what answer 6 to 13 please

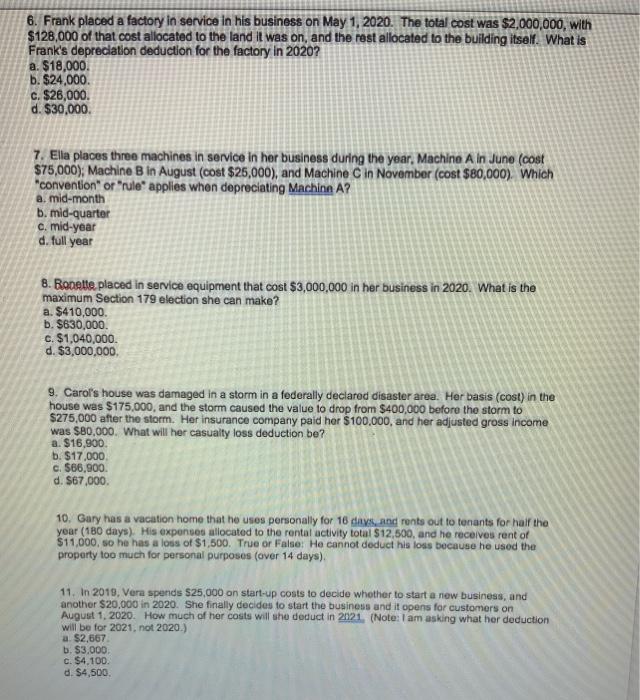

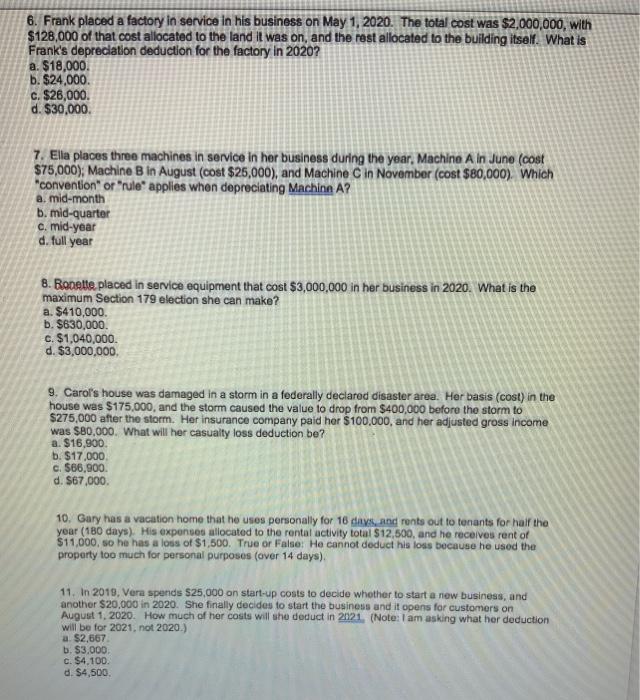

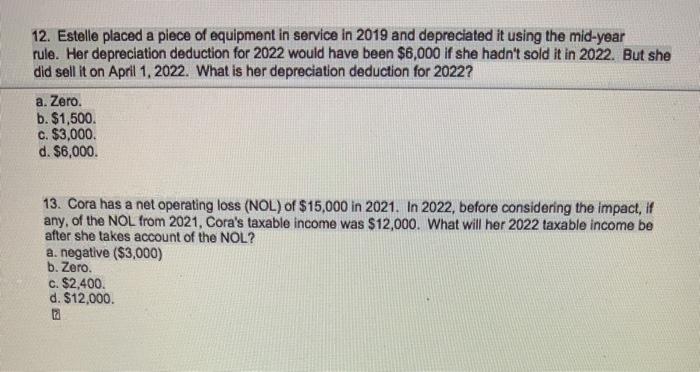

6. Frank placed a factory in service in his business on May 1, 2020. The total cost was $2,000,000, with $128,000 of that cost allocated to the land it was on, and the rest allocated to the building itself. What is Frank's depreciation deduction for the factory in 2020? a. $18,000. b. $24,000. c. $26,000 d. $30,000 7. Ela places three machines in service in her business during the year, Machine A in June (cost $75,000); Machine B in August (cost $25,000), and Machine Cin November (cost $80,000). Which "convention" or "rule" applies when depreciating Machine A? a. mid-month b. mid-quarter c. mid-year d. full year 8. Ropette placed in service equipment that cost $3,000,000 in her business in 2020. What is the maximum Section 179 election she can make? a. $410,000 b. $630,000 c. $1,040,000 d. $3,000,000 9. Carol's house was damaged in a storm in a federally declared disaster area. Her basis (cost) in the house was $175,000, and the storm caused the value to drop from $400,000 before the storm to $275,000 after the storm. Her insurance company paid her $100,000, and her adjusted gross income was $80,000. What will her casualty loss deduction bo? a. $16,900. b. $17,000 c. $66,900 d. $67,000. 10. Gary has a vacation home that he usos personally for 16 days, and rents out to tenants for all the year (180 days). His expenses allocated to the rental activity total $12,500, and he receives rent of $11,000, so he has a loss of $1,500. True or False: He cannot deduct his loss because he used the property too much for personal purposes (over 14 days) 11. In 2010, Vera spends $25,000 on start-up costs to decide whether to start a new business, and another $20,000 in 2020. She finally decides to start the business and it opens for customers on August 1, 2020. How much of her costs will she deduct in 2021. (Note: I am asking what her deduction will be for 2021, not 2020.) a $2,667 b. $3,000 c. $4.100. d. $4,500 12. Estelle placed a piece of equipment in service in 2019 and depreciated it using the mid-year rule. Her depreciation deduction for 2022 would have been $6,000 if she hadn't sold it in 2022. But she did sell it on April 1, 2022. What is her depreciation deduction for 2022? a. Zero. b. $1,500. c. $3,000. d. $6,000. 13. Cora has a net operating loss (NOL) of $15,000 in 2021. In 2022, before considering the impact, if any of the NOL from 2021, Cora's taxable income was $12,000. What will her 2022 taxable income be after she takes account of the NOL? a. negative ($3,000) b. Zero. c. $2,400. d. $12,000