Answered step by step

Verified Expert Solution

Question

1 Approved Answer

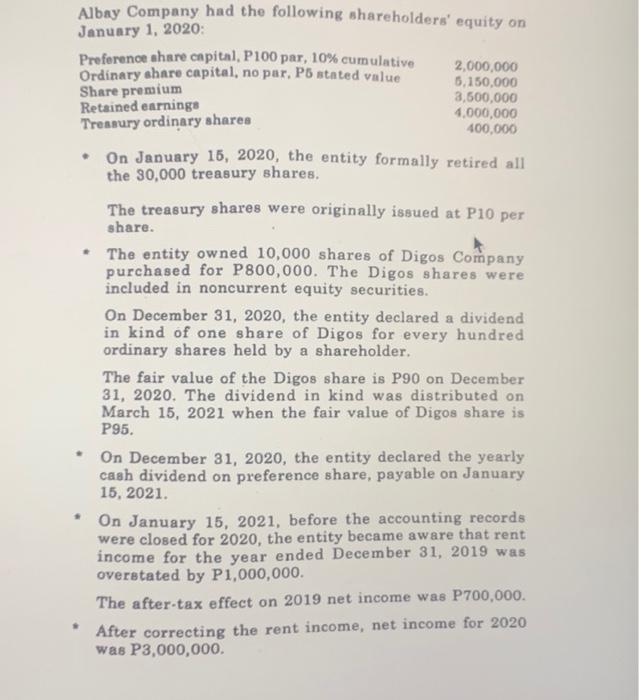

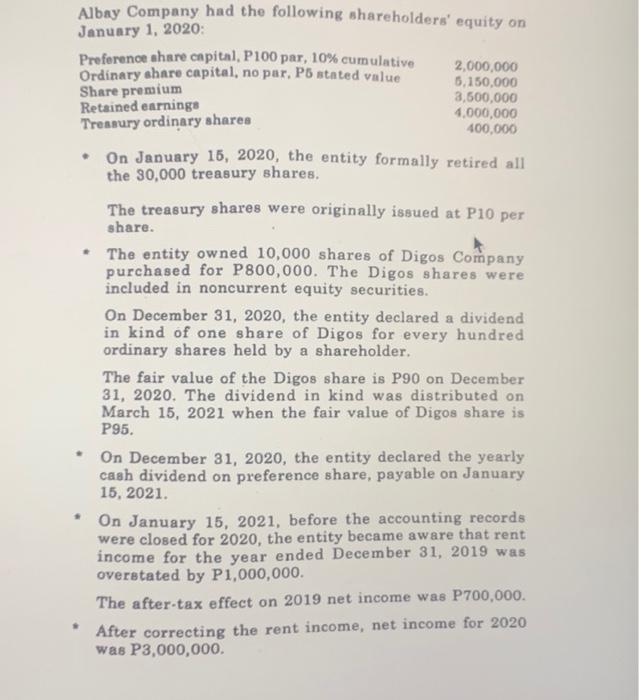

What amount should be reported as retained earnings on December 31,2020? Albay Company had the following shareholders' equity on January 1, 2020: Preference share capital,

What amount should be reported as retained earnings on December 31,2020?

Albay Company had the following shareholders' equity on January 1, 2020: Preference share capital, P100 par, 10% cumulative Ordinary share capital, no par, P6 stated value 2,000,000 6,150,000 Share premium 3,500,000 Retained earnings 4,000,000 Treasury ordinary shares 400,000 On January 16, 2020, the entity formally retired all the 30,000 treasury shares. The treasury shares were originally issued at P10 per share. The entity owned 10,000 shares of Digos Company purchased for P800,000. The Digos shares were included in noncurrent equity securities. On December 31, 2020, the entity declared a dividend in kind of one share of Digos for every hundred ordinary shares held by a shareholder The fair value of the Digos share is P90 on December 31, 2020. The dividend in kind was distributed on March 15, 2021 when the fair value of Digos share is P95. On December 31, 2020, the entity declared the yearly cash dividend on preference share, payable on January 15, 2021. On January 15, 2021, before the accounting records were closed for 2020, the entity became aware that rent income for the year ended December 31, 2019 was overstated by P1,000,000. The after-tax effect on 2019 net income was P700,000. After correcting the rent income, net income for 2020 was P3,000,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started