During the current year, a simple trust has the following receipts and expenditures. The Uniform Act governs the accounting classification. a. What amount must be

During the current year, a simple trust has the following receipts and expenditures. The Uniform Act governs the accounting classification.

a. What amount must be distributed to the beneficiary the amount to be distributed to the beneficiary?

b. What is the trust's taxable income under the shortcut approach?

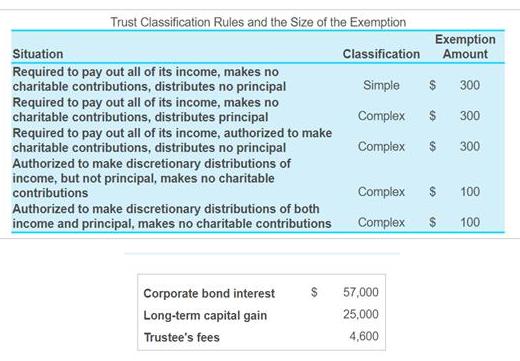

Trust Classification Rules and the Size of the Exemption Exemption Amount Situation Classification Required to pay out all of its income, makes no charitable contributions, distributes no principal Required to pay out all of its income, makes no charitable contributions, distributes principal Required to pay out all of its income, authorized to make charitable contributions, distributes no principal Authorized to make discretionary distributions of income, but not principal, makes no charitable contributions Simple $ 300 Complex $ 300 Complex 300 Complex 100 Authorized to make discretionary distributions of both income and principal, makes no charitable contributions Complex 100 Corporate bond interest 57,000 Long-term capital gain 25,000 Trustee's fees 4,600 %24

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Particulars income principal Corporate Bond Interest ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started