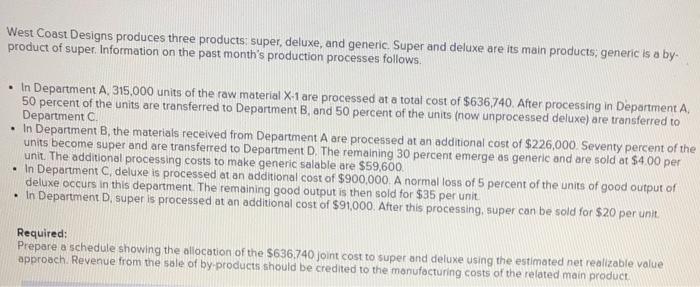

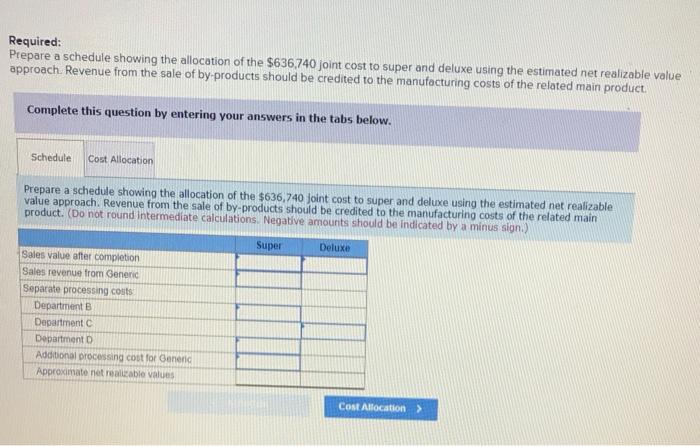

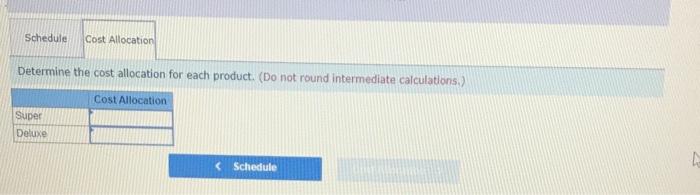

West Coast Designs produces three products: super, deluxe, and generic Super and deluxe are its main products, generic is a by product of super. Information on the past month's production processes follows. In Department A, 315,000 units of the raw material X-1 are processed at a total cost of $636,740. After processing in Department A, 50 percent of the units are transferred to Department B, and 50 percent of the units (now unprocessed deluxe) are transferred to Department In Department B, the materials received from Department A are processed at an additional cost of $226,000 Seventy percent of the units become super and are transferred to Department D. The remaining 30 percent emerge as generic and are sold at $4.00 per unit. The additional processing costs to make generic salable are $59,600. In Department C, deluxe is processed at an additional cost of $900,000. A normal loss of 5 percent of the units of good output of deluxe occurs in this department. The remaining good output is then sold for $35 per unit In Department D, super is processed at an additional cost of $91,000. After this processing, super can be sold for $20 per unit. Required: Prepare a schedule showing the allocation of the $636,740 joint cost to super and deluxe using the estimated net realizable value approach. Revenue from the sole of by-products should be credited to the manufacturing costs of the related main product Required: Prepare a schedule showing the allocation of the $636,740 joint cost to super and deluxe using the estimated net realizable value approach. Revenue from the sale of by-products should be credited to the manufacturing costs of the related main product. Complete this question by entering your answers in the tabs below. Schedule Cost Allocation Prepare a schedule showing the allocation of the $636,740 joint cost to super and deluxe using the estimated net realizable value approach. Revenue from the sale of by-products should be credited to the manufacturing costs of the related main product. (Do not round intermediate calculations. Negative amounts should be indicated by a minus sign.) Super Deluxe Sales value after completion Sales revenue from Generic Separate processing costs Department B Department Department Additional processing cost for Generic Approximate not realizable values Cost Allocation > Schedule Cost Allocation Determine the cost allocation for each product. (Do not round intermediate calculations.) Cost Allocation Super Deluxe Schedule West Coast Designs produces three products: super, deluxe, and generic Super and deluxe are its main products, generic is a by product of super. Information on the past month's production processes follows. In Department A, 315,000 units of the raw material X-1 are processed at a total cost of $636,740. After processing in Department A, 50 percent of the units are transferred to Department B, and 50 percent of the units (now unprocessed deluxe) are transferred to Department In Department B, the materials received from Department A are processed at an additional cost of $226,000 Seventy percent of the units become super and are transferred to Department D. The remaining 30 percent emerge as generic and are sold at $4.00 per unit. The additional processing costs to make generic salable are $59,600. In Department C, deluxe is processed at an additional cost of $900,000. A normal loss of 5 percent of the units of good output of deluxe occurs in this department. The remaining good output is then sold for $35 per unit In Department D, super is processed at an additional cost of $91,000. After this processing, super can be sold for $20 per unit. Required: Prepare a schedule showing the allocation of the $636,740 joint cost to super and deluxe using the estimated net realizable value approach. Revenue from the sole of by-products should be credited to the manufacturing costs of the related main product Required: Prepare a schedule showing the allocation of the $636,740 joint cost to super and deluxe using the estimated net realizable value approach. Revenue from the sale of by-products should be credited to the manufacturing costs of the related main product. Complete this question by entering your answers in the tabs below. Schedule Cost Allocation Prepare a schedule showing the allocation of the $636,740 joint cost to super and deluxe using the estimated net realizable value approach. Revenue from the sale of by-products should be credited to the manufacturing costs of the related main product. (Do not round intermediate calculations. Negative amounts should be indicated by a minus sign.) Super Deluxe Sales value after completion Sales revenue from Generic Separate processing costs Department B Department Department Additional processing cost for Generic Approximate not realizable values Cost Allocation > Schedule Cost Allocation Determine the cost allocation for each product. (Do not round intermediate calculations.) Cost Allocation Super Deluxe Schedule