Question

Westwood Electric Supply use LIFO cost flow assumption to value Inventory and Cost of Goods Sold. Selected information regarding Inventory and Cost of Goods Sold

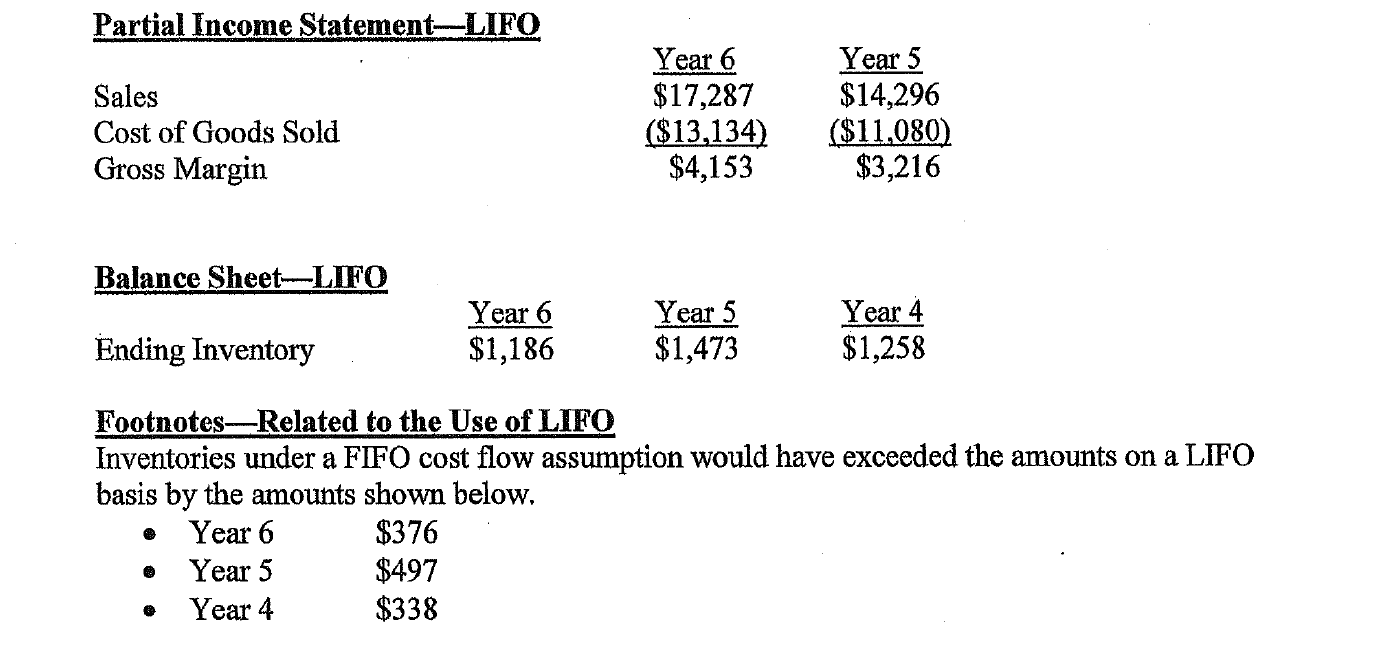

Westwood Electric Supply use LIFO cost flow assumption to value Inventory and Cost of Goods Sold. Selected information regarding Inventory and Cost of Goods Sold of Westwood Electrical Supply for Year 5 and Year 6 are shown below.

Questions:

1: Compute Cost of Goods Sold for Year 6 and Year 5 under the FIFO Cost Flow Assumption 2: Prepare a Partial Income Statement for Year 6 and Year 5 under the FIFO Cost Flow Assumption 3: Compute the Gross Margin Percentage for Year 6 and Year 5 under the LIFO Cost Flow Assumption 4: Compute the Gross Margin Percentage for Year 6 and Year 5 under the FIFO Cost Flow Assumption 5: During periods of rising prices, LIFO generally results in a higher Cost of Goods Sold and a lower Gross Margin than FIFO. Why does this generalization not describe the experience of Westwood Electrical Supply in Year 6?

Please upload specific process of solutions, thank you!

Partial Income Statement-LIFO Sales Cost of Goods Sold Gross Margin Year 6 $17,287 ($13,134) $4,153 Year 5 $14,296 ($11.080) $3,216 Balance Sheet-LIFO Year 6 $1,186 Year 5 $1,473 Year 4 $1,258 Ending Inventory FootnotesRelated to the Use of LIFO Inventories under a FIFO cost flow assumption would have exceeded the amounts on a LIFO basis by the amounts shown below, Year 6 $376 Year 5 $497 Year 4 $338Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started