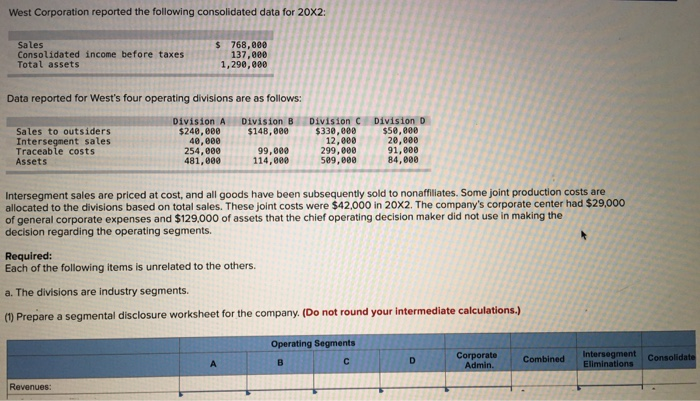

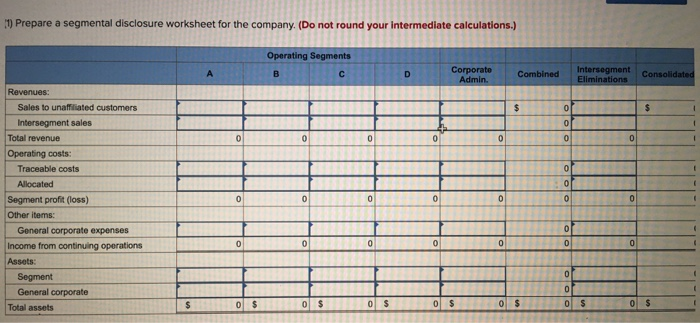

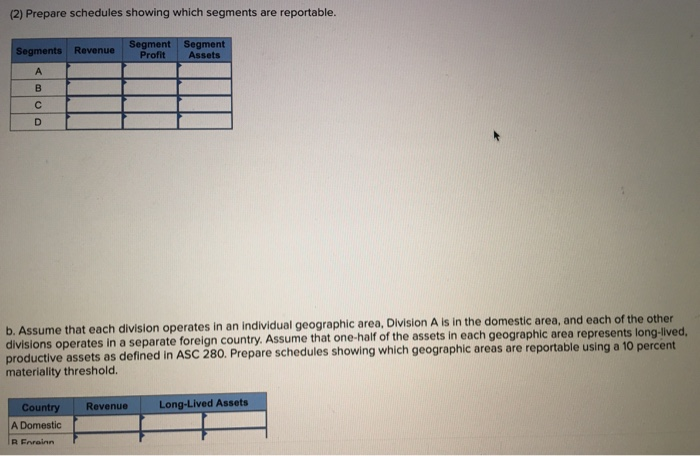

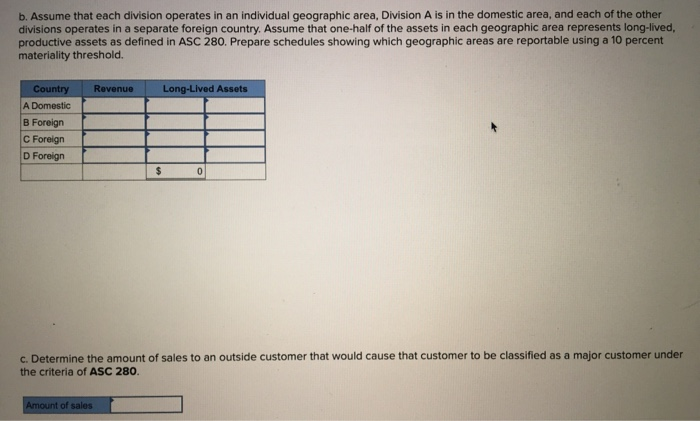

West Corporation reported the following consolidated data for 20x2: Sales Consolidated income before taxes Total assets $ 768,000 137,000 1,290,000 Data reported for West's four operating divisions are as follows: Division B $140,000 Sales to outsiders Intersegment sales Traceable costs Assets Division A $240,000 40,000 254,000 481,000 Division C $330,000 12,000 299,000 509,000 Division D $50,000 20,000 91,000 84,800 99,000 114,000 Intersegment sales are priced at cost, and all goods have been subsequently sold to nonaffiliates. Some joint production costs are allocated to the divisions based on total sales. These joint costs were $42.000 in 20x2. The company's corporate center had $29,000 of general corporate expenses and $129,000 of assets that the chief operating decision maker did not use in making the decision regarding the operating segments. Required: Each of the following items is unrelated to the others. a. The divisions are industry segments. (1) Prepare a segmental disclosure worksheet for the company. (Do not round your intermediate calculations.) Operating Segments B C D Corporate Admin. Intersegment Consolidate Eliminations Combined Revenues: 11) Prepare a segmental disclosure worksheet for the company. (Do not round your intermediate calculations.) Operating Segments B C D Corporate Admin. Combined Intersegment Eliminations Consolidated $ 0 $ 0 0 0 0 0 0 0 0 0 0 Revenues: Sales to unaffiliated customers Intersegment sales Total revenue Operating costs: Traceable costs Allocated Segment profit (loss) Other items: General cor Income from continuing operations Assets: Segment General corporate Total assets 0 0 0 0 0 0 0 0 0 0 0 0 0 0 OOO $ 0 $ 0 $ 0 S 0 $ 0 $ $ 0 $ (2) Prepare schedules showing which segments are reportable. Segments Revenue Segment Segment Profit Assets A B D b. Assume that each division operates in an individual geographic area, Division A is in the domestic area, and each of the other divisions operates in a separate foreign country. Assume that one-half of the assets in each geographic area represents long-lived, productive assets as defined in ASC 280. Prepare schedules showing which geographic areas are reportable using a 10 percent materiality threshold. Revenue Long-Lived Assets Country A Domestic R Errainn b. Assume that each division operates in an individual geographic area, Division A is in the domestic area, and each of the other divisions operates in a separate foreign country. Assume that one-half of the assets in each geographic area represents long-lived, productive assets as defined in ASC 280. Prepare schedules showing which geographic areas are reportable using a 10 percent materiality threshold Revenue Long-Lived Assets Country A Domestic B Foreign C Foreign D Foreign $ 0 c. Determine the amount of sales to an outside customer that would cause that customer to be classified as a major customer under the criteria of ASC 280. Amount of sales