Westen Hemisphere is developing a special ATV for recreational use. The development requires investments (costs) of $180,000 today, $200,000 in 2 years from today

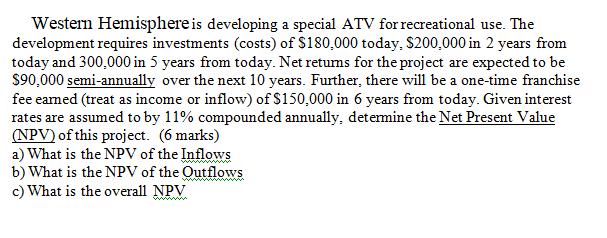

Westen Hemisphere is developing a special ATV for recreational use. The development requires investments (costs) of $180,000 today, $200,000 in 2 years from today and 300,000 in 5 years from today. Net retums for the project are expected to be S90,000 semi-annually over the next 10 years. Further, there will be a one-time franchise fee eamed (treat as income or inflow) of $150,000 in 6 years from today. Given interest rates are assumed to by 11% compounded annually, detemine the Net Present Value (NPV) of this project. (6 marks) a) What is the NPV of the Inflows b) What is the NPV of the Qutflows c) What is the overall NPV www

Step by Step Solution

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1Npv of inflows year disc factor discounted inflo...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started