Answered step by step

Verified Expert Solution

Question

1 Approved Answer

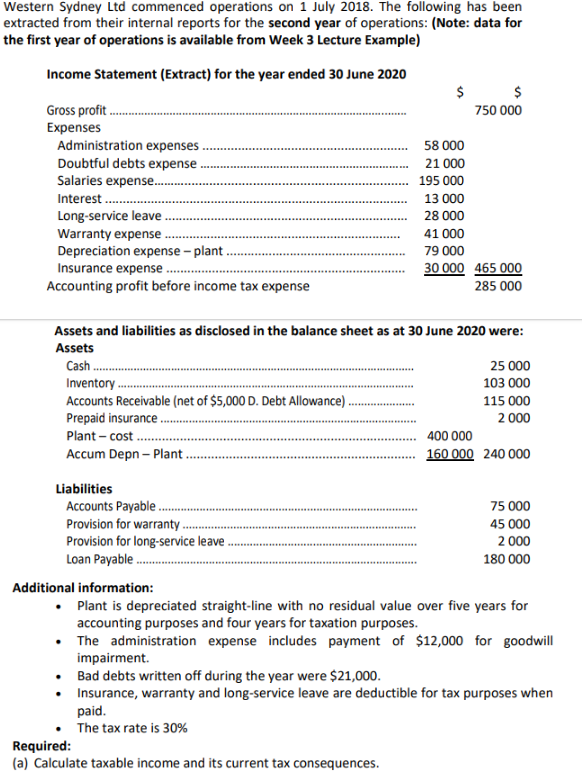

Western Sydney Ltd commenced operations on 1 July 2018. The following has been extracted from their internal reports for the second year of operations: (Note:

Western Sydney Ltd commenced operations on 1 July 2018. The following has been extracted from their internal reports for the second year of operations: (Note: data for the first year of operations is available from Week 3 Lecture Example) Assets and liabilities as disclosed in the balance sheet as at 30 June 2020 were: Additional information: - Plant is depreciated straight-line with no residual value over five years for accounting purposes and four years for taxation purposes. - The administration expense includes payment of $12,000 for goodwill impairment. - Bad debts written off during the year were $21,000. - Insurance, warranty and long-service leave are deductible for tax purposes when paid. - The tax rate is 30% Required: (a) Calculate taxable income and its current tax consequences

Western Sydney Ltd commenced operations on 1 July 2018. The following has been extracted from their internal reports for the second year of operations: (Note: data for the first year of operations is available from Week 3 Lecture Example) Assets and liabilities as disclosed in the balance sheet as at 30 June 2020 were: Additional information: - Plant is depreciated straight-line with no residual value over five years for accounting purposes and four years for taxation purposes. - The administration expense includes payment of $12,000 for goodwill impairment. - Bad debts written off during the year were $21,000. - Insurance, warranty and long-service leave are deductible for tax purposes when paid. - The tax rate is 30% Required: (a) Calculate taxable income and its current tax consequences Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started