Question

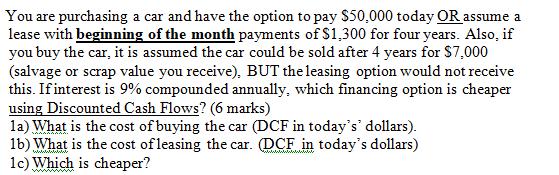

You are purchasing a car and have the option to pay $50,000 today OR assume a lease with beginning of the month payments of

You are purchasing a car and have the option to pay $50,000 today OR assume a lease with beginning of the month payments of S1,300 for four years. Also, if you buy the car, it is assumed the car could be sold after 4 years for $7,000 (salvage or scrap value you receive), BUT the leasing option would not receive this. If interest is 9% compounded annually, which financing option is cheaper using Discounted Cash Flows? (6 marks) la) What is the cost of buying the car (DCF in today's' dollars). 1b) What is the cost of leasing the car. (DCF in today's dollars) 1c) Which is cheaper? www wwwwwwwww

Step by Step Solution

3.36 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1a cost of buying car today50000 PV of scarp value 7000 1009 4 4959 Less the scrap ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Microeconomics Theory and Applications with Calculus

Authors: Jeffrey M. Perloff

3rd edition

133019934, 978-0133019933

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App