Western Components, Inc. manufactures a variety of pinions, gears and other component parts used by companies around the world. Their major customer is a large

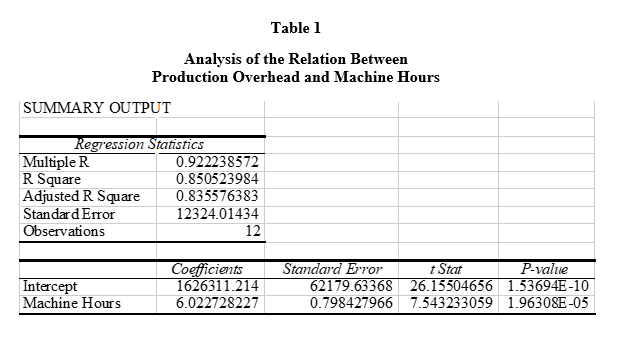

Western Components, Inc. manufactures a variety of pinions, gears and other component parts used by companies around the world. Their major customer is a large west-coast aircraft manufacturer. Currently, Western has substantial unused capacity due to a downturn in production for this major customer. This in turn has caused a significant drop in profits at Western since their workers are highly skilled and Western does not want to reduce head-count during this downturn which they expect to be temporary. Sally Jones, a recent business school graduate, is a marketing manager at Western Components. After reviewing the situation, Sally suggests to the vice president of marketing that Western selectively lower its bids to attract new business and better utilize the existing capacity. (In the past, bids have been formulated as 125% of total production cost). Intrigued by the suggestion, Sally's boss asks her to show an example analysis for a recent invitation to bid on a job for Husanti Industries. From the production department, Sally receives an estimate that the job will require direct materials of $185,000, 2,000 direct labor hours, and 8,000 machine hours. The cost accounting department indicates that the average labor cost is $22 per hour and the standard overhead rate is $34 per machine hour. The overhead rate for the current year was determined at the start of the year by dividing the estimated annual production overhead of $23,800,000 by the estimated number of machine hours for the current year, 700,000 machine hours. In order to formulate a bidding strategy for this job, Sally knows that it is important to carefully consider the three components of production cost, materials, labor, and overhead. Sally has heard numerous critical comments related to the overhead component. Her boss is critical of the overhead rate because it is based on capacity used (700,000 machine hours) rather than capacity supplied (1,000,000 machine hours). Recently, he told Sally "Our current approach to pricing burdens jobs with the cost of unused capacity so that in years where we are going through a downturn, the computed overhead rate goes up. Consequently, our system results in our bidding higher when we have more unused capacity and need the work more, and bidding lower when we have less unused capacity and need the work less. If the rate was based on capacity supplied, our overhead rate would be the same whether we are operating at capacity or far below." Rather than rely on the standard approach to pricing jobs at 125% of total production cost (using either the standard overhead rate or the modified overhead calculation suggested by her boss), Sally decides to first analyze the incremental behavior of overhead costs and then use this data to estimate the incremental overhead cost associated with the proposed job. Sally goes to the cost accounting department and they provide 12 months of prior data on monthly production overhead and monthly machine hours. Sally then runs a regression relating historical overhead costs to machine hours. (The results are in Table 1). Finally, before preparing her analysis, Sally sat down with her boss and they estimated the chances of winning the job from Husanti Industries with four different bid amounts. (See Table 2.)

Questions:

- Calculate the total production cost of the job for Husanti Industries using the current approach to allocating overhead. What would be the bid assuming it is 125% of total production cost?

- Suppose the company decides to allocate overhead using capacity supplied of 1,000,000 machine hours (instead of allocating overhead based on 700,000 machine hours of capacity used). What would be the bid on the job for Husanti Industries assuming it is priced at 125% of this modified cost measure?

- Now assume you have been assigned to assist Sally Jones to find which of the four possible bids listed in Table 2 will maximize the expected incremental contribution margin from the Husanti Industries job, where incremental contribution margin is defined as incremental revenue less incremental cost. Use the information in the case to determine the incremental cost for materials and the incremental cost for labor. Use the estimates on the relation between overhead and machine hours to determine the incremental cost of the overhead component. For purposes of your analysis in this question, assume that the coefficients in Table 1 are estimated without error.

- What other factors would you consider before selecting a bid?

- Table 2 provides the subjective probability of winning the bid for each of four possible bids. Speculate on how these probabilities were generated and how Western Components would generate probabilities for other possible bids, e.g., a bid of $425,000.

Table 1

Table 2

Subjective Probabilities of Winning the Bid

Proposed Probability of

Bid Amount Winning the Bid

$600,000 5%

$500,000 50%

$400,000 85%

$300,000 95%

Table 1 Analysis of the Relation Between Production Overhead and Machine Hours SUMMARY OUTPUT Regression Statistics Multiple R 0.922238572 R Square 0.850523984 Adjusted R Square 0.835576383 Standard Error 12324.01434 Observations 12 Intercept Machine Hours Coefficients 1626311.214 6.022728227 Standard Error 62179.63368 0.798427966 t Stat P-value 26.15504656 1.53694E-10 7.543233059 1.96308E-05

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started