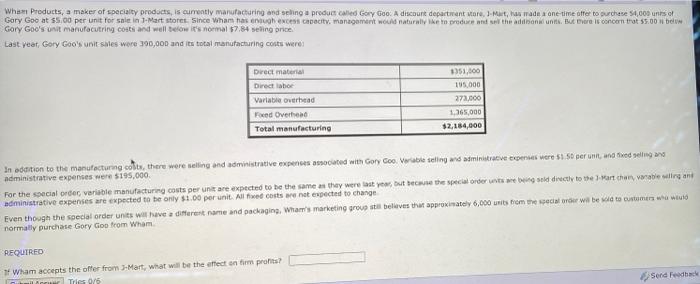

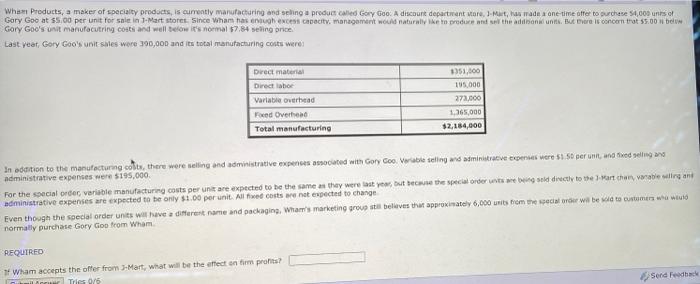

Wham Products, a maker of specialty products, is currently manufacturing and selling product category Cool A discount department store, Mas made a one time offer to purchase 51.000 unts of Gary Goo at $5.00 per unit for sale in 1-Mart store. Since Wham has excess capacity management would natural produse the advann. But ever It concern trat 55.00 Gory Goo's unit manufacutring costs and well below it's normal 7.84 selling price Last year, Gory Goo's unit sales were 390,000 and its total manufacturing costs were Drect material Direct labor Variable overhead Foxed Overhead Total manufacturing 351,600 105.000 272.000 1,365,000 32,184,000 In addition to the manufacturing colts, there were selling and administrative expenses acted with Gory Goo. We selling and administrace were 150 perunt, and selling administrative expenses were $195,000 For the special rec variable manufacturing costs per unit are expected to be the same as they were last year, but because the special order to directly to the Matchen, wie wir ant administrative expenses are expected to the only $1.00 per unit. Allwed costs are not expected to change Even though the special order units will have a different name and packaging War's marketing group still believes that approximately 6,000 units to the recorder will be with customers and normally purchase Gory Goo from Wham REQUIRED If Wham accepts the offer from Mart, what will be the effect on tim profits? Trics 0/5 Send Feed FOR Wham Products, a maker of specialty products, is currently manufacturing and selling a product called Gary Goo. A discount department store, 1-Mart, has made a one offer to purchase 54,000 to Gory Goo at $5.00 per unit for sale in Mart stores. Since Wham has enough excess capacity management would naturally like to produce and sell the additional But there is not that 00 is on Gory Goo's unit manufacutring costs and well below it's normal 37.84 selling price. Last year, Gory Goo's unit sales were 390,000 and its total manufacturing costs were: Direct material Direct labor Variable overhead Fixed Overhead Total manufacturing $351.000 195,000 273,000 1.365.000 $2,184,000 In addition to the manufacturing costs, there were selling and administrative expenses associated with Gory Goo. Variable seling and administrative expenses were $1.50 perunt, and feed selling and administrative expenses were $195,000 For the special orde variable manufacturing costs per unit are expected to be the same as they were last year, but because the special oder units are being sold directly to the Mart chain were seling and administrative expenses are expected to be only $1.00 per unit. Alfred costs are not expected to change Even though the special order units will have a different name and packaging, Whan's marketing group sell believes that approximately 6,000 units from the special order will be sold to customers who would normally purchase Gory Goo from Wham REQUIRED If Wham accepts the offer from 3-Mart, what will be the effect on firm profits