what additional information is needed

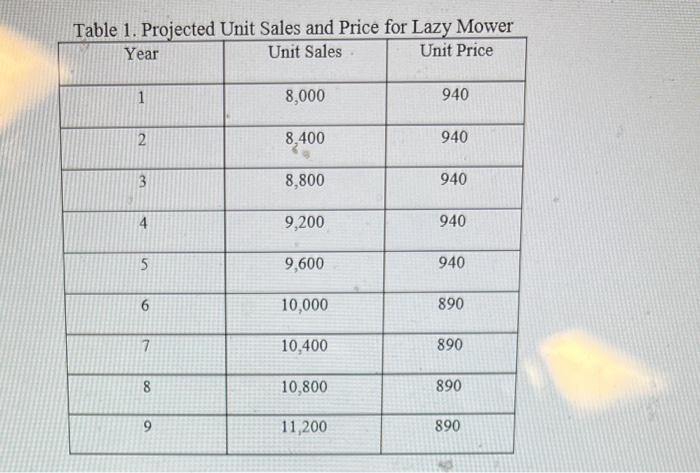

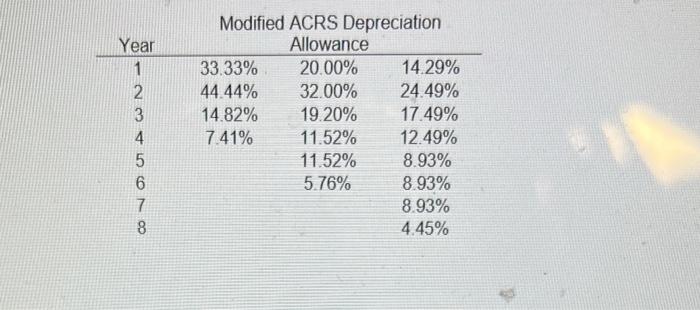

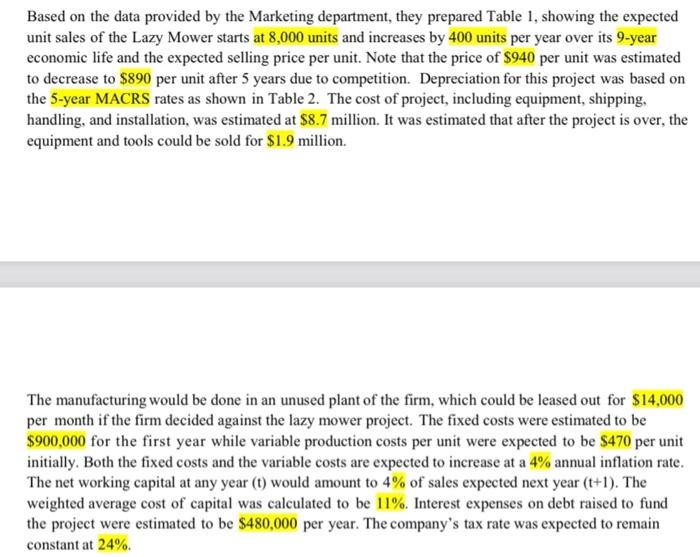

On a worksheet labeled "Base Cash flows," prepare a Pro Forma project cash flows showing the annual cash flows resulting from the Lazy Mower project. Perform capital budgeting analysis with the projected cash flows to compute NPV, IRR, MIRR, and payback. Based on the results, what should Dan and Ron recommend? Be sure to make your interpretation (not the definitions) of each computed result in your own words. Table 1. Projected Unit Sales and Price for Lazy Mower \begin{tabular}{|c|c|c|} \hline Year & Unit Sales & Unit Price \\ \hline 1 & 8,000 & 940 \\ \hline 2 & 8,400 & 940 \\ \hline 3 & 8,800 & 940 \\ \hline 4 & 9,200 & 940 \\ \hline 5 & 9,600 & 940 \\ \hline 6 & 10,000 & 890 \\ \hline 7 & 10,400 & 890 \\ \hline 8 & 10,800 & 890 \\ \hline 9 & 11,200 & 890 \\ \hline \end{tabular} \begin{tabular}{cccc} \multicolumn{4}{c}{ Modified ACRS Depreciation } \\ Year & \multicolumn{3}{c}{ Allowance } \\ \hline 1 & 33.33% & 20.00% & 14.29% \\ 2 & 44.44% & 32.00% & 24.49% \\ 3 & 14.82% & 19.20% & 17.49% \\ 4 & 7.41% & 11.52% & 12.49% \\ 5 & & 11.52% & 8.93% \\ 6 & & 5.76% & 8.93% \\ 7 & & & 8.93% \\ 8 & & & 4.45% \end{tabular} Based on the data provided by the Marketing department, they prepared Table 1 , showing the expected unit sales of the Lazy Mower starts at 8,000 units and increases by 400 units per year over its 9 -year economic life and the expected selling price per unit. Note that the price of $940 per unit was estimated to decrease to $890 per unit after 5 years due to competition. Depreciation for this project was based on the 5-year MACRS rates as shown in Table 2. The cost of project, including equipment, shipping, handling, and installation, was estimated at $8.7 million. It was estimated that after the project is over, the equipment and tools could be sold for $1.9 million. The manufacturing would be done in an unused plant of the firm, which could be leased out for $14,000 per month if the firm decided against the lazy mower project. The fixed costs were estimated to be $900,000 for the first year while variable production costs per unit were expected to be $470 per unit initially. Both the fixed costs and the variable costs are expected to increase at a 4% annual inflation rate. The net working capital at any year ( t ) would amount to 4% of sales expected next year (t+1). The weighted average cost of capital was calculated to be 11%. Interest expenses on debt raised to fund the project were estimated to be $480,000 per year. The company's tax rate was expected to remain constant at 24% On a worksheet labeled "Base Cash flows," prepare a Pro Forma project cash flows showing the annual cash flows resulting from the Lazy Mower project. Perform capital budgeting analysis with the projected cash flows to compute NPV, IRR, MIRR, and payback. Based on the results, what should Dan and Ron recommend? Be sure to make your interpretation (not the definitions) of each computed result in your own words. Table 1. Projected Unit Sales and Price for Lazy Mower \begin{tabular}{|c|c|c|} \hline Year & Unit Sales & Unit Price \\ \hline 1 & 8,000 & 940 \\ \hline 2 & 8,400 & 940 \\ \hline 3 & 8,800 & 940 \\ \hline 4 & 9,200 & 940 \\ \hline 5 & 9,600 & 940 \\ \hline 6 & 10,000 & 890 \\ \hline 7 & 10,400 & 890 \\ \hline 8 & 10,800 & 890 \\ \hline 9 & 11,200 & 890 \\ \hline \end{tabular} \begin{tabular}{cccc} \multicolumn{4}{c}{ Modified ACRS Depreciation } \\ Year & \multicolumn{3}{c}{ Allowance } \\ \hline 1 & 33.33% & 20.00% & 14.29% \\ 2 & 44.44% & 32.00% & 24.49% \\ 3 & 14.82% & 19.20% & 17.49% \\ 4 & 7.41% & 11.52% & 12.49% \\ 5 & & 11.52% & 8.93% \\ 6 & & 5.76% & 8.93% \\ 7 & & & 8.93% \\ 8 & & & 4.45% \end{tabular} Based on the data provided by the Marketing department, they prepared Table 1 , showing the expected unit sales of the Lazy Mower starts at 8,000 units and increases by 400 units per year over its 9 -year economic life and the expected selling price per unit. Note that the price of $940 per unit was estimated to decrease to $890 per unit after 5 years due to competition. Depreciation for this project was based on the 5-year MACRS rates as shown in Table 2. The cost of project, including equipment, shipping, handling, and installation, was estimated at $8.7 million. It was estimated that after the project is over, the equipment and tools could be sold for $1.9 million. The manufacturing would be done in an unused plant of the firm, which could be leased out for $14,000 per month if the firm decided against the lazy mower project. The fixed costs were estimated to be $900,000 for the first year while variable production costs per unit were expected to be $470 per unit initially. Both the fixed costs and the variable costs are expected to increase at a 4% annual inflation rate. The net working capital at any year ( t ) would amount to 4% of sales expected next year (t+1). The weighted average cost of capital was calculated to be 11%. Interest expenses on debt raised to fund the project were estimated to be $480,000 per year. The company's tax rate was expected to remain constant at 24%