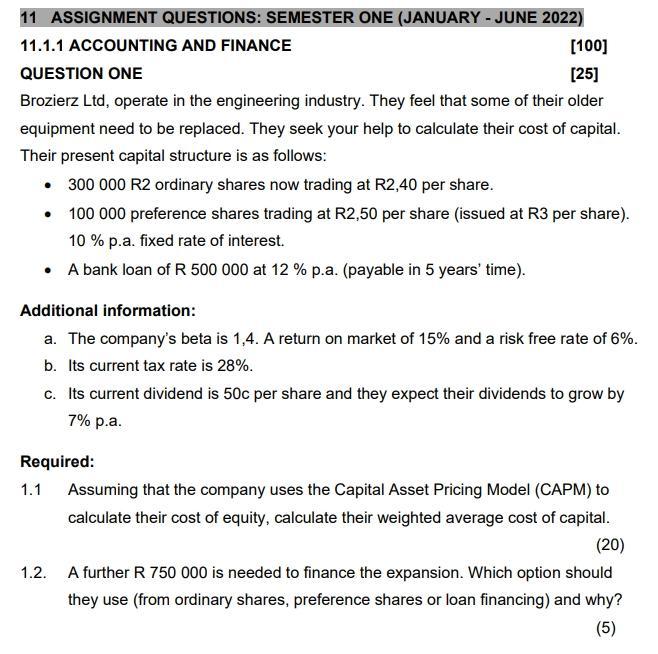

11 ASSIGNMENT QUESTIONS: SEMESTER ONE (JANUARY - JUNE 2022) 11.1.1 ACCOUNTING AND FINANCE QUESTION ONE [100] [25] Brozierz Ltd, operate in the engineering industry.

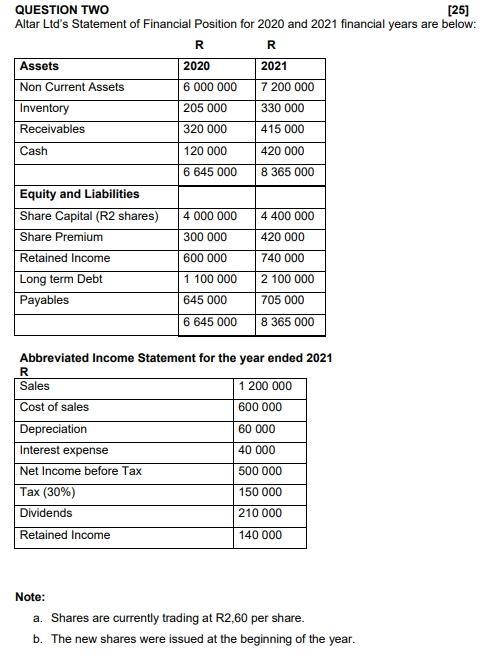

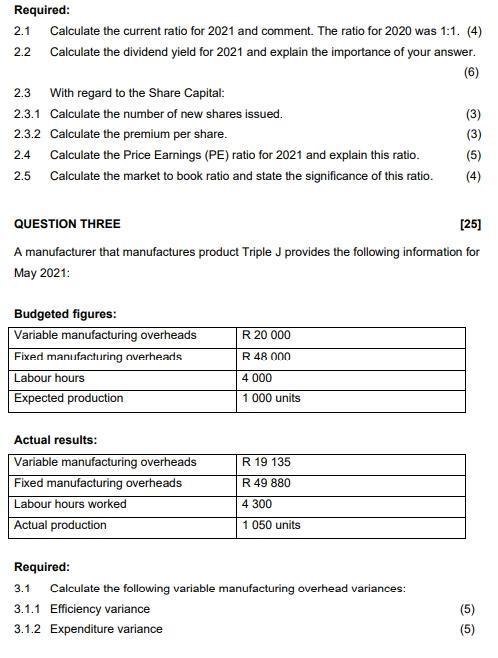

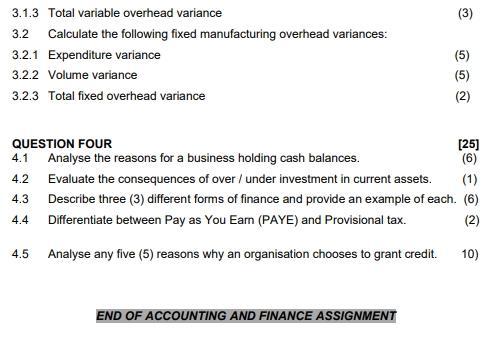

11 ASSIGNMENT QUESTIONS: SEMESTER ONE (JANUARY - JUNE 2022) 11.1.1 ACCOUNTING AND FINANCE QUESTION ONE [100] [25] Brozierz Ltd, operate in the engineering industry. They feel that some of their older equipment need to be replaced. They seek your help to calculate their cost of capital. Their present capital structure is as follows: 300 000 R2 ordinary shares now trading at R2,40 per share. 100 000 preference shares trading at R2,50 per share (issued at R3 per share). 10 % p.a. fixed rate of interest. A bank loan of R 500 000 at 12 % p.a. (payable in 5 years' time). Additional information: a. The company's beta is 1,4. A return on market of 15% and a risk free rate of 6%. b. Its current tax rate is 28%. c. Its current dividend is 50c per share and they expect their dividends to grow by 7% p.a. Required: 1.1 1.2. Assuming that the company uses the Capital Asset Pricing Model (CAPM) to calculate their cost of equity, calculate their weighted average cost of capital. (20) A further R 750 000 is needed to finance the expansion. Which option should they use (from ordinary shares, preference shares or loan financing) and why? (5) QUESTION TWO [25] Altar Ltd's Statement of Financial Position for 2020 and 2021 financial years are below: R 2021 7 200 000 Assets Non Current Assets Inventory Receivables Cash Equity and Liabilities Share Capital (R2 shares) Share Premium Retained Income Long term Debt Payables R 2020 6 000 000 205 000 320 000 120 000 6 645 000 R Sales Cost of sales Depreciation Interest expense Net Income before Tax Tax (30%) Dividends Retained Income 4 000 000 300 000 600 000 1 100 000 645 000 6 645 000 330 000 415 000 420 000 8 365 000 4 400 000 420 000 740 000 2 100 000 705 000 8 365 000 Abbreviated Income Statement for the year ended 2021 1 200 000 600 000 60 000 40 000 500 000 150 000 210 000 140 000 Note: a. Shares are currently trading at R2,60 per share. b. The new shares were issued at the beginning of the year. Required: 2.1 Calculate the current ratio for 2021 and comment. The ratio for 2020 was 1:1. (4) Calculate the dividend yield for 2021 and explain the importance of your answer. 2.2 (6) 2.3 With regard to the Share Capital: 2.3.1 Calculate the number of new shares issued. 2.3.2 Calculate the premium per share. 2.4 Calculate the Price Earnings (PE) ratio for 2021 and explain this ratio. 2.5 Calculate the market to book ratio and state the significance of this ratio. [25] QUESTION THREE A manufacturer that manufactures product Triple J provides the following information for May 2021: Budgeted figures: Variable manufacturing overheads Fixed manufacturing overheads Labour hours Expected production Actual results: Variable manufacturing overheads Fixed manufacturing overheads Labour hours worked Actual production R 20 000 R 48 000 4 000 1 000 units R 19 135 R 49 880 4 300 1 050 units (3) Required: 3.1 Calculate the following variable manufacturing overhead variances: 3.1.1 Efficiency variance 3.1.2 Expenditure variance (5) (5) 3.1.3 Total variable overhead variance 3.2 Calculate the following fixed manufacturing overhead variances: 3.2.1 Expenditure variance 3.2.2 Volume variance 3.2.3 Total fixed overhead variance QUESTION FOUR 4.1 Analyse the reasons for a business holding cash balances. 4.2 4.3 4.4 4.5 (3) END OF ACCOUNTING AND FINANCE ASSIGNMENT (5) (5) (2) [25] (6) (1) Evaluate the consequences of over / under investment in current assets. Describe three (3) different forms of finance and provide an example of each. (6) Differentiate between Pay as You Earn (PAYE) and Provisional tax. (2) Analyse any five (5) reasons why an organisation chooses to grant credit. 10)

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Use the guidelines below to give the correct answer ke R 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started