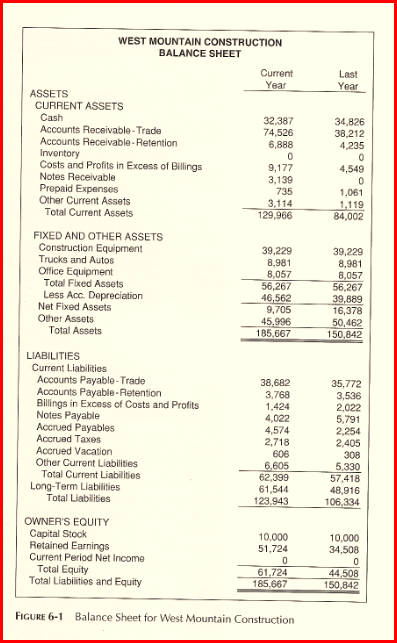

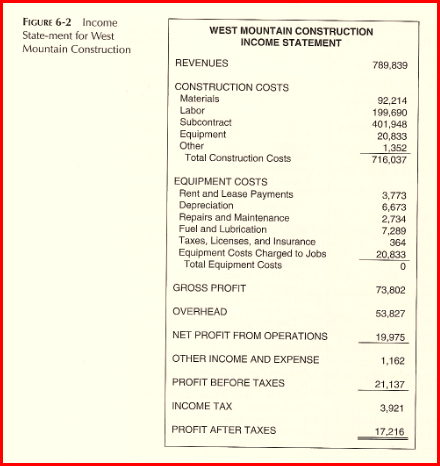

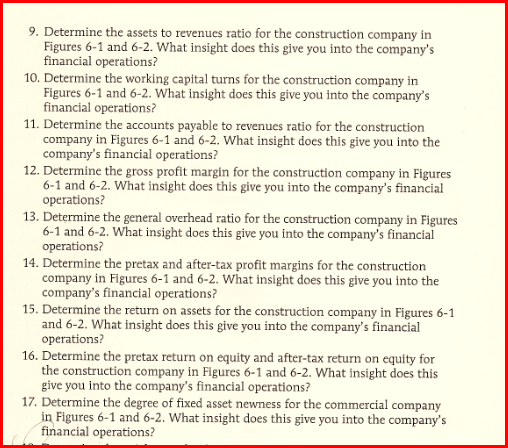

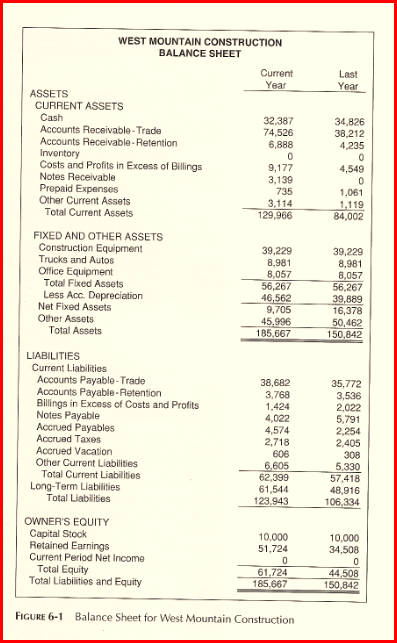

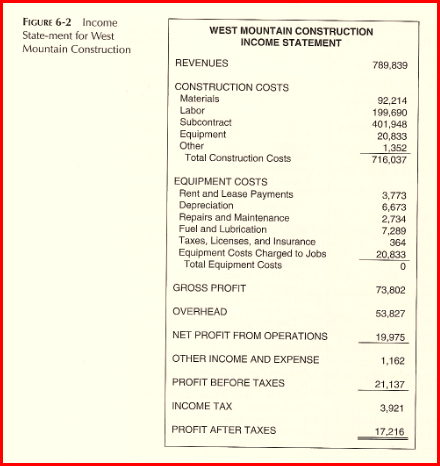

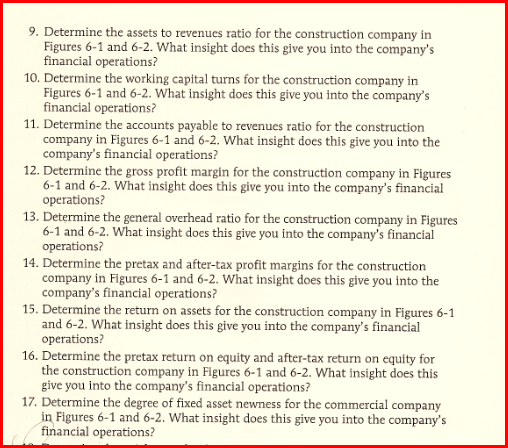

WEST MOUNTAIN CONSTRUCTION BALANCE SHEET Current Year Last Year ASSETS CURRENT ASSETS Cash Accounts Receivable-Trade Accounts Receivable-Retention Inventory Costs and Profits in Excess of Bilings Notes Receivable Prepaid Expenses Other Current Assets Total Current Assets FIXED AND OTHER ASSETS Construction Equipment Trucks and Autos Office Equipment Total Fixed Assets Less Acc. Depreciation Net Fixed Assets Other Assets Total Assets 32,387 74,526 6,888 0 9,177 3,139 735 3,114 129,966 34,826 38,212 4,235 0 4,549 0 1,061 1,119 84,002 39,229 8,981 8,057 56,267 46,562 9,705 45.996 185,667 39,229 8,981 8,057 56,267 39,889 16,378 50,462 150,842 LIABILITIES Current Liabilities Accounts Payable-Trade Accounts Payable-Retention Billings in Excess of Costs and Profits Notes Payable Accrued Payables Accrued Taxes Accrued Vacation Other Current Liabilities Total Current Liabilities Long-Term Liabilities Total Liabilities 38,682 3.768 1,424 4,022 4,574 2,718 606 6,605 62,399 61,544 123.943 35.772 3,536 2,022 5,791 2,254 2,405 308 5,330 57,418 48,916 106,334 OWNER'S EQUITY Capital Stock Retained Earnings Current Period Net Income Total Equity Total Liabilities and Equity 10,000 51.724 0 61.724 185,667 10,000 34.508 0 44,508 150,842 FIGURE 6-1 Balance Sheet for West Mountain Construction FIGURE 6-2 Income State-ment for West Mountain Construction WEST MOUNTAIN CONSTRUCTION INCOME STATEMENT REVENUES 789,839 CONSTRUCTION COSTS Materials 92,214 Labor 199,690 Subcontract 401,948 Equipment 20,833 Other 1,352 Total Construction Costs 716,037 3,773 6,673 2,734 7.289 364 20,833 0 EQUIPMENT COSTS Rent and Lease Payments Depreciation Repairs and Maintenance Fuel and Lubrication Taxes, Licenses, and Insurance Equipment Costs Charged to Jobs Total Equipment Costs GROSS PROFIT OVERHEAD NET PROFIT FROM OPERATIONS OTHER INCOME AND EXPENSE PROFIT BEFORE TAXES 73,802 53,827 19,975 1.162 21.137 INCOME TAX 3,921 PROFIT AFTER TAXES 17.216 9. Determine the assets to revenues ratio for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 10. Determine the working capital turns for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 11. Determine the accounts payable to revenues ratio for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 12. Determine the gross profit margin for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 13. Determine the general overhead ratio for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 14. Determine the pretax and after-tax profit margins for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 15. Determine the return on assets for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 16. Determine the pretax return on equity and after-tax return on equity for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 17. Determine the degree of fixed asset newness for the commercial company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? WEST MOUNTAIN CONSTRUCTION BALANCE SHEET Current Year Last Year ASSETS CURRENT ASSETS Cash Accounts Receivable-Trade Accounts Receivable-Retention Inventory Costs and Profits in Excess of Bilings Notes Receivable Prepaid Expenses Other Current Assets Total Current Assets FIXED AND OTHER ASSETS Construction Equipment Trucks and Autos Office Equipment Total Fixed Assets Less Acc. Depreciation Net Fixed Assets Other Assets Total Assets 32,387 74,526 6,888 0 9,177 3,139 735 3,114 129,966 34,826 38,212 4,235 0 4,549 0 1,061 1,119 84,002 39,229 8,981 8,057 56,267 46,562 9,705 45.996 185,667 39,229 8,981 8,057 56,267 39,889 16,378 50,462 150,842 LIABILITIES Current Liabilities Accounts Payable-Trade Accounts Payable-Retention Billings in Excess of Costs and Profits Notes Payable Accrued Payables Accrued Taxes Accrued Vacation Other Current Liabilities Total Current Liabilities Long-Term Liabilities Total Liabilities 38,682 3.768 1,424 4,022 4,574 2,718 606 6,605 62,399 61,544 123.943 35.772 3,536 2,022 5,791 2,254 2,405 308 5,330 57,418 48,916 106,334 OWNER'S EQUITY Capital Stock Retained Earnings Current Period Net Income Total Equity Total Liabilities and Equity 10,000 51.724 0 61.724 185,667 10,000 34.508 0 44,508 150,842 FIGURE 6-1 Balance Sheet for West Mountain Construction FIGURE 6-2 Income State-ment for West Mountain Construction WEST MOUNTAIN CONSTRUCTION INCOME STATEMENT REVENUES 789,839 CONSTRUCTION COSTS Materials 92,214 Labor 199,690 Subcontract 401,948 Equipment 20,833 Other 1,352 Total Construction Costs 716,037 3,773 6,673 2,734 7.289 364 20,833 0 EQUIPMENT COSTS Rent and Lease Payments Depreciation Repairs and Maintenance Fuel and Lubrication Taxes, Licenses, and Insurance Equipment Costs Charged to Jobs Total Equipment Costs GROSS PROFIT OVERHEAD NET PROFIT FROM OPERATIONS OTHER INCOME AND EXPENSE PROFIT BEFORE TAXES 73,802 53,827 19,975 1.162 21.137 INCOME TAX 3,921 PROFIT AFTER TAXES 17.216 9. Determine the assets to revenues ratio for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 10. Determine the working capital turns for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 11. Determine the accounts payable to revenues ratio for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 12. Determine the gross profit margin for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 13. Determine the general overhead ratio for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 14. Determine the pretax and after-tax profit margins for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 15. Determine the return on assets for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 16. Determine the pretax return on equity and after-tax return on equity for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 17. Determine the degree of fixed asset newness for the commercial company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations