Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wetland Corporation was organized on February 1, 2020. It is authorized to issue 100,000, $6 noncumulative preferred shares, and an unlimited number of common

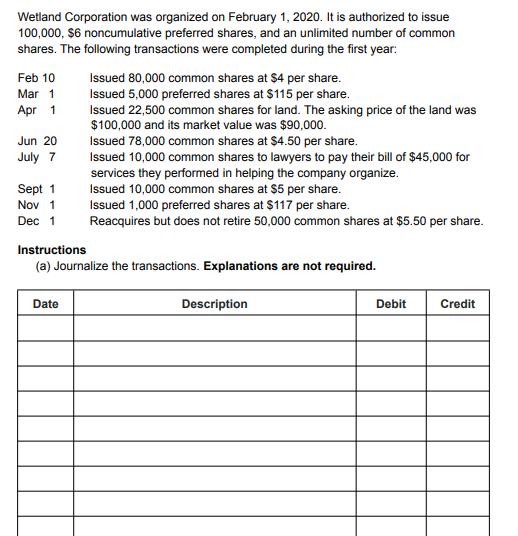

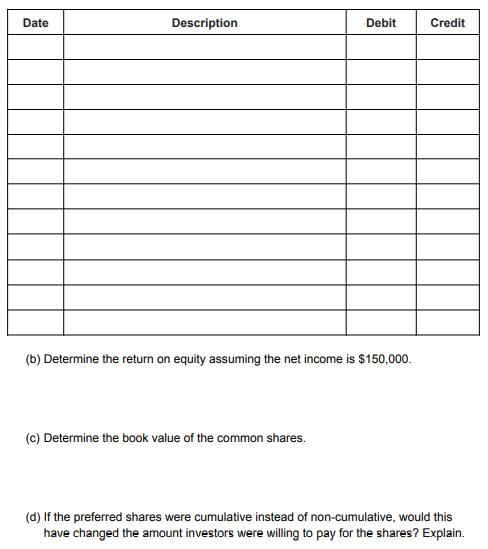

Wetland Corporation was organized on February 1, 2020. It is authorized to issue 100,000, $6 noncumulative preferred shares, and an unlimited number of common shares. The following transactions were completed during the first year: Feb 10 Mar 1 Apr 1 Issued 80,000 common shares at $4 per share. Issued 5,000 preferred shares at $115 per share. Issued 22,500 common shares for land. The asking price of the land was $100,000 and its market value was $90,000. Jun 20 Issued 78,000 common shares at $4.50 per share. Issued 10,000 common shares to lawyers to pay their bill of $45,000 for services they performed in helping the company organize. July 7 Sept 1 Issued 10,000 common shares at $5 per share. Nov 1 Issued 1,000 preferred shares at $117 per share. Reacquires but does not retire 50,000 common shares at $5.50 per share. Dec 1 Instructions (a) Journalize the transactions. Explanations are not required. Date Description Debit Credit Date Description Debit Credit (b) Determine the return on equity assuming the net income is $150,000. (c) Determine the book value of the common shares. (d) If the preferred shares were cumulative instead of non-cumulative, would this have changed the amount investors were willing to pay for the shares? Explain.

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

62832b3b29a29_86730.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started