Answered step by step

Verified Expert Solution

Question

1 Approved Answer

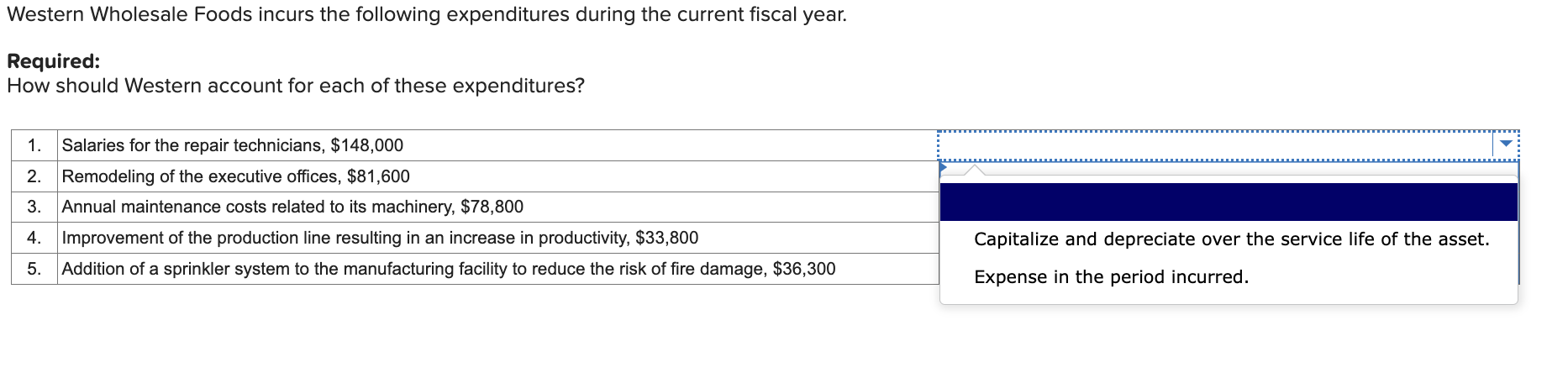

Western Wholesale Foods incurs the following expenditures during the current fiscal year. Required: How should Western account for each of these expenditures? 1. Salaries

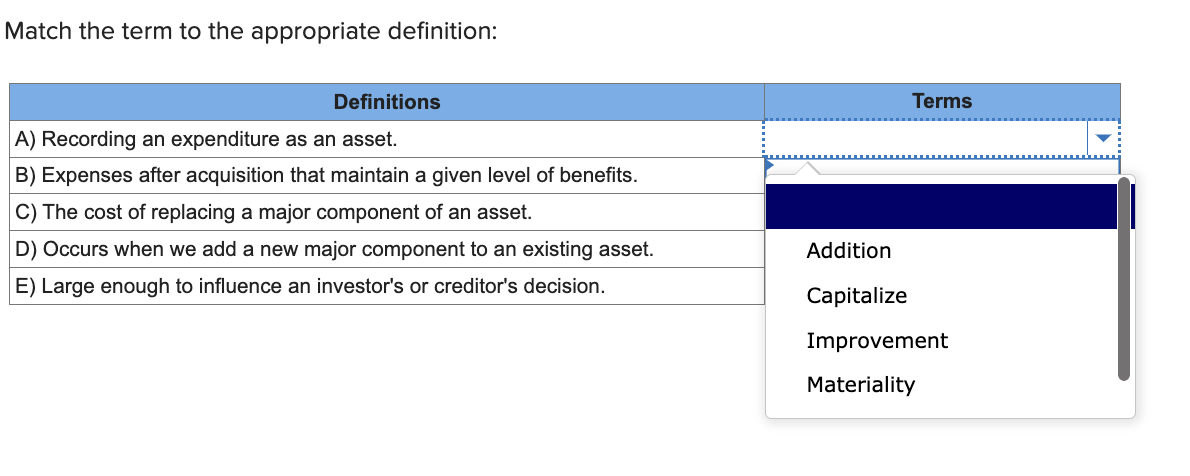

Western Wholesale Foods incurs the following expenditures during the current fiscal year. Required: How should Western account for each of these expenditures? 1. Salaries for the repair technicians, $148,000 2. Remodeling of the executive offices, $81,600 3. Annual maintenance costs related to its machinery, $78,800 4. Improvement of the production line resulting in an increase in productivity, $33,800 5. Addition of a sprinkler system to the manufacturing facility to reduce the risk of fire damage, $36,300 Capitalize and depreciate over the service life of the asset. Expense in the period incurred. Match the term to the appropriate definition: Definitions A) Recording an expenditure as an asset. B) Expenses after acquisition that maintain a given level of benefits. C) The cost of replacing a major component of an asset. D) Occurs when we add a new major component to an existing asset. E) Large enough to influence an investor's or creditor's decision. Addition Capitalize Terms Improvement Materiality

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started