Answered step by step

Verified Expert Solution

Question

1 Approved Answer

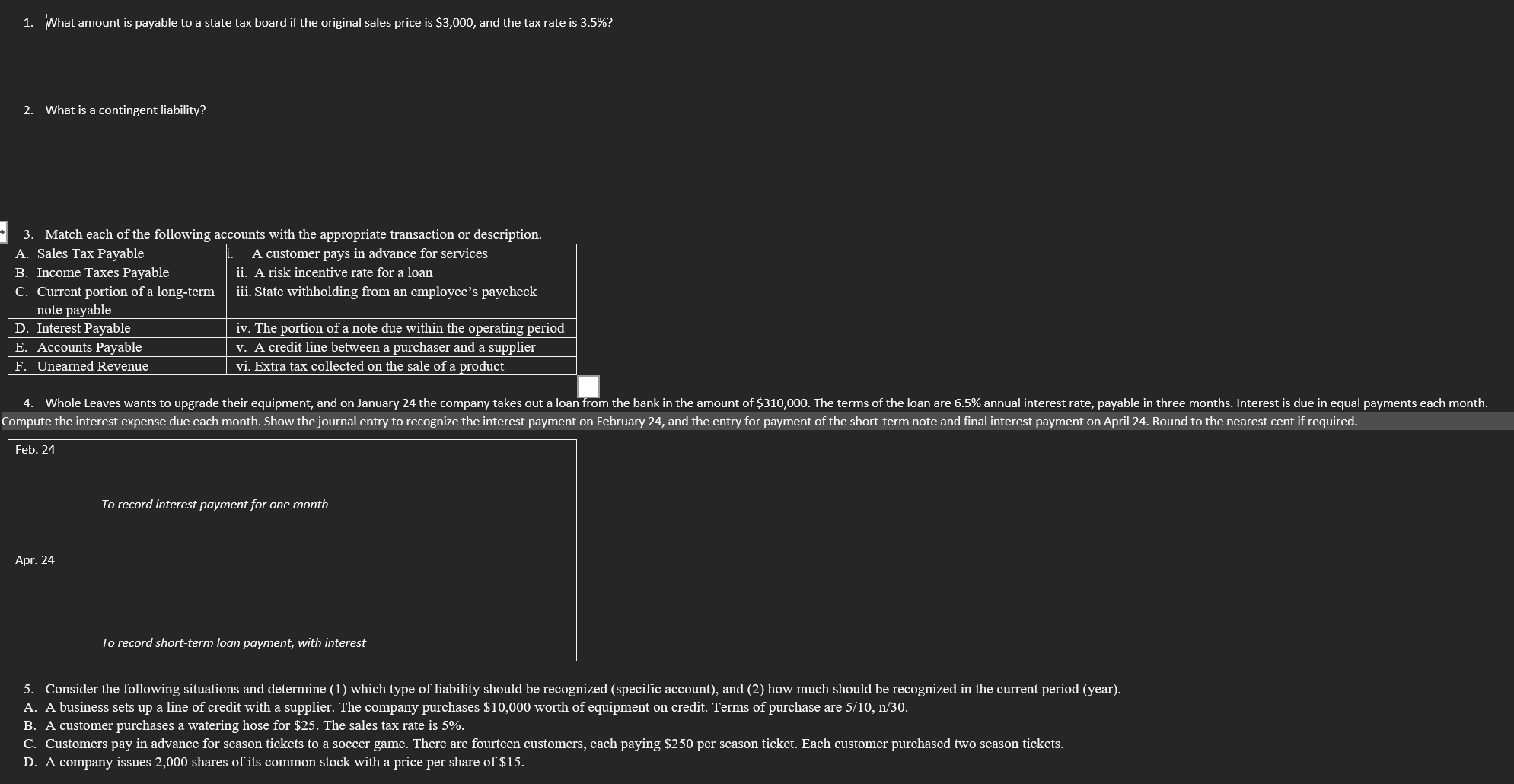

What amount is payable to a state tax board if the original sales price is $ 3 , 0 0 0 , and the tax

What amount is payable to a state tax board if the original sales price is $ and the tax rate is

What is a contingent liability?

Match each of the following accounts with the appropriate transaction or description.

Feb.

To record interest payment for one month

Apr.

To record shortterm loan payment, with interest

Consider the following situations and determine which type of liability should be recognized specific account and how much should be recognized in the current period year

A A business sets up a line of credit with a supplier. The company purchases $ worth of equipment on credit. Terms of purchase are

B A customer purchases a watering hose for $ The sales tax rate is

C Customers pay in advance for season tickets to a soccer game. There are fourteen customers, each paying $ per season ticket. Each customer purchased two season tickets.

D A company issues shares of its common stock with a price per share of $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started