Answered step by step

Verified Expert Solution

Question

1 Approved Answer

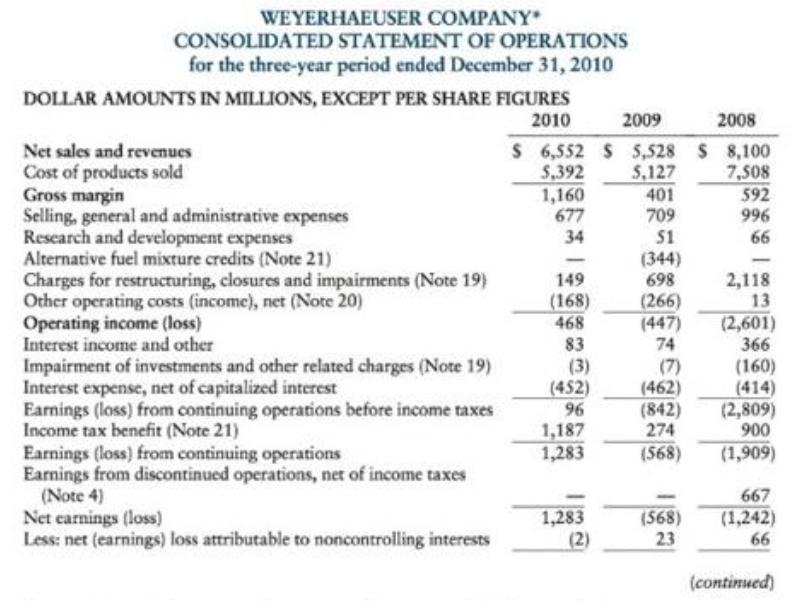

WEYERHAEUSER COMPANY CONSOLIDATED STATEMENT OF OPERATIONS for the three-year period ended December 31, 2010 DOLLAR AMOUNTS IN MILLIONS, EXCEPT PER SHARE FIGURES 2010 Net

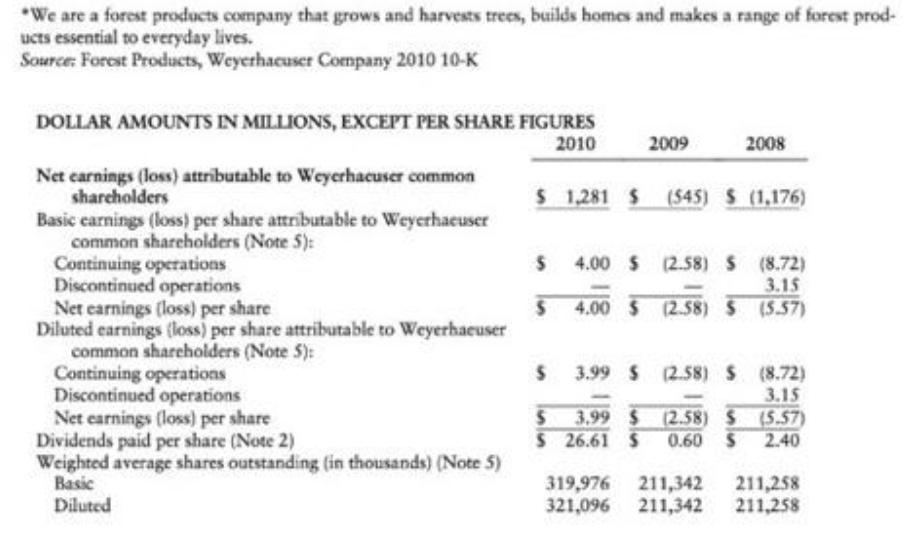

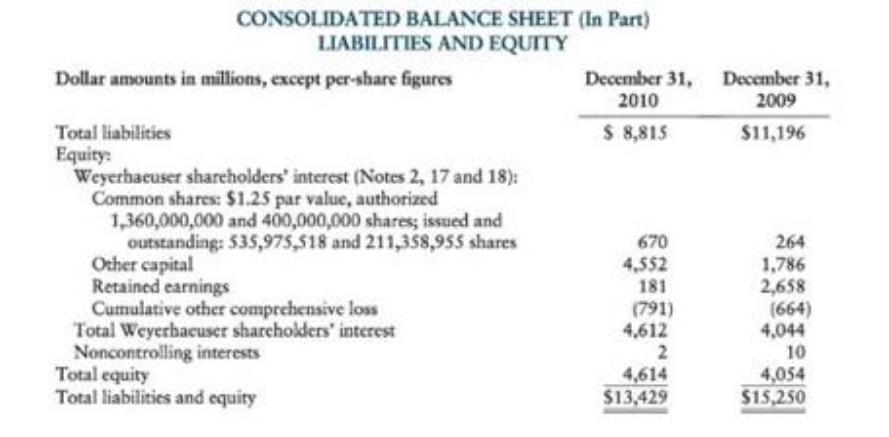

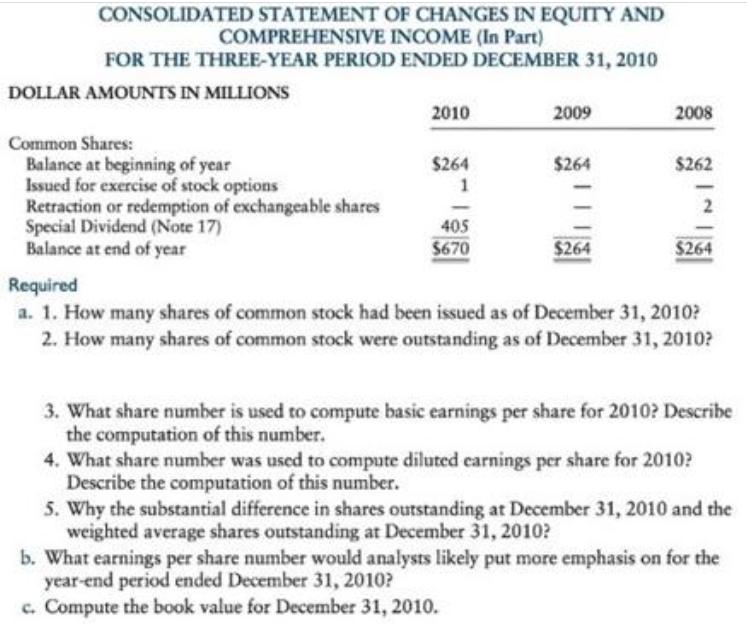

WEYERHAEUSER COMPANY CONSOLIDATED STATEMENT OF OPERATIONS for the three-year period ended December 31, 2010 DOLLAR AMOUNTS IN MILLIONS, EXCEPT PER SHARE FIGURES 2010 Net sales and revenues Cost of products sold Gross margin Selling, general and administrative expenses Research and development expenses Alternative fuel mixture credits (Note 21) Charges for restructuring, closures and impairments (Note 19) Other operating costs (income), net (Note 20) Operating income (loss) Interest income and other Impairment of investments and other related charges (Note 19) Interest expense, net of capitalized interest Earnings (loss) from continuing operations before income taxes Income tax benefit (Note 21) Earnings (loss) from continuing operations Earnings from discontinued operations, net of income taxes (Note 4) Net earnings (loss) Less: net (earnings) loss attributable to noncontrolling interests 2009 2008 $ 6,552 $ 5,528 $ 8,100 5,392 5,127 7,508 1,160 677 34 149 (168) 468 83 (3) (452) 96 1,187 1,283 1,283 (2) 401 709 51 (344) 698 (266) (447) 74 (7) (462) (842) 274 (568) (568) 23 592 996 66 2,118 13 (2,601) 366 (160) (414) (2,809) 900 (1,909) 667 (1,242) 66 (continued) *We are a forest products company that grows and harvests trees, builds homes and makes a range of forest prod- ucts essential to everyday lives. Source: Forest Products, Weyerhacuser Company 2010 10-K DOLLAR AMOUNTS IN MILLIONS, EXCEPT PER SHARE FIGURES 2010 Net earnings (loss) attributable to Weyerhacuser common shareholders Basic earnings (loss) per share attributable to Weyerhaeuser common shareholders (Note 5): Continuing operations Discontinued operations Net earnings (loss) per share Diluted earnings (loss) per share attributable to Weyerhaeuser common shareholders (Note 5): Continuing operations Discontinued operations Net earnings (loss) per share Dividends paid per share (Note 2) Weighted average shares outstanding (in thousands) (Note 5) Basic Diluted $ 1,281 S $ $ 4.00 $ 4.00 $ 2009 2008 (545) $(1,176) (2.58) $ (8.72) 3.15 (2.58) $ (5.57) $ 3.99 $ (2.58) $ (8.72) 3.15 $ 3.99 $(2.58) S (2.58) $ (5.57) S 26.61 S 0.60 $ 2.40 319,976 211,342 211,258 321,096 211,342 211,258 CONSOLIDATED BALANCE SHEET (In Part) LIABILITIES AND EQUITY Dollar amounts in millions, except per-share figures Total liabilities Equity: Weyerhaeuser shareholders' interest (Notes 2, 17 and 18): Common shares: $1.25 par value, authorized 1,360,000,000 and 400,000,000 shares; issued and outstanding: 535,975,518 and 211,358,955 shares Other capital Retained earnings Cumulative other comprehensive loss Total Weyerhacuser shareholders' interest Noncontrolling interests Total equity Total liabilities and equity December 31, 2010 $ 8,815 670 4,552 181 (791) 4,612 2 4,614 $13,429 December 31, 2009 $11,196 264 1,786 2,658 (664) 4,044 10 4,054 $15,250 CONSOLIDATED STATEMENT OF CHANGES IN EQUITY AND INCOME (In Part) COMPREHENSIVE FOR THE THREE-YEAR PERIOD ENDED DECEMBER 31, 2010 DOLLAR AMOUNTS IN MILLIONS Common Shares: Balance at beginning of year Issued for exercise of stock options Retraction or redemption of exchangeable shares Special Dividend (Note 17) Balance at end of year 2010 $264 1 405 $670 2009 $264 $264 2008 $262 2 $264 Required a. 1. How many shares of common stock had been issued as of December 31, 2010? 2. How many shares of common stock were outstanding as of December 31, 2010? 3. What share number is used to compute basic earnings per share for 2010? Describe the computation of this number. 4. What share number was used to compute diluted earnings per share for 2010? Describe the computation of this number. 5. Why the substantial difference in shares outstanding at December 31, 2010 and the weighted average shares outstanding at December 31, 2010? b. What earnings per share number would analysts likely put more emphasis on for the year-end period ended December 31, 2010? c. Compute the book value for December 31, 2010.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a 1 535975518 2 535975518 EPS Net Income Preferred dividen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started