Answered step by step

Verified Expert Solution

Question

1 Approved Answer

We've primarily discussed fixed - rate coupon bonds with stable coupon payments. However, another category of bonds utilizes floating ( or variable ) rates, meaning

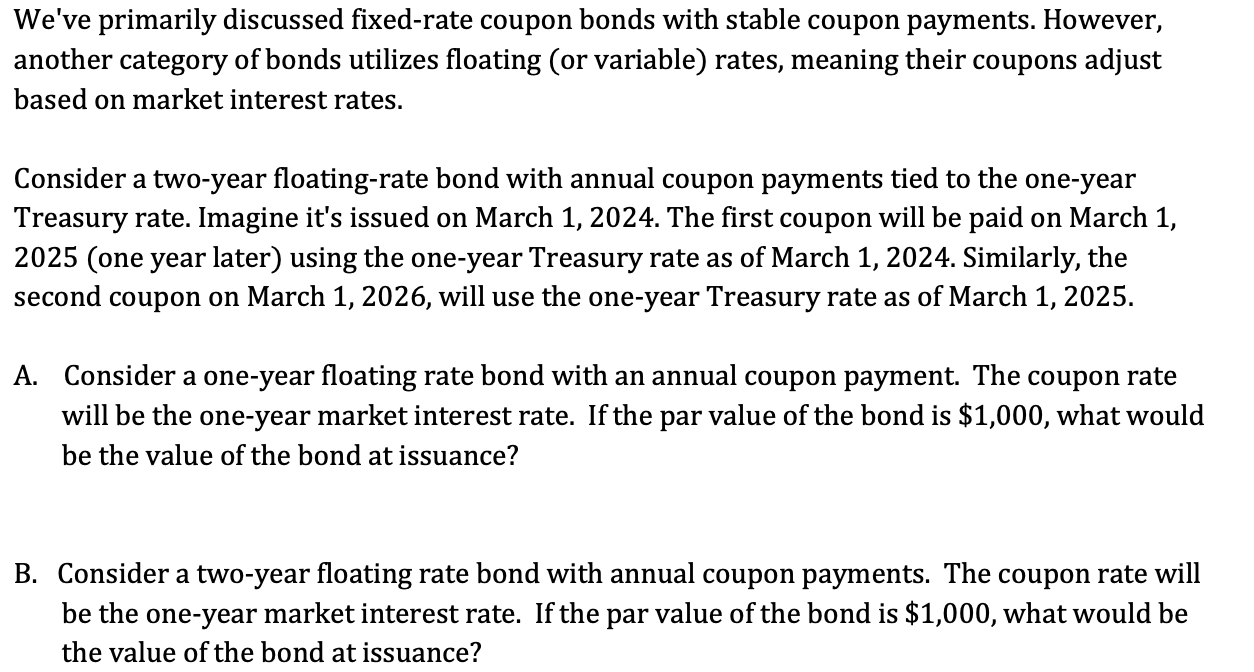

We've primarily discussed fixedrate coupon bonds with stable coupon payments. However,

another category of bonds utilizes floating or variable rates, meaning their coupons adjust

based on market interest rates.

Consider a twoyear floatingrate bond with annual coupon payments tied to the oneyear

Treasury rate. Imagine it's issued on March The first coupon will be paid on March

one year later using the oneyear Treasury rate as of March Similarly, the

second coupon on March will use the oneyear Treasury rate as of March

A Consider a oneyear floating rate bond with an annual coupon payment. The coupon rate

will be the oneyear market interest rate. If the par value of the bond is $ what would

be the value of the bond at issuance?

B Consider a twoyear floating rate bond with annual coupon payments. The coupon rate will

be the oneyear market interest rate. If the par value of the bond is $ what would be

the value of the bond at issuance?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started