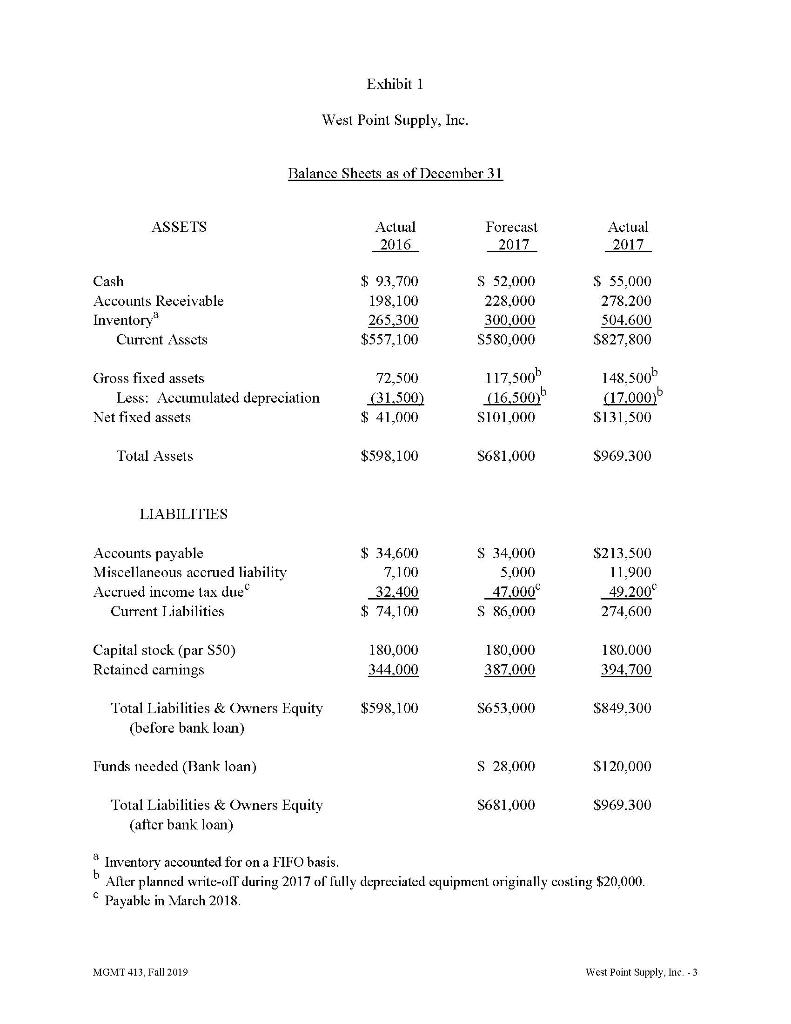

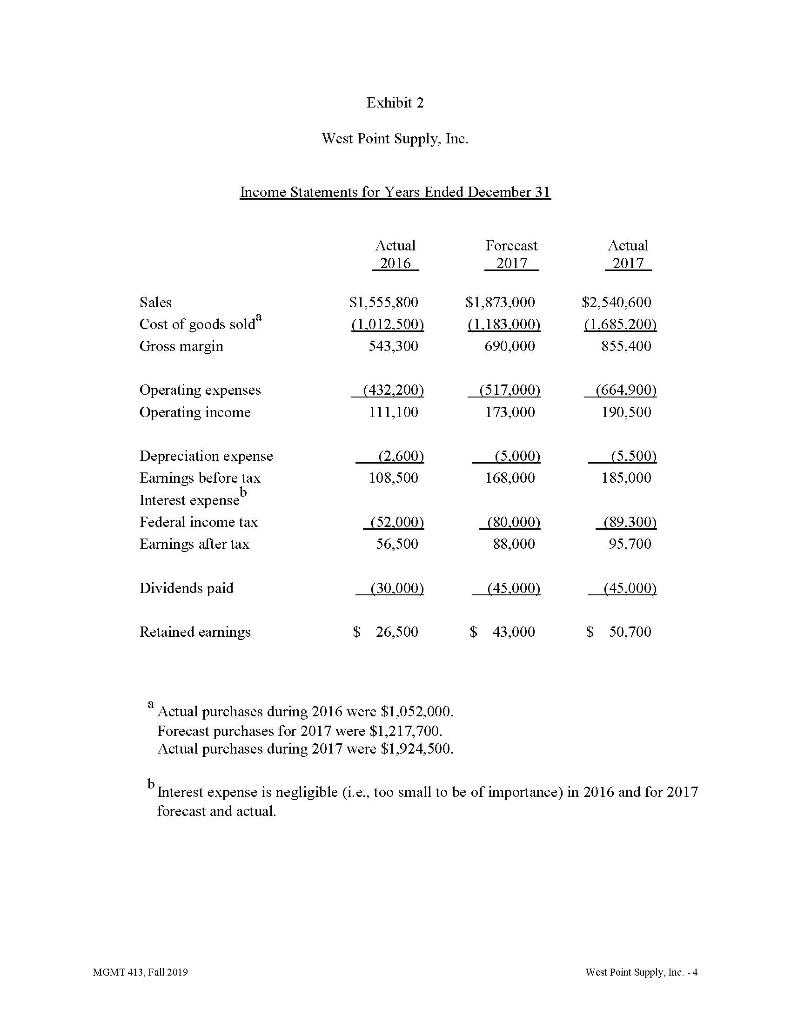

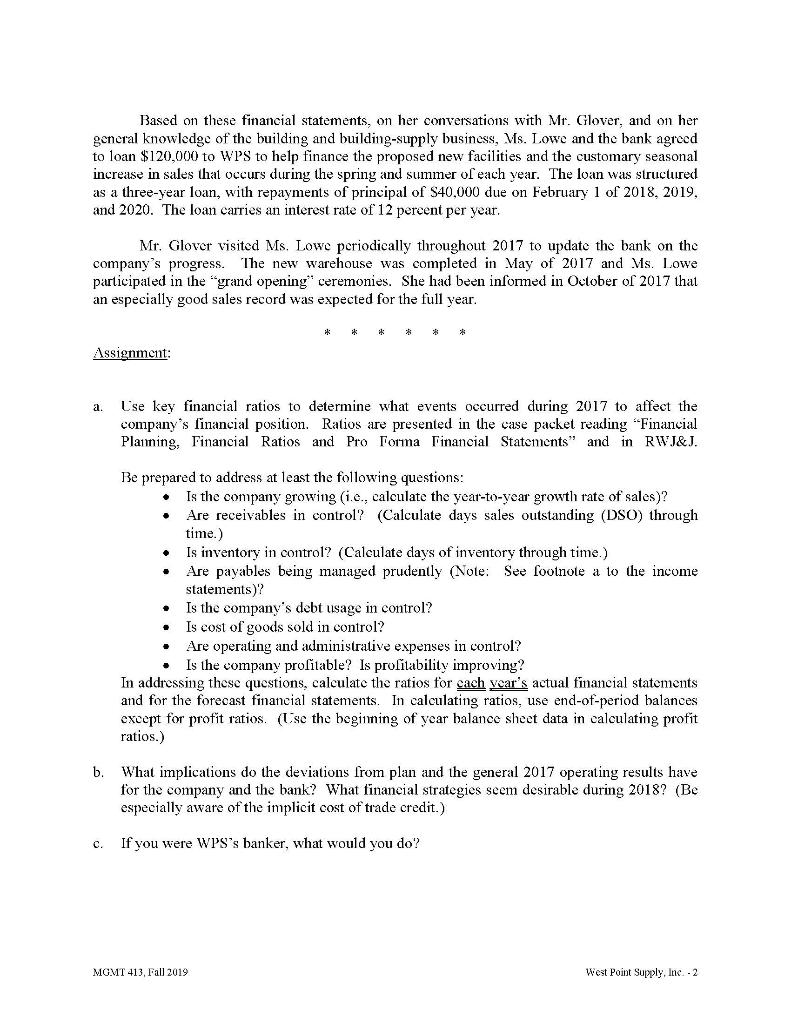

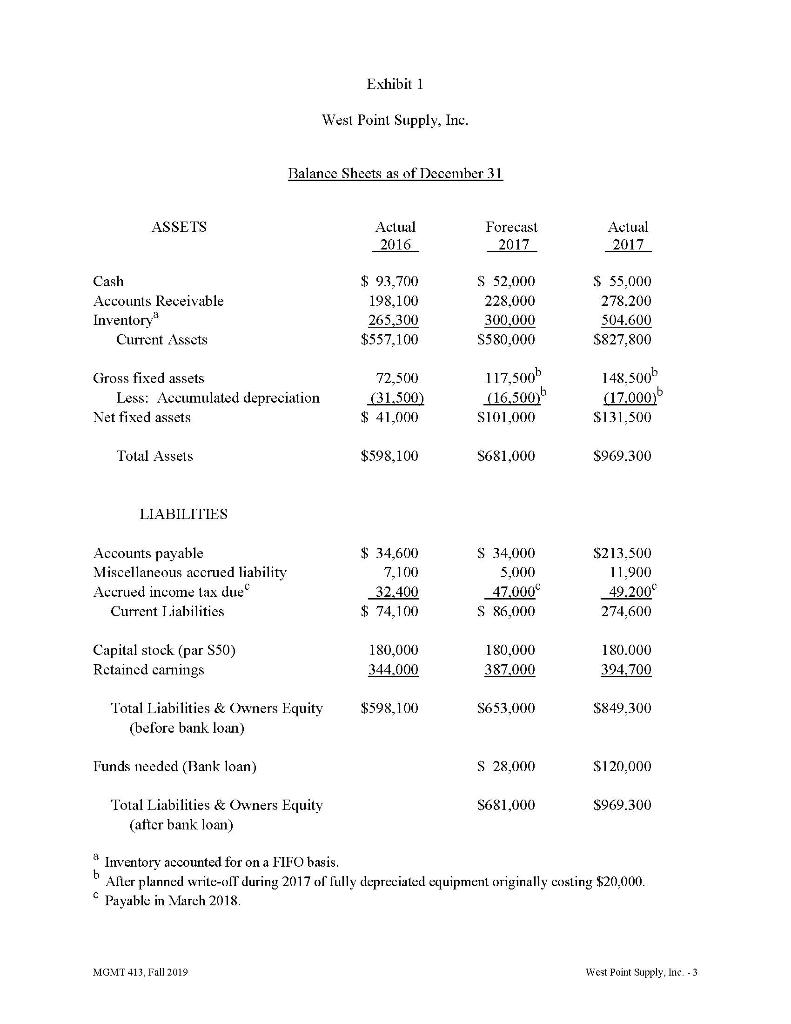

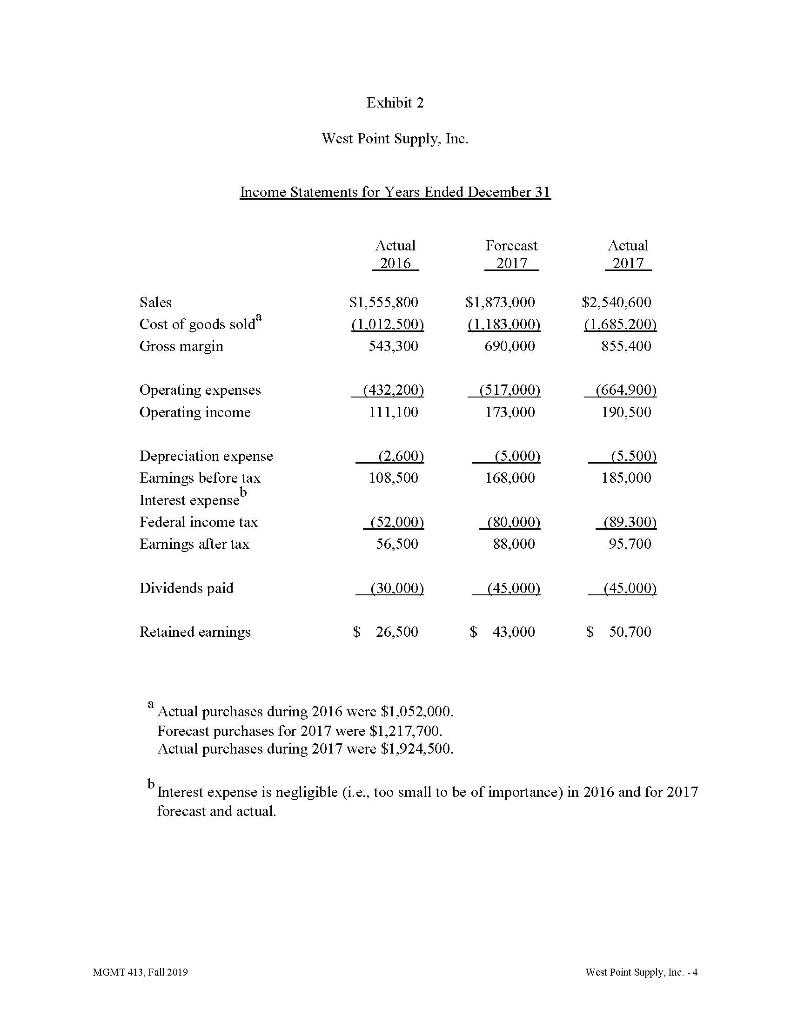

West Point Supply, Inc. It is the second week of January 2018. The Chief Executive Officer (CEO) of West Point Supply, Inc. (WPS). Mr. Donnie Glover, is preparing for a meeting with the company's bank, Welles Forgo Bank & Trust (Welles Forgo). To prepare for the meeting, Mr. Glover is reviewing the company's 2017 financial statements. He is working with the knowledge that 2017 was a very good year for WPS both in sales and in profits, and he is hopeful the company's bank will recognize this achievement. Such an outcome is important because in carly 2017 WPS had arranged a term loan, for the first time ever, and its initial repayment installment of $40,000 is due in February 1, 2018. Mr. Glover hopes that the company's strong results during 2017 will impress Ms. Carrie Lowe, the bank's loan officer. He is confident that the approaching loan payment is within WPS's financial capacity following its best year ever. He expects to send Ms. Lowe the company's 2017 financial statements soon so that she can review them before the due datc of the loan. The Company WPS was organized by Mr. Glover in 2001 as a wholesaler of electrical supplies and cquipment to building contractors in and around Pittsburgh, PA. After a contraction during the recession of 2007-2009 its sales had grown through the following 10 years. The company has built a reputation for rapid delivery on a wide array of materials required by huilders, many of whom are not well-capitalized and cannot finance an extensive inventory themselves. Mr. Glover believes WPS's competitive advantage depends on this reputation. An implication of this strategy is that WPS must carry substantial inventory. As a result, through time, the company had to rent warehouse space in growing capacity. To stock its inventory WPS purchases supplies from an array of dealers. WPS's suppliers sell to WPS on credit terms of 2/15, nct 30 days. All of WPS's purchases are on credit. In turn, the company sells to builders on credit terms of net 30 days and all sales are credit sales. During the latter part of 2016, a decision was made to construct a new warehouse adjacent to the company's main offices and existing storerooms. The new building meant that WPS 10 longer needed to rent warehouse space -- which represents a saving for the company. The Loan When the financial statements for the year 2016 were completed. Mr. Glover had visited Welles Forgo to secure a loan. Historically, WPS maintained operating cash balances with the bank ranging from $20,000 to $60,000. Never before, however, had the company sought a loan either for seasonal or longer-term capital requirements. Mr. Glover discussed with Ms. Lowe the possibilities for bank support of WPS's building expansion. He presented to her the 2016 statements, together with a forecast for 2017 which included the anticipated expenditures for construction, and savings on warehouse rental fees (see Exhibits 1 and 2). The numbers in this case may appear to be too small" to be realistic or worth worrying about. If so, just add three zeroes to all numbers. The concepts employed will be the same regardless of the dollars involved MGMT 413, Fall 2019 West Point Supply, Inc. - 1 Based on these financial statements, on her conversations with Mr. Glover, and on her general knowledge of the building and building-supply business, Ms. Lowe and the bank agreed to loan $120,000 to WPS to help finance the proposed new facilities and the customary seasonal increase in sales that occurs during the spring and summer of each year. The loan was structured as a three-year loan, with repayments of principal of $40,000 due on February 1 of 2018, 2019, and 2020. The loan carries an interest rate of 12 percent per year. Mr. Glover visited Ms. Lowe periodically throughout 2017 to update the bank on the company's progress. The new warehouse was completed in May of 2017 and Ms. Lowe participated in the "grand opening ceremonies. She had been informed in October of 2017 that an especially good sales record was expected for the full year. Assignment: a. Use key financial ratios to determine what events occurred during 2017 to affect the company's financial position. Ratios are presented in the case packet reading "Financial Planning, Financial Ratios and Pro Toma Financial Statements" and in RWJ&J. + Be prepared to address at least the following questions: Is the company growing (i.e., calculate the year-to-year growth rate of sales)? Are receivables in control? (Calculate days sales outstanding (DSO) through time.) Is inventory in control? (Calculate days of inventory through time.) Are payables being managed prudently (Note: See footnote a to the income statements)? Is the company's debt usage in control? Is cost of goods sold in control? Are operating and administrative expenses in control? Is the company profitable? Is profitability improving? In addressing these questions, calculate the ratios for cach year's actual financial statements and for the forecast financial statements. In calculating ratios, use end-of-period balances except for profit ratios. (Use the beginning of year balance sheet data in calculating profit ratios.) + + + . b. What implications do the deviations from plan and the general 2017 operating results have for the company and the bank? What financial strategies seem desirable during 2018? (Be especially aware of the implicit cost of trade credit.) c. If you were WPS's banker, what would you do? MGMT 413, Fall 2019 West Point Supply, Inc. - 2 Exhibit 1 West Point Supply, Inc. Balance Sheets as of December 31 ASSETS Actual 2016 Forecast 2017 Actual 2017 Cash Accounts Receivable Inventory Current Assets $ 93,700 198,100 265,300 $557.100 S 52,000 228,000 300,000 S580,000 $ 55,000 278.200 504.600 $827,800 Gross fixed assets Less: Accumulated depreciation Net fixed assets 72,500 (31.500) $ 41,000 117,500 (16.5006 148,500 (17.000) $131,500 S101,000 Total Assets $598,100 S681,000 $969.300 LIABILITIES Accounts payable Miscellaneous accrued liability Accrued income tax due Current Liabilities $ 34,600 7,100 32.400 $ 74,100 S 34,000 5,000 47,000 S 86,000 $213.500 11.900 49.2000 274,600 Capital stock (par S50) Retained camings 180,000 344.000 180,000 387,000 180.000 394.700 $598,100 $653,000 $849.300 Total Liabilities & Owners Equity (before bank loan) Funds needed (Bank loan) S 28,000 $120,000 S681,000 $969.300 Total Liabilities & Owners Equity (after bank loan) 6 Inventory accounted for on a FIFO basis. After planned write-off during 2017 of fully depreciated equipment originally costing $20,000. Payable in March 2018 MGMT 413, Fall 2019 West Point Supply, Inc. - 3 Exhibit 2 West Point Supply, Inc. Income Statements for Years Ended December 31 Actual 2016 Forecast 2017 Actual 2017 Sales Cost of goods sold Gross margin S1,555,800 (1,012,500) 543,300 $1,873,000 (1,183,000) 690,000 $2.540,600 (1.685.200) 855.400 Operating expenses Operating income (432,200) 111,100 (517,000) 173,000 (664.900) 190.500 (2.600) 108,500 (5,000) 168,000 (5.500) 185.000 Depreciation expense Earnings before tax b Interest expense Federal income tax Earnings aller lax (52,000) 36,500 (80.000) 88,000 (89.300) 95.700 Dividends paid (30,000) (45,000) (45.000) Retained earnings $ 26,500 $ 43,000 $ 50.700 a Actual purchases during 2016 were $1,052,000. Forecast purchases for 2017 were $1,217,700. Actual purchases during 2017 were $1,924,500. b Interest expense is negligible (i.e., too small to be of importance) in 2016 and for 2017 forecast and actual. MGMT 413, Fall 2019 West Point Supply, Inc.. 4