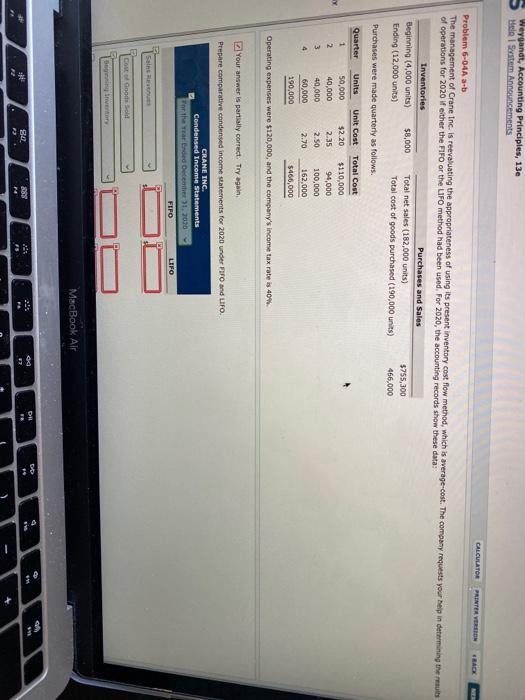

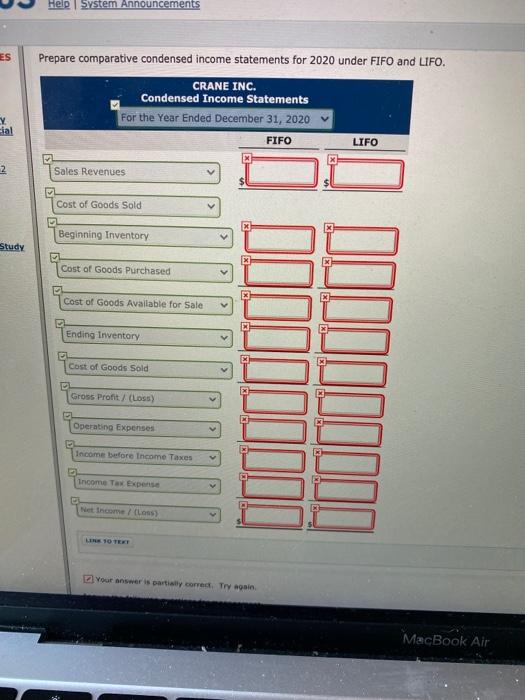

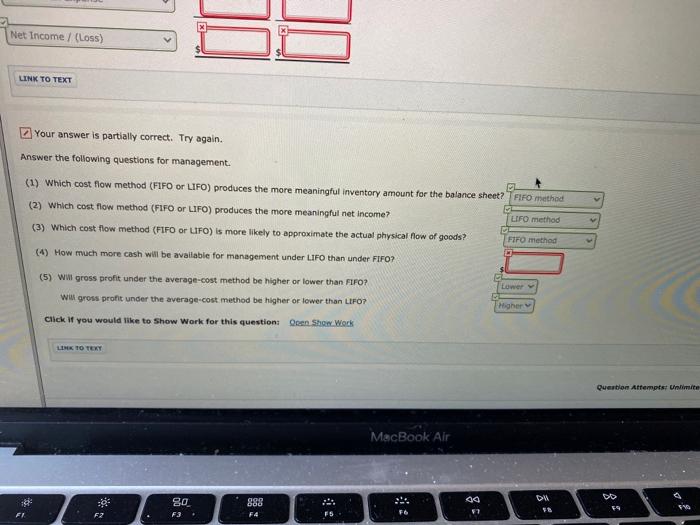

Weygandt, Accounting Principles, 13e Melo System Announcements CALCULATOR PRINTER VERSION BACK Problem 6-04A - The management of Crane Inc. is reevaluating the appropriateness of using its present inventory cost flow method, which is average-cost. The company requests your help in determining the results of operations for 2020 If either the FIFO or the LIFO method had been used. For 2020, the accounting recor show these data: Inventories Purchases and Sales Beginning (4,000 units) $8,000 Total net sales (182,000 units) $755,300 Ending (12.000 units) Total cost of goods purchased (190,000 units) 466,000 Purchases were made quarterly as follows. Units Unit Cost Total Cost Quarter 1 2 Y 50,000 40,000 40,000 60,000 190.000 $2.20 2.35 2.50 2.70 3 4 $110,000 94,000 100,000 162.000 5466,000 Operating expenses were $120,000, and the company's income tax rate is 40% Your answer is partially correct. Try again Prepare comparative condensed income statements for 2020 under FIFO and LIFO. CRANE INC. Condensed Income Statements For the rar Ended Dec 31. 3030 FIFO LIFO Sains Cost of God MacBook Air 8 342 3 288 Help System Announcements ES Prepare comparative condensed income statements for 2020 under FIFO and LIFO. CRANE INC. Condensed Income Statements For the Year Ended December 31, 2020 Y. cial FIFO LIFO 2 Sales Revenues Cost of Goods Sold Beginning Inventory Study Cost of Goods Purchased Cost of Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit (Loss) Operating Expenses Income before Income Taxes Income Tax Expense Net Income (Loss) El your answer is partly corred. Try again MacBook Air Net Income (Loss) LINK TO TEXT Your answer is partially correct. Try again. Answer the following questions for management. (1) Which cost flow method (FIFO or LIFO) produces the more meaningful inventory amount for the balance sheet? FIFO method (2) Which cost flow method (FIFO or LIFO) produces the more meaningful net income? (3) Which cost flow method (FIFO or LFO) is more likely to approximate the actual physical flow of goods? LIFO method FIFO method (4) How much more cash will be available for management under LIFO than under FIFO? (5) Wil gross profit under the average-cost method be higher or lower than FIFO? Lower WW gross profit under the average cost method be higher or lower than LIFO? Higher Click If you would like to show Work for this questioni Qeen Show Work LINK TO TEXT Question Attempts Unlimite MacBook Air og bu 80 F3 OOP COD F4 49 FI F2 FG F5 Weygandt, Accounting Principles, 13e Melo System Announcements CALCULATOR PRINTER VERSION BACK Problem 6-04A - The management of Crane Inc. is reevaluating the appropriateness of using its present inventory cost flow method, which is average-cost. The company requests your help in determining the results of operations for 2020 If either the FIFO or the LIFO method had been used. For 2020, the accounting recor show these data: Inventories Purchases and Sales Beginning (4,000 units) $8,000 Total net sales (182,000 units) $755,300 Ending (12.000 units) Total cost of goods purchased (190,000 units) 466,000 Purchases were made quarterly as follows. Units Unit Cost Total Cost Quarter 1 2 Y 50,000 40,000 40,000 60,000 190.000 $2.20 2.35 2.50 2.70 3 4 $110,000 94,000 100,000 162.000 5466,000 Operating expenses were $120,000, and the company's income tax rate is 40% Your answer is partially correct. Try again Prepare comparative condensed income statements for 2020 under FIFO and LIFO. CRANE INC. Condensed Income Statements For the rar Ended Dec 31. 3030 FIFO LIFO Sains Cost of God MacBook Air 8 342 3 288 Help System Announcements ES Prepare comparative condensed income statements for 2020 under FIFO and LIFO. CRANE INC. Condensed Income Statements For the Year Ended December 31, 2020 Y. cial FIFO LIFO 2 Sales Revenues Cost of Goods Sold Beginning Inventory Study Cost of Goods Purchased Cost of Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit (Loss) Operating Expenses Income before Income Taxes Income Tax Expense Net Income (Loss) El your answer is partly corred. Try again MacBook Air Net Income (Loss) LINK TO TEXT Your answer is partially correct. Try again. Answer the following questions for management. (1) Which cost flow method (FIFO or LIFO) produces the more meaningful inventory amount for the balance sheet? FIFO method (2) Which cost flow method (FIFO or LIFO) produces the more meaningful net income? (3) Which cost flow method (FIFO or LFO) is more likely to approximate the actual physical flow of goods? LIFO method FIFO method (4) How much more cash will be available for management under LIFO than under FIFO? (5) Wil gross profit under the average-cost method be higher or lower than FIFO? Lower WW gross profit under the average cost method be higher or lower than LIFO? Higher Click If you would like to show Work for this questioni Qeen Show Work LINK TO TEXT Question Attempts Unlimite MacBook Air og bu 80 F3 OOP COD F4 49 FI F2 FG F5