What are some of the tangible and intangible capabilities of CrossFit?

Based on these capabilities, what are two core competencies? Explain how you decided these are core competencies.

In which part of the value chain is CrossFit strong? Give details for each area cited. Use outside research for what you don't find

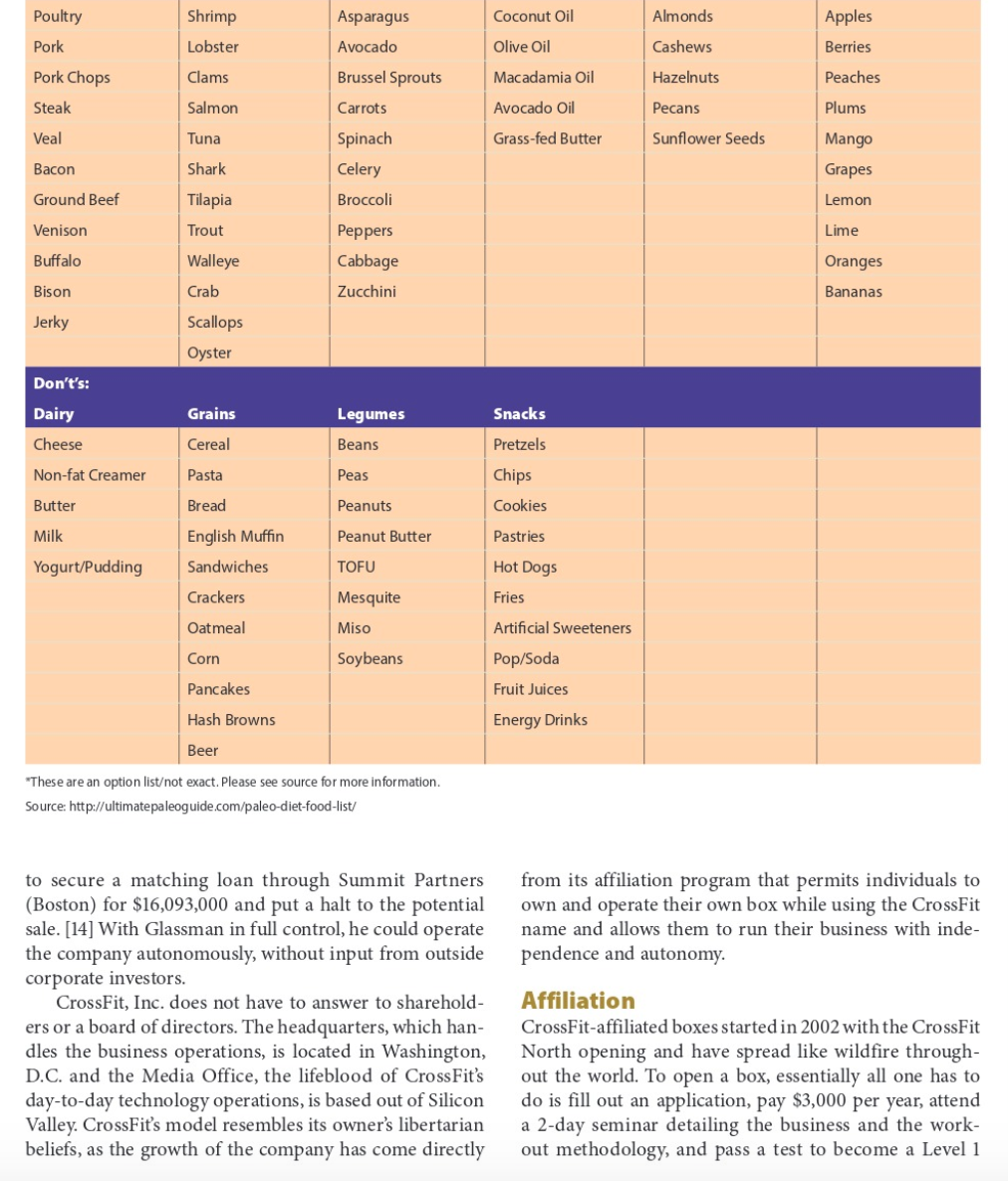

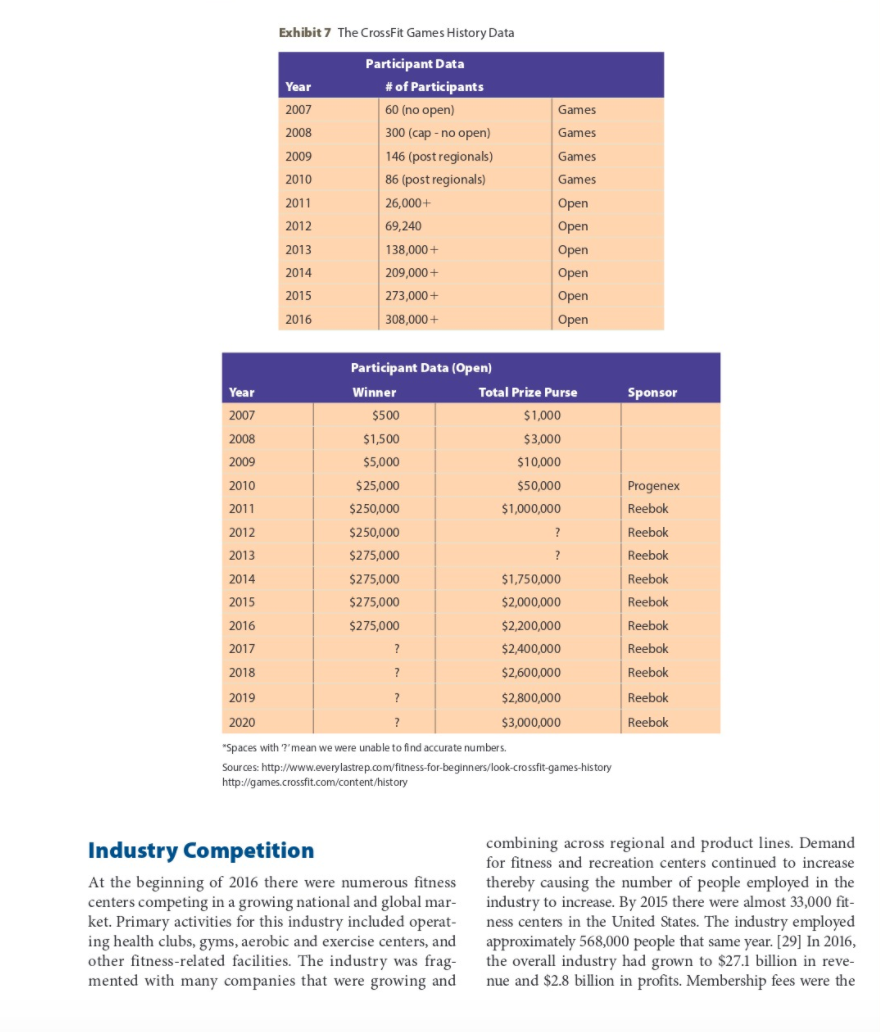

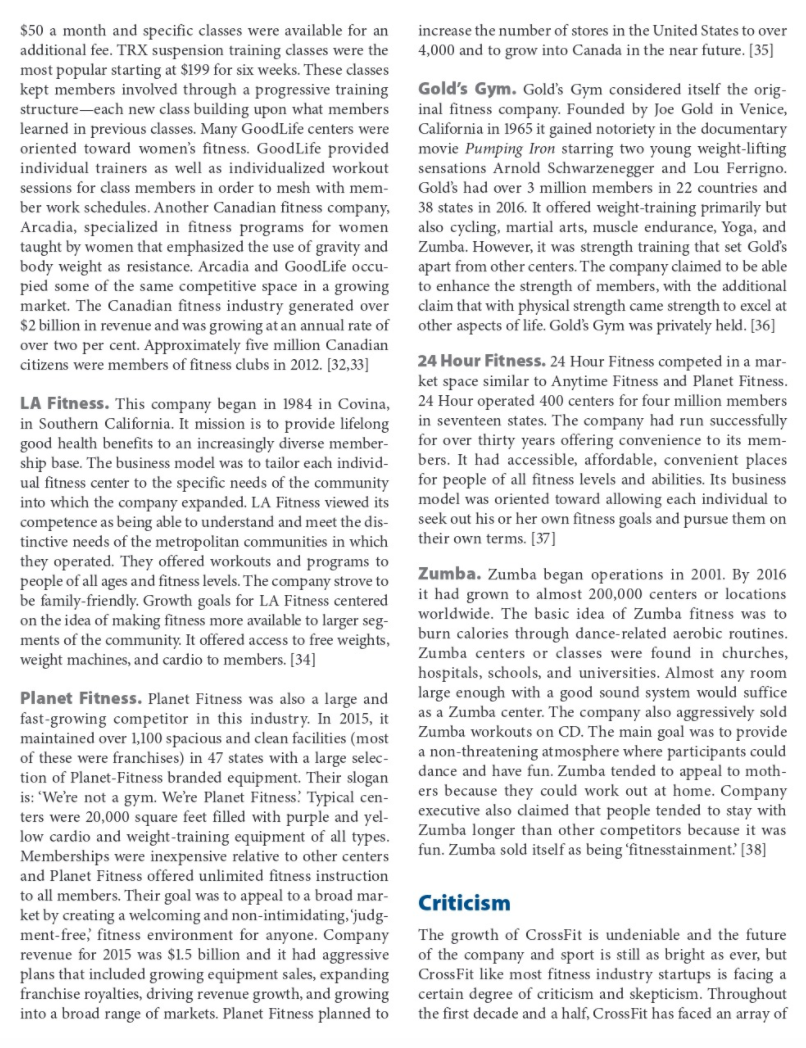

Poultry Shrimp Asparagus Coconut Oil Almonds Apples Pork Lobster Avocado Olive Oil Cashews Berries Pork Chops Clams Brussel Sprouts Macadamia Oil Hazelnuts Peaches Steak Salmon Carrots Avocado Oil Pecans Plums Veal Tuna Spinach Grass-fed Butter Sunflower Seeds Mango Bacon Shark Celery Grapes Ground Beef Tilapia Broccoli Lemon Venison Trout Peppers Lime Buffalo Walleye Cabbage Oranges Bison Crab Zucchini Bananas Jerky Scallops Oyster Don't's: Dairy Grains Legumes Snacks Cheese Cereal Beans Pretzels Non-fat Creamer Pasta Peas Chips Butter Bread Peanuts Cookies Milk English Muffin Peanut Butter Pastries Yogurt/Pudding Sandwiches TOFU Hot Dogs Crackers Mesquite Fries Oatmeal Miso Artificial Sweeteners Corn Soybeans Pop/Soda Pancakes Fruit Juices Hash Browns Energy Drinks Beer "These are an option listot exact. Please see source for more information. Source: http://ultimatepaleoguide.com/paleo-diet-food-list/ to secure a matching loan through Summit Partners from its affiliation program that permits individuals to (Boston) for $16,093,000 and put a halt to the potential own and operate their own box while using the CrossFit sale. [14] With Glassman in full control, he could operate name and allows them to run their business with inde- the company autonomously, without input from outside pendence and autonomy. corporate investors. CrossFit, Inc. does not have to answer to sharehold- Affiliation ers or a board of directors. The headquarters, which han- CrossFit-affiliated boxes started in 2002 with the CrossFit dles the business operations, is located in Washington, North opening and have spread like wildfire through- D.C. and the Media Office, the lifeblood of CrossFit's out the world. To open a box, essentially all one has to day-to-day technology operations, is based out of Silicon do is fill out an application, pay $3,000 per year, attend Valley. CrossFit's model resembles its owner's libertarian a 2-day seminar detailing the business and the work- beliefs, as the growth of the company has come directly out methodology, and pass a test to become a Level 1(-70 instructor ($000). When confronted about the seem- ingly easy nature of this process, CrossFit's fearless lead er's response was: \"Mating huh?... Here's how it used to be: allyou had to do nor have the money . . and you dorft even have to take a test That? where every other chain mmeom. someone just launched 'em.\" {4] CrossFit box owners have the freedom to manage their box in their best interests so that they can cater to the local demographic. To Glassman, his main con cern is not about what hours the ailiate owners are operating, the location in which they choose to open their business, or the music that is played; his only concern is that they follow CrossFit's physiology and methodology. [l] Each afliate is locked into their orig inal annual fee in case the fee is ever raised. In fact, there are afliates. who got in early. that still pay only 5500 per year. CrossFit, Inc. created CrossFit ERG (Risk Retention Group). which is a captive stock insurance company that allows American afliates to purchase specic CrossFit general liability and professional liability policies designed to cover the unusual risks boxes are susceptible to. [IE] CF- RRG is a form of self-insurance where the afliate owners purchase stock and become shareholders (l-time fee of $1,000}. Box owners who buy into the group are involved in the underwriting, risk management, claims administration. and nancial committees. [[6] Boxes earning less than $125,000 per year pay a yearly premium of SLIBS with boxes that earn greater than $125,000 per year paying an extra $8.70 per $1,000 of gross revenue earned. Altiliations are urged to purchase insurance from CFRRG rather than an outside vendor because CrossFit endures unique circumstances that most liability policies may not thoroughly cover. Owning this specialized policy, box owners are eliminating the possibility of omis sions and will have the most comprehensive cover- age available. International CrossFit boxes are insured through somewhat similar companies such as the CrossFit International Insurance Programme, which is run through Lloyd's of London and covers box owners in the UK. [1?] Growth Glassman admits that when he started CrossFit he did not have a business plan. that his goal was simply \"being committed not to screw it up.\" and that he has Part 4: Case Sixties stuck by that plan ever since. [18] The numbers, though, would suggest otherwise. In 2016, a little over a decade and a half since CrossFit, Inc. was formed. Glassman's corporation has become one of the fastest growing frt ness companies of all time. With roughly 13.000 gyms in 142 different countries. CrossF'rt. Inc. rakes in close to $100 million and the CrossFit brand's estimated ocosys~ tern is approximately in the 54 billion range {2016). [18] The scary part? The company is still growing. \"I don't know how you compete against me\" said Glassman in an interview with CNBC. CrossFit. Inc. brings in most of its profits from two main sources: 1) afliates and 2) CrossFit Training Certication courses. But even with CrossFit's rapidly growing business it is hard to look anywhere else but the core concepts that have brought them to this point: technology and having a loyal group dynamic culture that has adopted CrossFit as more than a workout but a way of life. CrossFit is a technology company. it started with Glassman posting workouts, journal articles, and an easy-to-use blog onto www.crosstcom. Since then, the company's success has followed the growth of the Internet. One tenminute browsing session on their Web site and you can find CrossFit's mission, workout meth- odology, limitless instructional videos, worlwuts of the day, nutritional ideas. gym locations, and much. much more. all for FREE. Yes, for free! When asked about the nancial implications of giving away free content and how that makes sense in today's capitalistic economy, Glassman replied \"it didn't until we did it. the more video we give away, the more money we make.\" [4] The all exposure is good exponoe philosophy has assembled one of the largest viral communities in the world and when combined with their devout and enthusiastic alle giance toward the brand. largely explains why CrossFit, Inc. has been able to grow at the record-breaking pace it has. 11\"! Community CrossFit is much more than just a fitness regimenit has evolved into a distinctive community within itself where its followers are amazingly loyal and dedicated. For many. CrossFit has become a way of life. CrossFit afliates have been extraordinarily successful in cre ating an atmosphere where its members feel a sense of belonging which motivates them to come back day after day and push themselves harder, whether that's to beat the person next to them or just to improve from their previous scores. The CrossFit Community members have taken a leading role in marketing the CrossFit brand. They have created an almost obses sivel ike adoration for CrossFit to the point where they actively promote the sport through any outlet possible. it has prompted outsiders to joke that "the rst rule of CrossFit is that you never stop talking about CrossFil,\" parodying a line from the Brad Pitt movie. Fight Club. [l9] Whether box members are viewed as loyal. fanatic, annoying, or crazy one thing for certain is that their dedication to spreading the brand. whether intention- ally or unintentionally, has been an exceptionally lucra tive model for CrossFit, Inc. Glassman insists that he has not recruited one person to CrossFit. To him CrossFit has an open door policy and anyone who wants to join is welcomed to do so. [4] Through tremendous leadership and coaching, CrossFit has been able to provide an atmosphere where its mem bers seek to liVe their litres in a state of optimal health and tness in a time where health and tness are becom- ing less of a priority. [5} The members work out together multiple times per week often creating a teamlike bond. This type of interaction. uniting by a common goal or interest. is similar to the Familylike atmosphere most sports or military teams have. The CrossFit Community is also able to attract members through their group vol- unteer and charitable. American sociologist Ray Oldenburg introduced the idea of a \"'Ihird Place\" for healthy human existence. [20] He believed that humans must live in a balance of three realms: l) Homei'Family Life, 2} Work Life where people spend most of their time. and 3) a Third Placeinclusively sociable places. Third Places are described as \"anchors\" of community life and facilitate 8t foster broader, more creative social interaction. One of the main characteristics of Third Places is that they act as a "leveleri' which means they place no impor tance on an individual's status in society and allows for a sense of commonality between members. They are highly accessible places, where friendships develop that ll the human need for \"intimacy and affiliation.\" In what used to be the traditional Third Place, church. studies have shown that the new generation of millen nials have been leaving the relig'ous life behind, [21] thus creating a void in many people's lives. The CrossFit Community, through its affiliates, have been able to provide that Third Place for many of its members. The box offers its athletes a place where they can build those social relationships and have a sense of \"place." In turn, its members adopt the CrossFit lifestyle as one of their main id entities and that which becomes a part of who they are. This could explain why they "always talk about CrossFit" or post CrossFit related content to social media outlets. CrossFit, in a {smaller} sense, is as much a part of many of its members' lives as say their families, therefore creating that automatic impulse to constantly want to talk or interact with other about their CrossFit lives, the same as they would about their children or signicant others. in a 2014 CrossFit demographic study, the data did illustrate that the millennial generation had the highest level of participants but not byas much as many would think. They only comprised 4096 of participants while the 354-1 age group consisted of 20% with the under 18's covering 18%. [22.] Along with the age demographic they found that CrossFil is evenly split 50.50 between female and male participants thus attesting to the fact that the CrossFit workout is feasible at any age. male or female. Technology and Social Media The shift toward social media outlets becoming a primary form of contact in today's society has vastly affected the field of communication, marketing work and advertising. Gone are the days where the major ity of adults actually dial someone's number up and spealt to them over the phone as social media has increased the ability and frequency in which people can 'checkup" on one another in a much less personal way. In a 2014 social media study, it was found that 52% of on] ine adults now use at least two forms of social media sites and the numbers showed that usage of young adults (1829 yr'o) on Instagram. just one form of social media, was around 53%. [B] The CrossFit Community is no stranger to this as the basis of their growth can be attributed to increased action on the Internet and social media sites from its members. When CrossFit. Inc. launched its first blog system, which allowed box owners to communicate not only with headquarters, the media team, and other afliates at the click of a mouse but also with their own clientele, they created an easy medium where information could be shared at a faster pace and to a larger audience. Just because Glassman himself has not recruited anyone over social media that does not mean his loyal follow ers have not. The Internet communication concept has spread to more common and interactive uses of social media (YouTube, Facebook, Twitter, lnstagrarn. etc.) now within specific box communities as a way to mass market their new and exciting fitness program with outsiders. Since the mid20005 box owners and community members have hit the social media world running and are no strangers to posting pictures. videos. or workout statuses from their experiences or the CmssFit world. Social media is an incredibly accessible and cost- effective way to reach a wide audience in little time, and the more c'ornrnunityr members post the more CrossFit's ecosystem grows. It's a multiplier effect that spreads the CrossFit brand like wildre. A 2012 study on Internet usage found that 23% of us. Internet users under the age of 35 said they would buy a brand because of a friend's social endorsement, such as a \"like\" on Faceboolt. [24] This is a growing trend in the capitalistic technological world we live in. and for businesses looking to grow it is almost a must that they use social media as a market ing outlet. Although many of the CrossFit customers who actively post personal information on social media understand the logic or intent of spreading \"the word\" about CrossFit, often times they are also engaging in a form of selfpromotion. As adults. people start to have fewer tangible goals they can point to and share as a source of pride. Their high school accolades have lost social value and their current work accomplishments usually do not translate well to social media. CrossFit lls that void and allows members to take pride in their accomplishments, whether it is losing weight. hitting a new personal record, or even simply proving that they have gotten off the couch and are participating in an intense workout. [25] A 2014 sociological study [26] on \"trophies of surplus enjoyment" (photo's. merchandise, trinkets, etc.) found that people hunt for trophies at events they attend not just for their fandorn and remem brance but also as envyinducing commodities they can share on social media so that others can acknowledge them through "likes.\" \"favorites.\" and \"retweets.\" This is often what CrossFit community members are doing when posting photos and videos to social media. The picturm or videos of them participating in (3th act as "acquired trophies\" so that others can socially recog nize their efforts and potentiaiiy elevate their \"status\" in the viewer's eyes. The CrossFit Community's indulgence in social media. evidenced by the rapid success of CrossFit as a sport and a brand, further proves that their presence in the technological and social media world has been a surefire benefit. The CrossFit Community as a whole understands the value (If social media, and Whether their intentions are of the conscious or unconscious nature. they use this medium to pique the interest of outsiders about as well as anybody. 1110 CrossFit Games From the very rst journal article introducing CrossFit to a larger scale,ng Glassman has challenged the idea of who is the "ttest on earth." The CrossFit philosophy of dening tness through meaningful and measurable ways opened up a door for competition to exist. Enter, The CrossFit Games. which have been held annually since 2007 and continue to grow at record numbers each year. The games are a physically and mentally demand ing competition held over a few days where competitors are blind to the certain events until right before they pICipate. At the end, the overall winners are awardEd the title \"Finest on Earth.\" The rst games in 200?. held on CrossFit Games Director Dave Castro's parents' land in California, consisted of first-come participation with the win- ner receiving a $500 priZe. Popularity grew with The Games as the company grew and in ml] The CrossFit Games hit a banner year as CrossFit. Inc. signed Reebok to a 10year title sponsorship as well as having the games broadcasted through ESPN3 (online). [2?] With the rising number of participants yearly. CrossFit adopted an online qualication format that included three stages. Stage I, known as 'The Open,' occurs in March when contestants submit weekly scores online from recently released competition workouts from crossfit.com. The scores are validated through afliates, or video is uploaded proving participants score times. The top qualiers from pre-determined regions will participate in Stage 2, regional events, held throughout the world in order to qualify for Stage 3. The CrossFit Games. In 201l,online participation totaled 26,000 sub missions and has grown exponentiatly as 2016 online submissions totaled 308,000 people. a CrossFit Games record. [28] With Reebok and ESPN on board. The CrossFit Games are now considered a top ight tness compe- tition and are broadcast worldwide live on ESPN. The winners in 2016 will receive $275,000 and the total prize pool. paid from the Reebok contract, is $2,200,000 and Will rise annually throughout the length of the contract (Exhibit i). Even though The CrossFit Games are not a large prot source for CrossFit, the the magnitude of what The Games brings to the company is immeasur able. The exposure of the competition alone is one of the driving forces in making CrossFit the nunber one tness enterprise on the planet and looking at the yearly increase in participants, prize money and attendance, The Games momentum does not appear to be slowing down. Exhibit 7 The CrossFit Games History Data Participant Data Year # of Participants 2007 60 (no open) Games 2008 300 (cap - no open) Games 2009 146 (post regionals) Games 2010 86 (post regionals) Games 2011 26,000+ Open 2012 59,240 Open 2013 138,000+ Open 2014 209,000+ Open 2015 273,000+ Open 2016 308,000+ Open Participant Data (Open) Year Winner Total Prize Purse Sponsor 2007 500 $1,000 2008 $1,500 $3,000 2009 $5,000 $10,000 2010 $ 25,000 $50,000 Progenex 2011 $250,000 $1,000,000 Reebok 2012 $250,000 Reebok 2013 $275,000 Reebok 2014 $275,000 $1,750,000 Reebok 2015 $275,000 $2,000,000 Reebok 2016 $275,000 $2,200,000 Reebok 2017 $2,400,000 Reebok 2018 $2,600,000 Reebok 2019 $2,800,000 Reebok 2020 $3,000,000 Reebok "Spaces with "?" mean we were unable to find accurate numbers. Sources: http://www.everylastrep.com/fitness-for-beginners/look-crossfit-games-history http://games.crossfit.com/content/history Industry Competition combining across regional and product lines. Demand for fitness and recreation centers continued to increase At the beginning of 2016 there were numerous fitness thereby causing the number of people employed in the centers competing in a growing national and global mar- industry to increase. By 2015 there were almost 33,000 fit- ket. Primary activities for this industry included operat- ness centers in the United States. The industry employed ing health clubs, gyms, aerobic and exercise centers, and approximately 568,000 people that same year. [29] In 2016, other fitness-related facilities. The industry was frag- the overall industry had grown to $27.1 billion in reve- mented with many companies that were growing and nue and $2.8 billion in profits. Membership fees were theC-74 Part 4: Case Studies single largest revenue component and member retention Anytime Fitness. As the name implies, Anytime was the key to a center's profitability. Fitness centers com- Fitness operates fitness centers that are open for workouts peted on brand recognition, customer service, price, and twenty-four hours a day 365 days a year. Anytime Fitness, services offered. [47] with more than 3 million members, was one of the Even though competition was great, industry entry fastest-growing and most progressive fitness businesses barriers were considered to be low. It was possible to in the world. It received notoriety as one of Entrepreneur lease equipment and buildings and both equipment and Magazine's top 10 fastest-growing franchises across all buildings had long life spans. Many start-ups were able industries in 2015. From its first center in 2002 it grew to use second hand or previously used equipment. Wages into all fifty states and twenty countries with 38 wholly were low. There were not many regulations other than owned and approximately 3,000 franchised centers zoning and building permit processes at the local levels. worldwide in 2016. For example, they opened a fit- Access to capital for start-ups was readily available in ness center in Rome in 2016. The co-founder Chuck most instances. The only real entry barrier was the brand Runyon, used private equity and franchising to finance loyalty and recognition built up by established gyms and the company's rapid growth. Also to facilitate growth, fitness centers. Fitness center memberships were on the in 2016 it moved into a new building and expanded to rise. However, in the future, it was expected that entry 300 employees at its headquarters in Woodbury, Minnesota. barriers would rise due to the possibility that corpo- Runyon expected to continue growing the company at a rate wellness programs would create strong demand for rate of approximately 400 franchisees annually toward large-scale memberships, thereby creating barriers for of goal of 4,500 centers by 2020. Starting a franchise cost newer companies. [47] between $100,000 and 500,000 plus a $30-37,500 fran- Yet even with all this activity in the business of fitness chise fee. Anytime required franchise owners to pay a there was evidence that additional growth was possible. A 2016 study of nine countries by Censuswide, a global $549 monthly royalty. In 2017, the parent company of Anytime Fitness, Self Esteem Brands, was diversifying consultancy, found that the average person spent only 0.7% of their life exercising-or stated differently, out into salons and other fitness-related businesses. [31] of an average person's 25,915 days on earth, they tend to spend only 180 days exercising. [30] However, the num- Arcadia and GoodLife. With more than 365 operat- ber of adults aged 20 to 64 spending leisure times exer- ing fitness centers, GoodLife Fitness was the largest fit- cising and on sports was increasing. Plus, the number of ness company in Canada. Members could join for around employers viewing exercise as an important component of employee health was also on the rise. Therefore, in the minds of many these findings established the need for Exhibit 8 Top 20 Worldwide Fitness Trends for 2017 increased emphasis on global fitness. The view of indus- 1. Wearable technology try experts was that there was plenty of room for growth 2. Body weight training for both large companies and niche players (See Exhibit 8 3. High-intensity interval training for possible fitness niches). The industry was expected to 4. Educated, certified, and experienced fitness professionals grow, in terms of industry value added (IVA- a measure 5. Strength training 6. Group training of the industry's contribution to the economy overall) by 7. Exercise is medicine approximately 3% from 2016 to 2021. [47] 8. Yoga Cross Fit competed in this industry with a unique 9. Personal training value proposition that was more a philosophy of fitness 10. Exercise and weight loss than a business model. It appealed strongly to the largest 11. Fitness programs for older adults 12. Functional fitness market segment-consumers aged 34 years and younger. 13. Outdoor activities [47] Still, other companies thrived in the industry 14. Group personal training as well. Among the industry leaders were Anytime Fitness, 15. Wellness coaching Arcadia Fitness, Gold's Gym, GoodLife Fitness, LA 16. Worksite health promotion Fitness, Planet Fitness, 24 Hour Fitness and Zumba. LA 17. Smartphone exercise apps 18. Outcomes measurements Fitness and Planet Fitness were publicly traded companies 19. Circuit training while most other competitors were private or closely held 20. Flexibility and mobility rollers firms. Each company sought large-scale expansion while Source: Worldwide Survey of Fitness Trends for 2017 by Walter R. Thompson, PhD., at the same time targeting particular segments for growth. ACSM's Health & Fitness Journal, November/December 2016$50 a month and specic classes were available for an additional fee. TEX suspension training classes were the most popular starting at $199 for six weeks. These classes kept members involved through a progressive training structureeach new class building upon what members learned in previous classes. Many GoodLife centers were oriented toward women's tness. GoodLife provided individual trainers as well as individuali2ed Workout sessions for class members in order to mesh with mem- ber work schedules. Another Canadian tness company. Arcadia, specialized in tness programs for women taught by women that emphasized the use of gravity and body weight as resistance. Arcadia and GoodLife occu pied some of the same competitive space in a growing market. The Canadian tness industry generated over 52 billion in revenue and was growing at an annual rate of over two per cent. Approximately five million Canadian citizens were members of tness clubs in 2.012. [32.33] LA Filnoss. This company began in 1934 in Covina, in Southern California. It mission is to provide lifelong good health benets to an increasingly diverse member ship base. The busineas model was to tailor each individ ual tness center to the specific needs of the community into which the company expanded. LA Fitness viewed its competence as being able to understand and meet the dis tinctive needs of the metropolitan communities in which they operated. They offered workouts and programs to people of all ages and fitness levels. The company strove to be family- friendly. Growth goals for LA Fitness centered on the idea of making fitness more available to larger seg- ments of the community. It offered access to free weights, weight machines, and cardio to members. [34] Plano! Fitness. Planet Fitness was also a large and fast-growing competitor in this industry. In 2015. it maintained over 1,100 spacious and clean facilities (most of these were franchises) in 47 states with a large selec tion of Planet-Fitness branded equipment. Their slogan i51'We're not a gym. We're Planet Fitness: Typical cen ters were 20.000 square feet lled with purple and yel low cardio and weight-training equipment of all types. MemberShips were inexpensiVe relative to other centers and Planet Fitness offered unlimited tness instruction to all members. Their goal was to appeal to a broad mar- ket by creating a welcoming and nonintitnidating,'judg ment'free,' tness environment for anyone. Company revenue lbr 2015 was $1.5 billion and it had aggressive plans that included growing equipment sales, expanding franchise royalties. driving revenue growth, and growing into a broad range of markets. Planet Fitness planned to increase the number of stores in the United States to over 4,000 and to grow into Canada in the near future. [35] Gold's Gym. Gold's Gym considered itself the orig- inal tness company. Founded by Joe Gold in Venice, California in 1965 it gained notoriety in the documentary movie Pumping Iron starring two young weightlifting sensations Arnold SdtWarZenegger and. Lou Ferrigno. Golds had over 3 million members in 22 countries and 38 states in 20l6. lt offered weighttraining primarily but also cycling, martial arts, muscle endurance. Yo, and Zomba. However. it was strength training that set Gold's apart from other centers The company claimed to be able to enhance the strength of members, with the additional claim that with physical strength came strength to excel at other aspects of life. Gold's Gym was privately held. [36] 24 Hour Fitness. 24 Hour Fitness competed in a mar ket space similar to Anytime Fitness and Planet Fitness. 24 Hour operated 400 centers for four million members in seventeen states The company had run successfully for over thirty years offering convenience to its mem- bers. It had accessible. affordable, convenient places for people of all tness levels and abilities Its business model was oriented mward allowing each individual to seek out his or her own tness goals and pursue them on their own terms. [37] Zomba. Zumba began operations in 2001. By 2016 it had grown to almost 200,000 centers or locations worldwide. The basic idea of Zumba fitness was to burn calories through dancerelated aerobic routines. Zurnba centers or classes were found in churches, hospitals. schools. and universities. Almost any room large enough with a good sound system would suffice as a Zomba center. The company also aggressively sold Zomba workouts on CD. The main goal was to provide a nonthreatening atmosphere where participants could dance and have fun. Zomba tended to appeal to moth ers because they could work out at home. Company executive also claimed that people tended to stay with Zomba longer than other competitors because it was fun. Zomba sold itself as being 'tnesstainment.' [38] Criticism The growth of CrossFit is undeniable and the future of the company and sport is still as bright as ever, but CrossFit like most fitness industry startups is facing a certain degree of criticism and skepticism. Throughout the rst decade and a half. CrossFit has faced an array of naysayers who criticize CrossFit's methods, techniques, safety measures, and legitimacy. The following are a few of CrossFit's most common criticisms: Cult. One of the most widely mentioned criticisms of the CrossFit industry is that it is a \"cult.\" Doubters of CrossFit feel that the familyoriented atmosphere that CrossFit revolves around resembles that ofa cultlike following. Typical arguments insist that CrossFit brain- washes its members with their workout effectiveness, paying large membership fees (generally around Sllilir month). to being led by a 'leader' who dictates how they should act, to being elitists who only socialize with other CrossFit members. InjuryiSafety. Outsiders have often claimed that the CrossFit workout can be unsafe for its participants. The intensity and competitive nature can lead to too much heavy lifting and improper form all the way through the rep sets opening up opportunities for injury. The most commonly mentioned injuryldisease used against CrossFit is rhabdomyolysis Shortened in the CrossFit world to \"rhabclo,\" this is caused by the death of muscle bers and the release of their contents into the blood stream. [29] Rhabdo results from overexertion, which leads to the body's muscles breaking down and poten tially causing kidney failure. Although it can be deadly, it is usually a treatable disease. Legitimacy. Many proponents of CrossFit argue that the workout methods do not produce realistic results that the libertarian methods of allowing box owners to create their own workouts within an entire methodol- ogy opens up the risk for unqualied coaches to piece together workouts that are not safe and do not translate into results. [30] High Intensity Interval Training (HIITJI is widely considered one of the best forms of exercise to burn fat, and CrossFit is no stranger to utilizing this method. But many feel CrossFit fails at this in their mix of intensity versus volume. Some contend that CrossFit uses HIIT as a tness test and not necessarily for the best results. For example. a widely used HII'I' method is TABTA (named for Iapanese Scientist D1: lzunti Tabata],which uses eight rounds of one exercise (bike, sprints. etc} that includes 20 seconds of all-out work and It] seconds of rest. CrossFit has a workout called