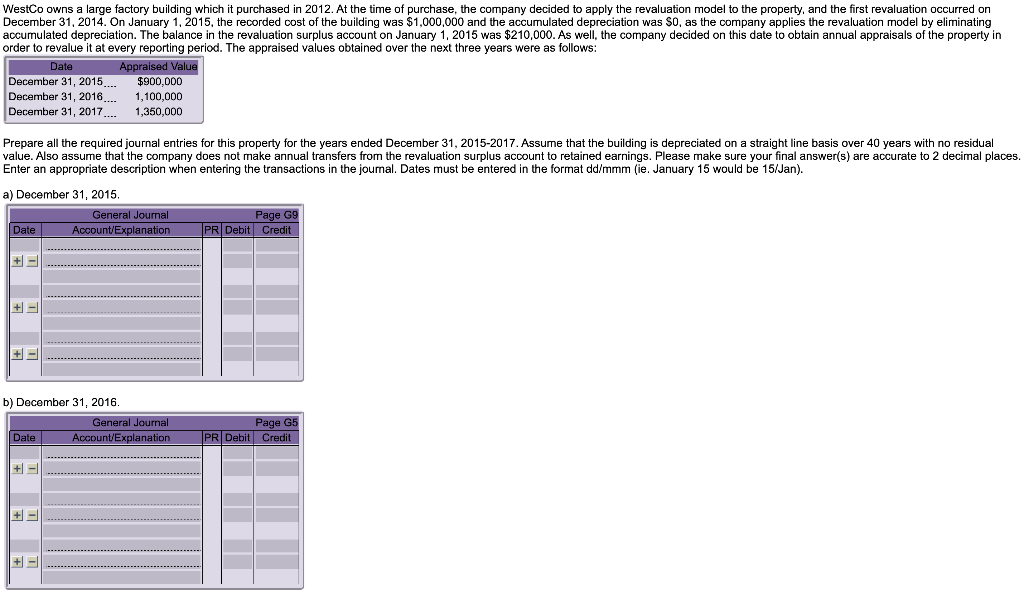

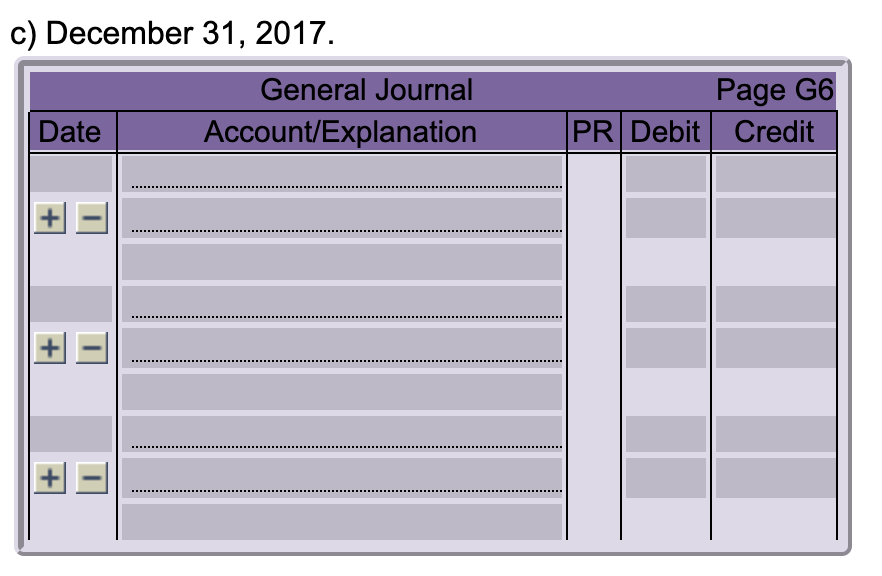

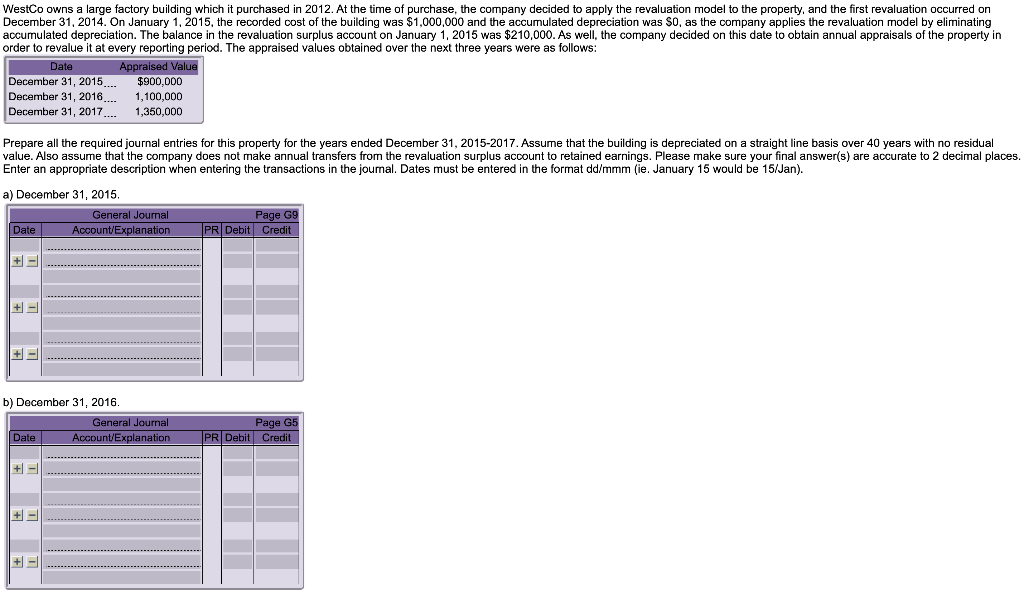

WestCo owns a large factory building which it purchased in 2012. At the time of purchase, the company decided to apply the revaluation model to the property, and the first revaluation occurred on December 31, 2014. On January 1, 2015, the recorded cost of the building was $1,000,000 and the accumulated depreciation was $0, as the company applies the revaluation model by eliminating accumulated depreciation. The balance in the revaluation surplus account on January 1, 2015 was $210,000. As well, the company decided on this date to obtain annual appraisals of the property in order to revalue it at every reporting period. The appraised values obtained over the next three years were as follows: Date Appraised Value December 31, 2015 $900,000 December 31, 2016 1,100,000 December 31, 2017 1,350,000 Prepare all the required journal entries for this property for the years ended December 31, 2015-2017. Assume that the building is depreciated on a straight line basis over 40 years with no residual value. Also assume that the company does not make annual transfers from the revaluation surplus account to retained earnings. Please make sure your final answer(s) are accurate to 2 decimal places. Enter an appropriate description when entering the transactions in the journal. Dates must be entered in the format dd/mmm (ie. January 15 would be 15/Jan). a) December 31, 2015 General Journal Page G9 Date Account/Explanation PR Debit Credit b) December 31, 2016. General Journal Date Account/Explanation Page G5 PR Debit Credit + - c) December 31, 2017. General Journal Account/Explanation Page G6 PR Debit Credit Date + WestCo owns a large factory building which it purchased in 2012. At the time of purchase, the company decided to apply the revaluation model to the property, and the first revaluation occurred on December 31, 2014. On January 1, 2015, the recorded cost of the building was $1,000,000 and the accumulated depreciation was $0, as the company applies the revaluation model by eliminating accumulated depreciation. The balance in the revaluation surplus account on January 1, 2015 was $210,000. As well, the company decided on this date to obtain annual appraisals of the property in order to revalue it at every reporting period. The appraised values obtained over the next three years were as follows: Date Appraised Value December 31, 2015 $900,000 December 31, 2016 1,100,000 December 31, 2017 1,350,000 Prepare all the required journal entries for this property for the years ended December 31, 2015-2017. Assume that the building is depreciated on a straight line basis over 40 years with no residual value. Also assume that the company does not make annual transfers from the revaluation surplus account to retained earnings. Please make sure your final answer(s) are accurate to 2 decimal places. Enter an appropriate description when entering the transactions in the journal. Dates must be entered in the format dd/mmm (ie. January 15 would be 15/Jan). a) December 31, 2015 General Journal Page G9 Date Account/Explanation PR Debit Credit b) December 31, 2016. General Journal Date Account/Explanation Page G5 PR Debit Credit + - c) December 31, 2017. General Journal Account/Explanation Page G6 PR Debit Credit Date +