Wexdorf Consulting Ltd. has been in business for several years, providing software consulting to its customers on an annual contract or special assignment basis. All

Wexdorf Consulting Ltd. has been in business for several years, providing software consulting to its customers on an annual contract or special assignment basis. All work is done over the Internet, although some travel is occasionally required for meeting with customers to negotiate contracts and renewals of contracts, as well as resolving possible disputes in invoicing for their services. Wexdorf operates out of rented premises in Toronto and Stratford, Ontario (see note 5 below) and has a modest investment in equipment that is used by the consulting team. Wexdorf is a private company that follows ASPE and that has a calendar year end.

At the end of each year, Wexdorf obtains the services of an accountant to complete the annual accounting cycle of the business and prepare any year-end adjusting of journal entries, financial statements, and corporate tax returns.

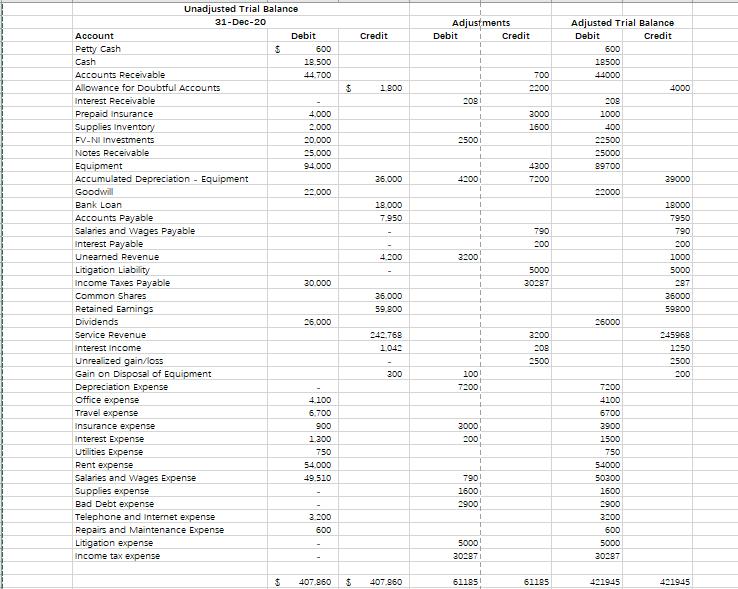

Upon arrival in early 2020, the accountant was given an unadjusted trial balance (excel template provided) and obtained the following additional information to complete his work.

Additional information:

1. Management has been going over the list of accounts receivable for possible accounts that are not collectible. One account for $700 must be written off. In the past, 5% of the balance of all accounts receivable has been the basis of an estimate for the required balance in the allowance for doubtful accounts. Management feels that this estimate should be followed for 2020.

2. After doing a count of supplies on hand, management determined that $400 of supplies remained unused at December 31, 2020.

3. The account balance in Prepaid Insurance of $4,000 represents the annual cost of the renewal of all of Wexdorf's insurance policies that expire in one year. The policies' coverage started April 1, 2020.

4. FV-NI Investments are long-term investments. The fair value of the portfolio of investments was $22,500 at December 31, 2020, based on quoted market values on the TSX.

5. In March 2020, Wexdorf closed its Stratford, ON location. The Stratford location had some equipment that it sold for proceeds of $300 cash. The entry made when depositing the cash was debit Cash, credit Gain on Disposal of Equipment. The original cost of the equipment was $4,300 and the accumulated depreciation was $4,200. Up to its closure, the Stratford location generated Service Revenue of $11,750 in 2020 and had the following expenses that are included in the unadjusted trial balance:

- Salaries and Wages, $3,600

- Rent, $9,000

- Telephone and internet expense, $300

- Office expense, $500

6. The depreciation expense for the remaining equipment was calculated to be $7,200 for the 2020 fiscal year.

7. The notes receivable from customers are due October 31, 2023, and bear interest at 5%, with interest paid semi-annually. The last interest collected related to the notes was for the six months ended October 31, 2020.

8. Bank loans are demand bank loans for working capital needs and vary in amount as the needs arise. The bank advised that the interest charge for December 2020 that will go through on the January 2021 bank statement is in the amount of $200.

9. Unpaid salaries and wages at December 31, 2020, totalled $790. These will be paid as part of the first payroll of 2021.

10. After some analysis, management informs the accountant that the Unearned Revenue account should have a balance of $1,000.

11. Wexdorf was sued by one of its former clients for $50,000 for giving bad advice and instructions. Upon discussion with legal counsel, it has been agreed that it will likely take $5,000 to settle this dispute out of court, in the next fiscal year. No entry has yet been recorded.

12. The accountant is told that a sublet lease arrangement for some excess office space has been negotiated and signed. It will provide Wexdorf with rent revenue starting on February 1, 2021, at a rate of $400 per month.

13. Wexdorf has been making income tax instalments as required by the Canada Revenue Agency. All instalment payments have been debited to the Income Taxes Payable account.

14. After recording all of the necessary adjustments and posting to the general ledger, management drafted a new trial balance to arrive at the income before income taxes. Using this result, the accountant prepared the tax returns, and determined that a tax rate of 28% needed to be applied to the income before income tax amount. The necessary adjusting entry for taxes has not yet been recorded.

Instructions

Using the adjusted trial balance columns of your worksheet, calculate the amount of income before income taxes. Use the information provided in item 14 to record income tax expense for the year.

Prepare a multi-step statement of income with expenses reported by nature, astatement of retained earnings, and a statement of financial position for 2020. (Use Excel tabs provided for each statement).

Explain the various levels of input in the fair value hierarchy. Based on the IFRS 13 guidance, indicate at which level in the fair value hierarchy the FV-NI investments will fall (level 1, 2, or 3). Explain your choice. How would your analysis change under ASPE? Is the amount reported in the unadjusted trial balance of $20,000 equal to the cost of the investments in the portfolio? Explain. (Answer on excel tab e. Fair Value Hierarchy)

Account Petty Cash Cash Accounts Receivable Allowance for Doubtful Accounts Interest Receivable Prepaid Insurance Supplies Inventory FV-NI Investments Notes Receivable Unadjusted Trial Balance 31-Dec-20 Equipment Accumulated Depreciation Equipment Goodwill Bank Loan Accounts Payable Salaries and Wages Payable Interest Payable Unearned Revenue Litigation Liability Income Taxes Payable Common Shares Retained Earnings Dividends Service Revenue Interest income Unrealized gain/loss Gain on Disposal of Equipment Depreciation Expense office expense Travel expense Insurance expense Interest Expense Utilities Expense Rent expense Salaries and Wages Expense Supplies expense Bad Debt expense Telephone and internet expense Repairs and Maintenance Expense Litigation expense Income tax expense $ Debit 600 18.500 44.700 4.000 2.000 20,000 25.000 94.000 22,000 30.000 26,000 4.100 6.700 900 1.300 750 54.000 49.510 3.200 600 $ 407.860 $ Credit 1.800 36,000 18,000 7.950 4.200 36.000 59.800 242,768 1042 300 407,960 Adjustments Debit 208 2500 4200 3200 100 7200 3000 200 790 1600 2900 5000 30287 61185 Credit 700 2200 3000 1600 4300 7200 790 200 5000 30287 3200 208 2500 61185 Adjusted Trial Balance Debit Credit 600 18500 44000 208 1000 400 22500 25000 89700 22000 26000 7200 4100 6700 3900 1500 750 54000 50300 1600 2900 3200 600 5000 30287 421945 4000 39000 18000 7950 790 200 1000 5000 287 36000 59900 245969 1250 2500 200 421945

Step by Step Solution

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Journal entries Date Particulars Bad Debts Ac Dr To Allowance for Bad debts AC To Account Receivable Ac Being entry for creating bad debts Supplies expenses Ac Dr To Supplies AC being Entry for use of ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started