Answered step by step

Verified Expert Solution

Question

1 Approved Answer

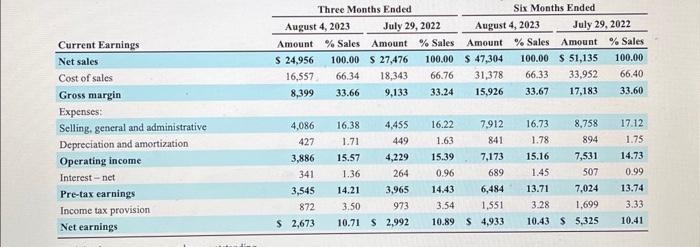

what accounting method (e.g. FIFO) does Lowes companies, Inc use? what is the companies inventory turnover? what is lowes companies, inc gross profit percentage? using

what accounting method (e.g. FIFO) does Lowes companies, Inc use?

what is the companies inventory turnover?

what is lowes companies, inc gross profit percentage?

using only the info for 2023

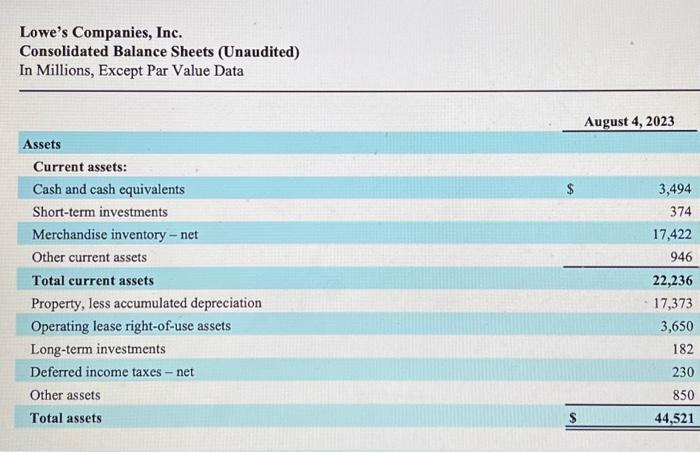

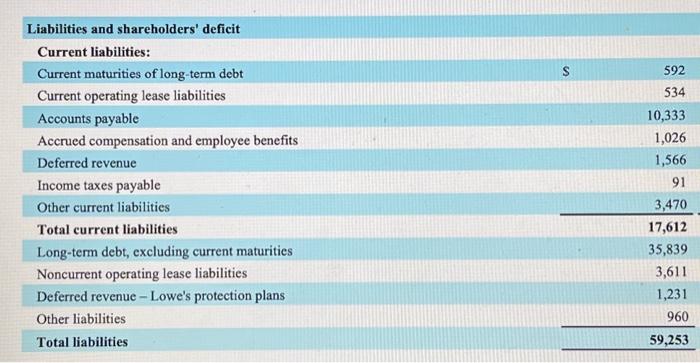

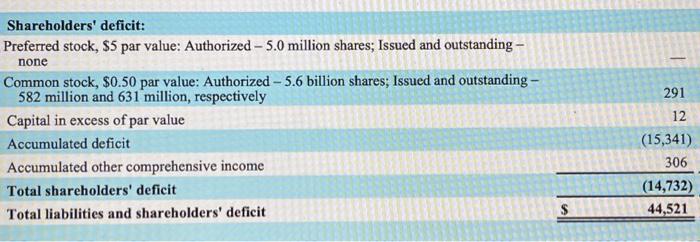

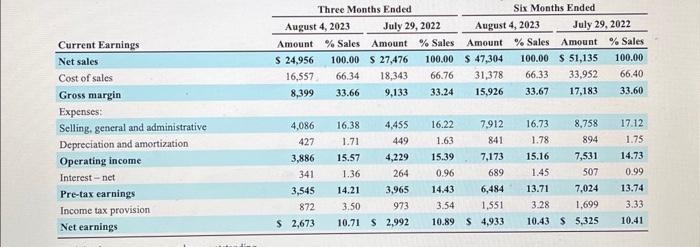

Shareholders' deficit: Preferred stock, \$5 par value: Authorized - 5.0 million shares; Issued and outstanding none Common stock, $0.50 par value: Authorized - 5.6 billion shares; Issued and outstanding 582 million and 631 million, respectively Capital in excess of par value Accumulated deficit Accumulated other comprehensive income Total shareholders' deficit Total liabilities and shareholders' deficit \begin{tabular}{|l|r|} \hline Liabilities and shareholders' deficit & \\ \hline Current liabilities: & 592 \\ \hline Current maturities of long-term debt & 534 \\ \hline Current operating lease liabilities & 10,333 \\ \hline Accounts payable & 1,026 \\ \hline Accrued compensation and employee benefits & 1,566 \\ \hline Deferred revenue & 91 \\ \hline Income taxes payable & 3,470 \\ \hline Other current liabilities & 17,612 \\ \hline Total current liabilities & 35,839 \\ \hline Long-term debt, excluding current maturities & 3,611 \\ \hline Noncurrent operating lease liabilities & 1,231 \\ \hline Deferred revenue - Lowe's protection plans & 960 \\ \hline Other liabilities & 59,253 \\ \hline Total liabilities & \\ \hline \end{tabular} Lowe's Companies, Inc. Consolidated Balance Sheets (Unaudited) In Millions, Except Par Value Data Three Months Ended Six Months Ended \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline \multirow[b]{3}{*}{ Current Earnings } & \multicolumn{4}{|c|}{ Three Months Ended } & \multicolumn{4}{|c|}{ Six Months Ended } \\ \hline & \multicolumn{2}{|c|}{ August 4,2023} & \multicolumn{2}{|c|}{ July 29,2022} & \multicolumn{2}{|c|}{ August 4, 2023} & \multicolumn{2}{|c|}{ July 29,2022} \\ \hline & Amount & % Sales & Amount & % Sales & Amount & % Sales & Amount & % Sales \\ \hline Net sales & S 24,956 & 100.00 & S 27,476 & 100.00 & S 47,304 & 100.00 & S 51,135 & 100.00 \\ \hline Cost of sales & 16,557 & 66.34 & 18,343 & 66.76 & 31,378 & 66.33 & 33,952 & 66.40 \\ \hline Gross margin & 8,399 & 33.66 & 9,133 & 33.24 & 15,926 & 33.67 & 17,183 & 33.60 \\ \hline Expenses: & & & & & & & & \\ \hline Selling, general and administrative & 4,086 & 16.38 & 4,455 & 16.22 & 7,912 & 16.73 & 8,758 & 17.12 \\ \hline Depreciation and amortization & 427 & 1.71 & 449 & 1.63 & 841 & 1.78 & 894 & 1.75 \\ \hline Operating income & 3,886 & 15.57 & 4,229 & 15.39 & 7,173 & 15.16 & 7,531 & 14.73 \\ \hline Interest - net & 341 & 1.36 & 264 & 0.96 & 689 & 1.45 & 507 & 0.99 \\ \hline Pre-tax earnings & 3,545 & 14.21 & 3,965 & 14.43 & 6,484 & 13.71 & 7,024 & 13.74 \\ \hline Income tax provision & 872 & 3.50 & 973 & 3.54 & 1,551 & 3.28 & 1,699 & 3.33 \\ \hline Net earnings & S 2,673 & 10.71 & S 2,992 & 10.89 & S 4,933 & 10.43 & S 5,325 & 10.41 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started