Answered step by step

Verified Expert Solution

Question

1 Approved Answer

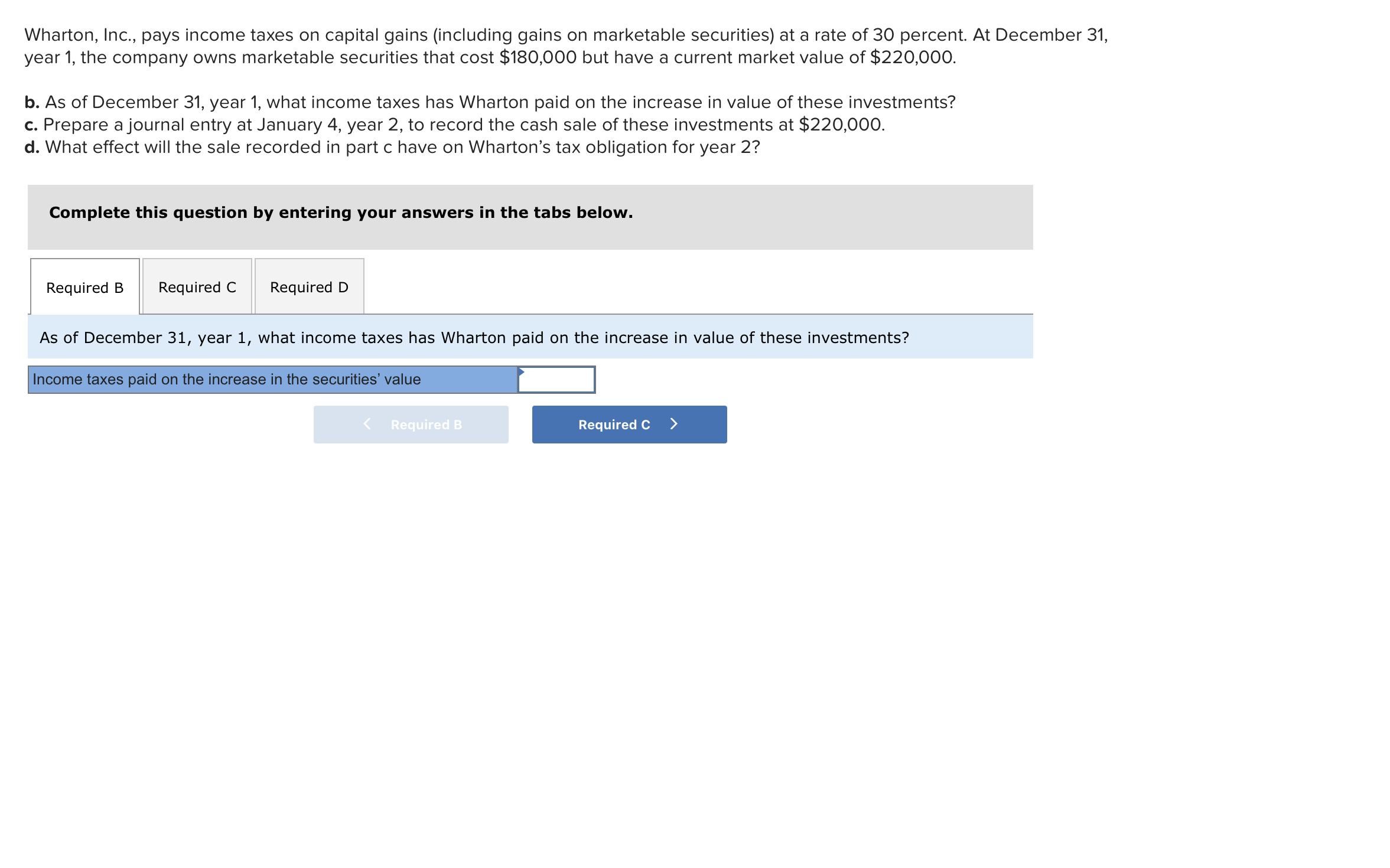

Wharton, Inc., pays income taxes on capital gains ( including gains on marketable securities ) at a rate of 3 0 percent. At December 3

Wharton, Inc., pays income taxes on capital gains including gains on marketable securities at a rate of percent. At December year the company owns marketable securities that cost $ but have a current market value of $

b As of December year what income taxes has Wharton paid on the increase in value of these investments?

c Prepare a journal entry at January year to record the cash sale of these investments at $

d What effect will the sale recorded in part c have on Wharton's tax obligation for year

Complete this question by entering your answers in the tabs below.

As of December year what income taxes has Wharton paid on the increase in value of these investments?

Income taxes paid on the increase in the securities value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started