Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wexton Technologies Inc. began 2020 with inventory of $24,000. During the year, Wexton purchased inventory costing $115,000 and sold goods for $150,000, with all

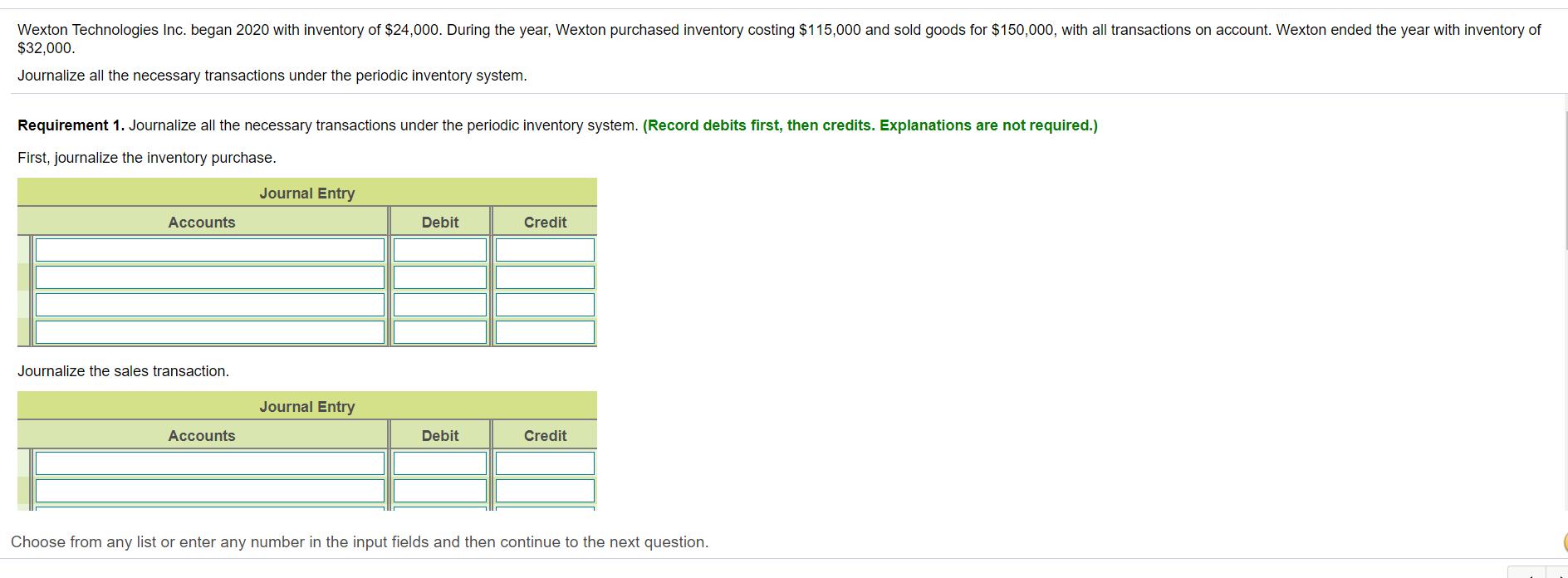

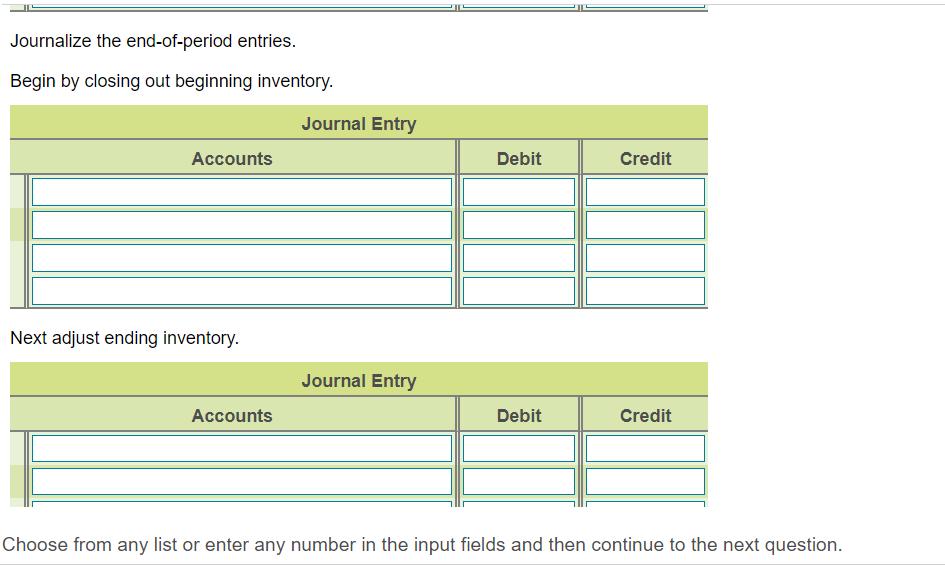

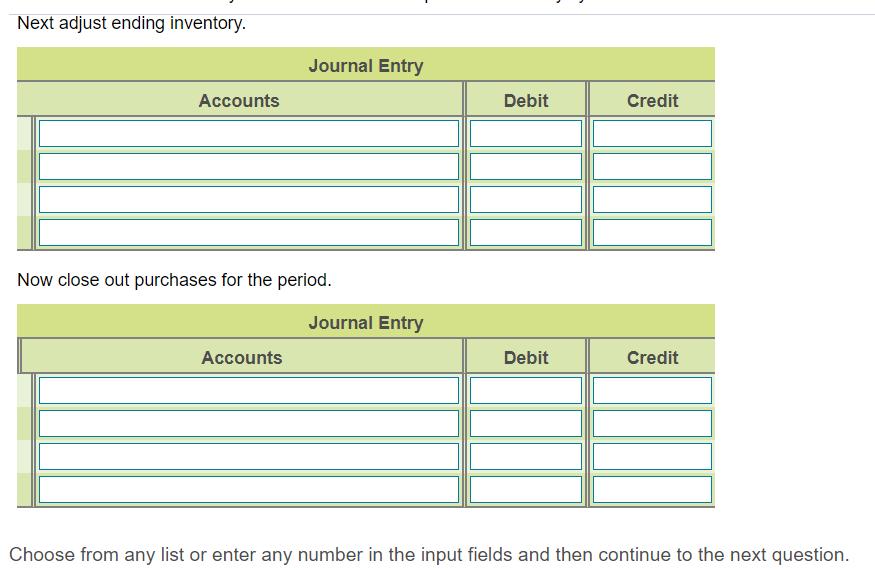

Wexton Technologies Inc. began 2020 with inventory of $24,000. During the year, Wexton purchased inventory costing $115,000 and sold goods for $150,000, with all transactions on account. Wexton ended the year with inventory of $32,000. Journalize all the necessary transactions under the periodic inventory system. Requirement 1. Journalize all the necessary transactions under the periodic inventory system. (Record debits first, then credits. Explanations are not required.) First, journalize the inventory purchase. Accounts Journalize the sales transaction. Accounts Journal Entry Journal Entry Debit Debit Credit Credit Choose from any list or enter any number in the input fields and then continue to the next question. Journalize the end-of-period entries. Begin by closing out beginning inventory. Accounts Next adjust ending inventory. Accounts Journal Entry Journal Entry Debit Debit Credit Credit Choose from any list or enter any number in the input fields and then continue to the next question. Next adjust ending inventory. Accounts Journal Entry Now close out purchases for the period. Accounts Journal Entry Debit Debit Credit Credit Choose from any list or enter any number in the input fields and then continue to the next question.

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution Following Journal entries are requi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started