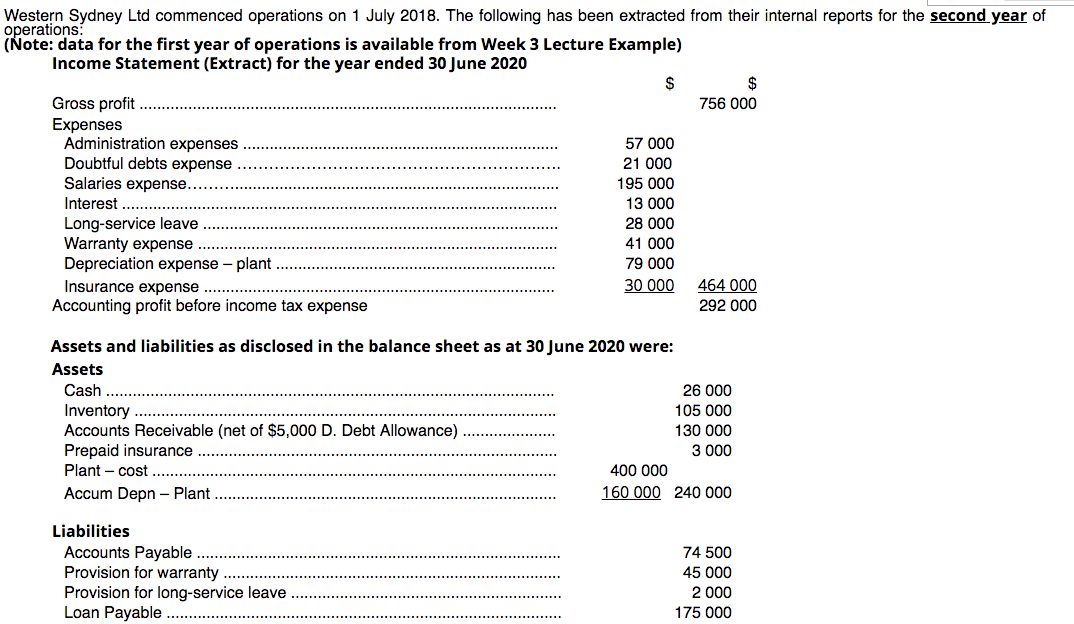

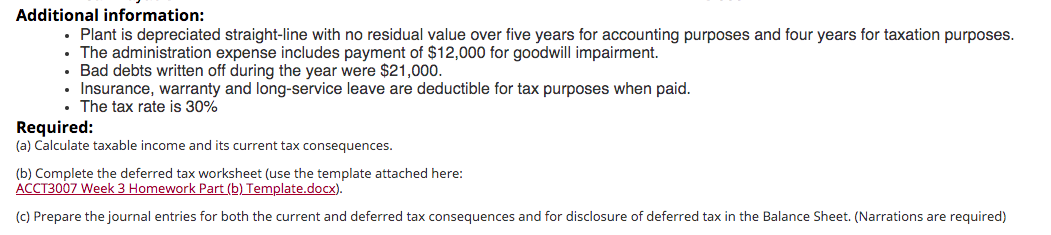

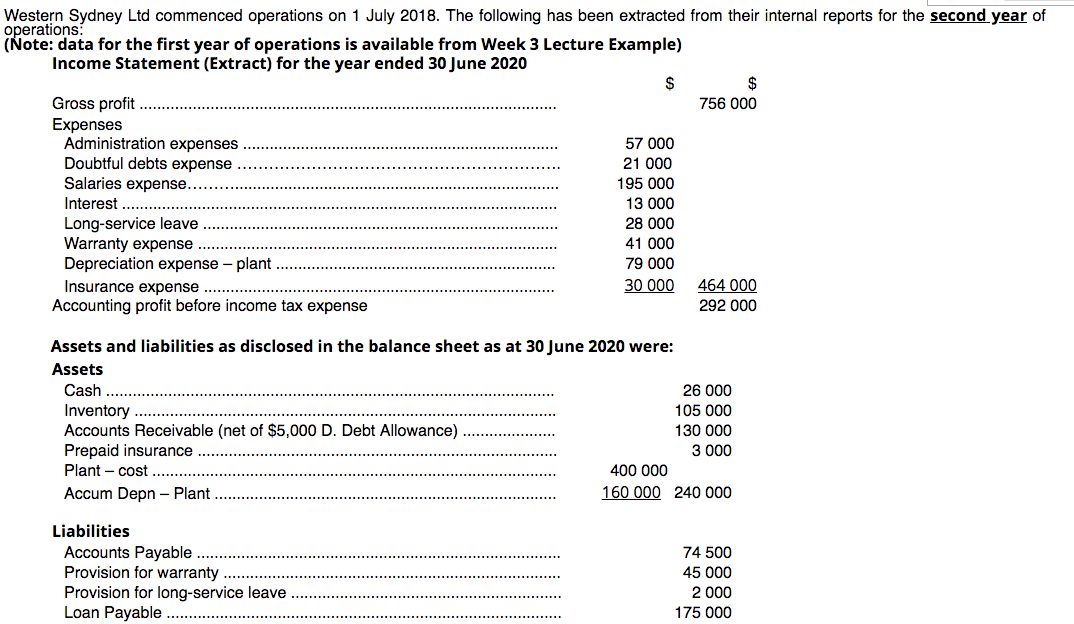

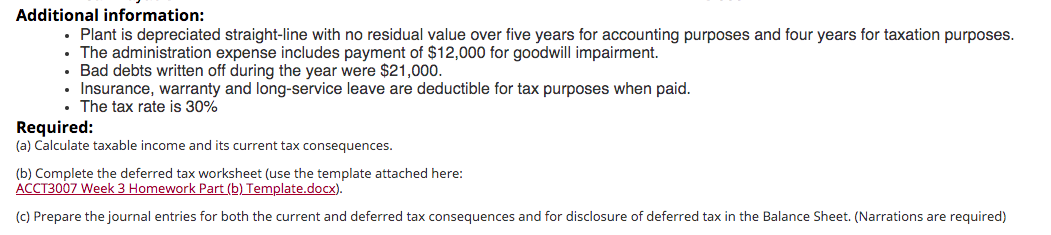

Western Sydney Ltd commenced operations on 1 July 2018. The following has been extracted from their internal reports for the second year of operations: (Note: data for the first year of operations is available from Week 3 Lecture Example) Income Statement (Extract) for the year ended 30 June 2020 $ $ Gross profit 756 000 Expenses Administration expenses 57 000 Doubtful debts expense 21 000 Salaries expense 195 000 Interest 13 000 Long-service leave 28 000 Warranty expense 41 000 Depreciation expense - plant 79 000 Insurance expense 30 000 464 000 Accounting profit before income tax expense 292 000 Assets and liabilities as disclosed in the balance sheet as at 30 June 2020 were: Assets Cash 26 000 Inventory ....... 105 000 Accounts Receivable (net of $5,000 D. Debt Allowance) 130 000 Prepaid insurance 3 000 Plant -cost 400 000 Accum Depn - Plant 160 000 240 000 Liabilities Accounts Payable Provision for warranty Provision for long-service leave Loan Payable 74 500 45 000 2 000 175 000 Additional information: Plant is depreciated straight-line with no residual value over five years for accounting purposes and four years for taxation purposes. The administration expense includes payment of $12,000 for goodwill impairment. . Bad debts written off during the year were $21,000. Insurance, warranty and long-service leave are deductible for tax purposes when paid. The tax rate is 30% Required: (a) Calculate taxable income and its current tax consequences. (b) Complete the deferred tax worksheet (use the template attached here: ACCT3007 Week 3 Homework Part (b) Template.docx). (c) Prepare the journal entries for both the current and deferred tax consequences and for disclosure of deferred tax in the Balance Sheet. (Narrations are required) Western Sydney Ltd commenced operations on 1 July 2018. The following has been extracted from their internal reports for the second year of operations: (Note: data for the first year of operations is available from Week 3 Lecture Example) Income Statement (Extract) for the year ended 30 June 2020 $ $ Gross profit 756 000 Expenses Administration expenses 57 000 Doubtful debts expense 21 000 Salaries expense 195 000 Interest 13 000 Long-service leave 28 000 Warranty expense 41 000 Depreciation expense - plant 79 000 Insurance expense 30 000 464 000 Accounting profit before income tax expense 292 000 Assets and liabilities as disclosed in the balance sheet as at 30 June 2020 were: Assets Cash 26 000 Inventory ....... 105 000 Accounts Receivable (net of $5,000 D. Debt Allowance) 130 000 Prepaid insurance 3 000 Plant -cost 400 000 Accum Depn - Plant 160 000 240 000 Liabilities Accounts Payable Provision for warranty Provision for long-service leave Loan Payable 74 500 45 000 2 000 175 000 Additional information: Plant is depreciated straight-line with no residual value over five years for accounting purposes and four years for taxation purposes. The administration expense includes payment of $12,000 for goodwill impairment. . Bad debts written off during the year were $21,000. Insurance, warranty and long-service leave are deductible for tax purposes when paid. The tax rate is 30% Required: (a) Calculate taxable income and its current tax consequences. (b) Complete the deferred tax worksheet (use the template attached here: ACCT3007 Week 3 Homework Part (b) Template.docx). (c) Prepare the journal entries for both the current and deferred tax consequences and for disclosure of deferred tax in the Balance Sheet. (Narrations are required)