Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Western Vole-taic started operations early in 2022, making and selling kits to convert gas vehicles into fully electric vehicles. The following events occurred during

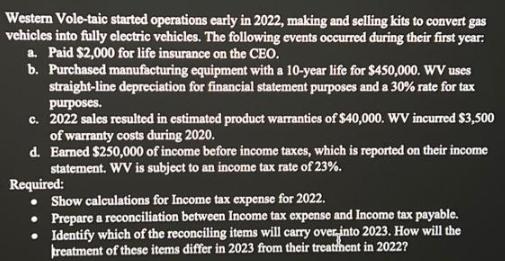

Western Vole-taic started operations early in 2022, making and selling kits to convert gas vehicles into fully electric vehicles. The following events occurred during their first year: a. Paid $2,000 for life insurance on the CEO. b. Purchased manufacturing equipment with a 10-year life for $450,000. WV uses straight-line depreciation for financial statement purposes and a 30% rate for tax purposes. c. 2022 sales resulted in estimated product warranties of $40,000. WV incurred $3,500 of warranty costs during 2020. d. Earned $250,000 of income before income taxes, which is reported on their income statement. WV is subject to an income tax rate of 23%. Required: Show calculations for Income tax expense for 2022. Prepare a reconciliation between Income tax expense and Income tax payable. Identify which of the reconciling items will carry over into 2023. How will the treatment of these items differ in 2023 from their treatment in 2022?

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the income tax expense for 2022 and prepare the reconciliation between income tax expense and income tax payable we need to consider the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started