What are Diva's projected profits for the fiscal year ending September 1995?

What are Diva's projected profits for the fiscal year ending September 1995?

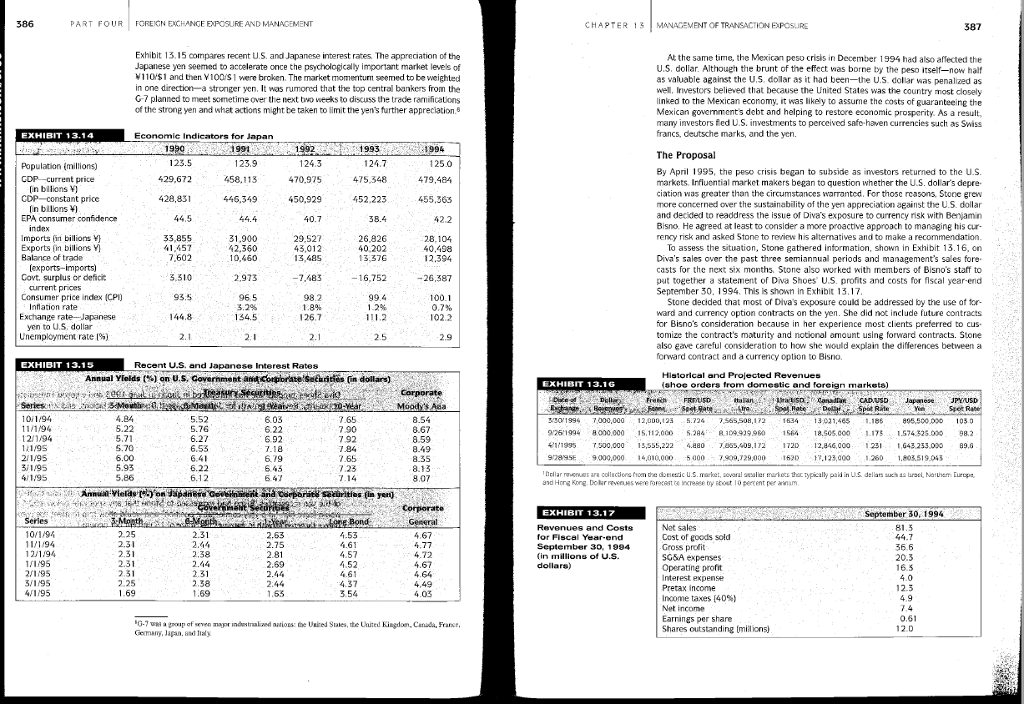

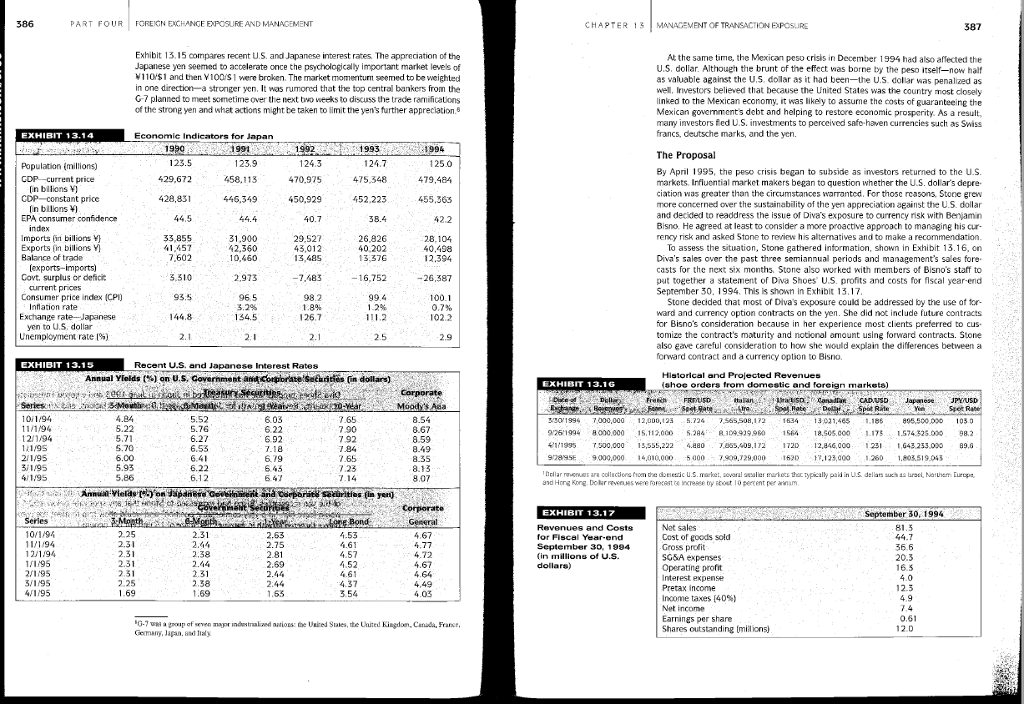

386 PART FOUR FOREIGN EXCHANGE EXPOSURE AND MANAGEMENT CHAPTER 13 MANAGEMENT OF TRANSACTION EXPOSIRE 387 Exhibit 13,15 compares recent U.S. and Japanese interest rates The appreciation of the Japanese yen seemed to accelerate once the psychologically important market levels of 1101 and then V100/S1 were broken. The market momenturn seemed to be weighted in one direction-a stronger yen. It was rumored that the top central bankers from the G7 planned to meet sometime over the next bwo weeks to discuss the trade ramifications of the strong yen and what actions might be taken to limit the yen's further appreciation At the same time, the Mexican peso crisis in December 1994 had also affected the U.S. dollar. Although the brunt of the effect vas borne by the peso itself-now half as valuable against the U.S. dolar as it had been-the U.S. doliar was penalized as well. Inivestors believed that because the United States was the country most closely linked to the Mexican economy, it was likey to assurme the costs of guaranteeing the Mexican government's debt and helping to restore economic prosperity. As a result, mamy investors fed U.S. investments to percelved safe-haven currencies such as Swiss francs, deutsche marks, and the yen. Economic Indicators for Japan 1993 1994 The Proposal 124.7 475.348 452,223 38.4 26,826 125.0 479,484 455,363 123.9 Population (miltions) COP current price By April 1995, the peso crisis began to subside as investors returned to the U.S markets. Irfiuential market makers began to question whether the U.S. dolar's depre ciation was greater than the circumstances warranted. For thosc reasons, Stone grew more concerned over the sustainability of the yen appreciation against the U.S. dollar and decided to readdress the issue of Diva's exposure to ourrency risk with Beriamin Bisno. He agreed at least to consider a more proactive approach to managing his cur- rency risk and asked Stone to review his alternatives and to make a 429,672 458,11 470.975 In bilons Y) 446,349 450,929 (in bilions ) 44.4 EPA consumer confidence Imports (in billions Balance of trade Covt, surplus or defici Consumer price index ICPI 33,855 41,457 29,527 28.104 40.202 To assess the situation, Stone gathered information, shown in Exhibit 13.16, on Diva's sales over the past three semiannual periods and management's sales fore casts for the next six months. Stone also worked with members of Bisno's staff to put together a statement of Diva Shoes U.S. profits and costs for fiscal year-end September 30, 1994. This is shown in Exhibit 13,17 2,360 10,460 3,510 26 Stone decided that most of Diva's exposure could be addressed by the use at tor- ward and currency option contracts on the yen. She did not include future contracts for Bisno's consideration because in her experience most clients preferred to cus tomize the contract's maturity and notional amount using forward contracts. Stone also gave careful consideration to how she would explain the differences between a forward contract and a currency option to Bisno. Inflation rate Exchanpe rate Japanese 1345 102.2 yen to U.S, dollar Unemployment rate 1%) EXHIBIT 13.15 Recent U.S. and Japanese Interest Rates Annual Yields (%) on U.S. Government antCotplorate!Steu?ds (in dollars) HIBIT shoe orders from domestic and foreign markets) Spet 6.03 4.84 5.22 sso 1994 7,000,000 12,000.123 5.724 7,565S08,172 1634 t3 021,465 1186 895.500,000 105 926 1994 8000.00 ,12000.284R093991505.co0 1.1751574 325 982 4,1/1995 7500.000 15,555,222 4.880 7,055,409.172 1720 12,846,000 i231643.253.000 89.G 908SSE 9000,000 14,010,000-5000-7-909,729,000 1630.17,123,coo 1200 1.803.519.043 Dellar rveus ar collactions om dhe doneic U.S.mrkt several sesal lar markes hac typically paid in U.S dellats such as arael, Niahem Eurupa, 8.67 8.59 12/194 692 8.13 4/1/95 and Hong kKong.Dolar evees were rorecest ce incresse tby out 10 percent per annam EXHIBIT 13.17 hber 30 1994 Net sales Cost of goods sold Revenues and Costs for Fiscal Year-end September 30, 1994 (in millions of U.S. dollara) 10/19 SG&A expenses Operatine profit 1.52 12.3 Pretax income income taxes (40%) 41195 ncome G-7 ww a goup of seven magor indestrialzed ios:he Used Staes, the Uited Kiagdom, Canuda, France Gemany, Japan, and taly Earnings per share Shares outstanding [milions) 386 PART FOUR FOREIGN EXCHANGE EXPOSURE AND MANAGEMENT CHAPTER 13 MANAGEMENT OF TRANSACTION EXPOSIRE 387 Exhibit 13,15 compares recent U.S. and Japanese interest rates The appreciation of the Japanese yen seemed to accelerate once the psychologically important market levels of 1101 and then V100/S1 were broken. The market momenturn seemed to be weighted in one direction-a stronger yen. It was rumored that the top central bankers from the G7 planned to meet sometime over the next bwo weeks to discuss the trade ramifications of the strong yen and what actions might be taken to limit the yen's further appreciation At the same time, the Mexican peso crisis in December 1994 had also affected the U.S. dollar. Although the brunt of the effect vas borne by the peso itself-now half as valuable against the U.S. dolar as it had been-the U.S. doliar was penalized as well. Inivestors believed that because the United States was the country most closely linked to the Mexican economy, it was likey to assurme the costs of guaranteeing the Mexican government's debt and helping to restore economic prosperity. As a result, mamy investors fed U.S. investments to percelved safe-haven currencies such as Swiss francs, deutsche marks, and the yen. Economic Indicators for Japan 1993 1994 The Proposal 124.7 475.348 452,223 38.4 26,826 125.0 479,484 455,363 123.9 Population (miltions) COP current price By April 1995, the peso crisis began to subside as investors returned to the U.S markets. Irfiuential market makers began to question whether the U.S. dolar's depre ciation was greater than the circumstances warranted. For thosc reasons, Stone grew more concerned over the sustainability of the yen appreciation against the U.S. dollar and decided to readdress the issue of Diva's exposure to ourrency risk with Beriamin Bisno. He agreed at least to consider a more proactive approach to managing his cur- rency risk and asked Stone to review his alternatives and to make a 429,672 458,11 470.975 In bilons Y) 446,349 450,929 (in bilions ) 44.4 EPA consumer confidence Imports (in billions Balance of trade Covt, surplus or defici Consumer price index ICPI 33,855 41,457 29,527 28.104 40.202 To assess the situation, Stone gathered information, shown in Exhibit 13.16, on Diva's sales over the past three semiannual periods and management's sales fore casts for the next six months. Stone also worked with members of Bisno's staff to put together a statement of Diva Shoes U.S. profits and costs for fiscal year-end September 30, 1994. This is shown in Exhibit 13,17 2,360 10,460 3,510 26 Stone decided that most of Diva's exposure could be addressed by the use at tor- ward and currency option contracts on the yen. She did not include future contracts for Bisno's consideration because in her experience most clients preferred to cus tomize the contract's maturity and notional amount using forward contracts. Stone also gave careful consideration to how she would explain the differences between a forward contract and a currency option to Bisno. Inflation rate Exchanpe rate Japanese 1345 102.2 yen to U.S, dollar Unemployment rate 1%) EXHIBIT 13.15 Recent U.S. and Japanese Interest Rates Annual Yields (%) on U.S. Government antCotplorate!Steu?ds (in dollars) HIBIT shoe orders from domestic and foreign markets) Spet 6.03 4.84 5.22 sso 1994 7,000,000 12,000.123 5.724 7,565S08,172 1634 t3 021,465 1186 895.500,000 105 926 1994 8000.00 ,12000.284R093991505.co0 1.1751574 325 982 4,1/1995 7500.000 15,555,222 4.880 7,055,409.172 1720 12,846,000 i231643.253.000 89.G 908SSE 9000,000 14,010,000-5000-7-909,729,000 1630.17,123,coo 1200 1.803.519.043 Dellar rveus ar collactions om dhe doneic U.S.mrkt several sesal lar markes hac typically paid in U.S dellats such as arael, Niahem Eurupa, 8.67 8.59 12/194 692 8.13 4/1/95 and Hong kKong.Dolar evees were rorecest ce incresse tby out 10 percent per annam EXHIBIT 13.17 hber 30 1994 Net sales Cost of goods sold Revenues and Costs for Fiscal Year-end September 30, 1994 (in millions of U.S. dollara) 10/19 SG&A expenses Operatine profit 1.52 12.3 Pretax income income taxes (40%) 41195 ncome G-7 ww a goup of seven magor indestrialzed ios:he Used Staes, the Uited Kiagdom, Canuda, France Gemany, Japan, and taly Earnings per share Shares outstanding [milions)

What are Diva's projected profits for the fiscal year ending September 1995?

What are Diva's projected profits for the fiscal year ending September 1995?