What are the adjusted balances for Cash, Accounts Receivable, Inventory, Accounts Payable, Notes Payable, and Unearned Revenue?

What are the adjusted balances for Cash, Accounts Receivable, Inventory, Accounts Payable, Notes Payable, and Unearned Revenue?

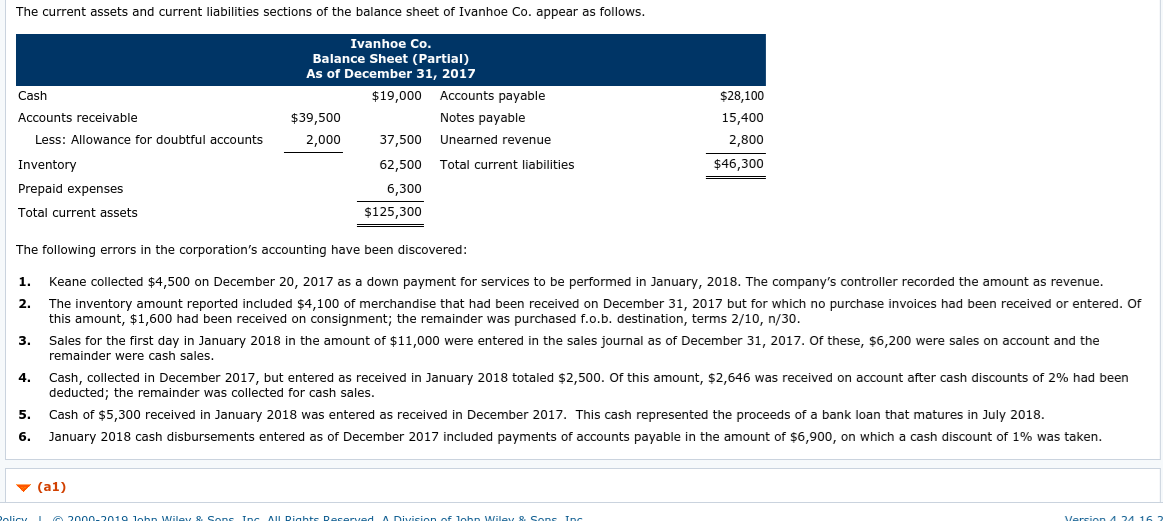

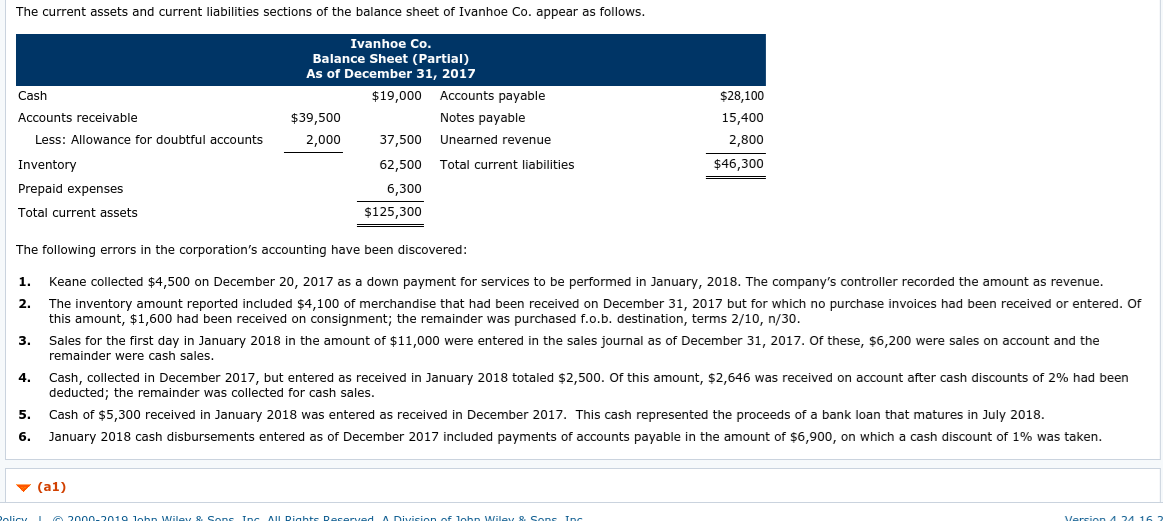

The current assets and current liabilities sections of the balance sheet of Ivanhoe Co. appear as follows. Cash Accounts receivable Less: Allowance for doubtful accounts Ivanhoe Co. Balance Sheet (Partial) As of December 31, 2017 $19,000 Accounts payable $39,500 Notes payable 2,000 37,500 Unearned revenue 62,500 Total current liabilities 6,300 $125,300 $28,100 15,400 2,800 $46,300 Inventory Prepaid expenses Total current assets The following errors in the corporation's accounting have been discovered: 1. Keane collected $4,500 on December 20, 2017 as a down payment for services to be performed in January, 2018. The company's controller recorded the amount as revenue. 2. The inventory amount reported included $4,100 of merchandise that had been received on December 31, 2017 but for which no purchase invoices had been received or entered. Of this amount, $1,600 had been received on consignment; the remainder was purchased f.o.b. destination, terms 2/10, n/30. 3. Sales for the first day in January 2018 in the amount of $11,000 were entered in the sales journal as of December 31, 2017. Of these, $6,200 were sales on account and the remainder were cash sales. 4. Cash, collected in December 2017, but entered as received in January 2018 totaled $2,500. Of this amount, $2,646 was received on account after cash discounts of 2% had been deducted; the remainder was collected for cash sales. 5. Cash of $5,300 received in January 2018 was entered as received in December 2017. This cash represented the proceeds of a bank loan that matures in July 2018. 6. January 2018 cash disbursements entered as of December 2017 included payments of accounts payable in the amount of $6,900, on which a cash discount of 1% was taken. (al) Policy 2000.2010 John Wiley . Sone To All Dichte Deserved Division of lohn Wiley & Sons Inc Version 2016 The current assets and current liabilities sections of the balance sheet of Ivanhoe Co. appear as follows. Cash Accounts receivable Less: Allowance for doubtful accounts Ivanhoe Co. Balance Sheet (Partial) As of December 31, 2017 $19,000 Accounts payable $39,500 Notes payable 2,000 37,500 Unearned revenue 62,500 Total current liabilities 6,300 $125,300 $28,100 15,400 2,800 $46,300 Inventory Prepaid expenses Total current assets The following errors in the corporation's accounting have been discovered: 1. Keane collected $4,500 on December 20, 2017 as a down payment for services to be performed in January, 2018. The company's controller recorded the amount as revenue. 2. The inventory amount reported included $4,100 of merchandise that had been received on December 31, 2017 but for which no purchase invoices had been received or entered. Of this amount, $1,600 had been received on consignment; the remainder was purchased f.o.b. destination, terms 2/10, n/30. 3. Sales for the first day in January 2018 in the amount of $11,000 were entered in the sales journal as of December 31, 2017. Of these, $6,200 were sales on account and the remainder were cash sales. 4. Cash, collected in December 2017, but entered as received in January 2018 totaled $2,500. Of this amount, $2,646 was received on account after cash discounts of 2% had been deducted; the remainder was collected for cash sales. 5. Cash of $5,300 received in January 2018 was entered as received in December 2017. This cash represented the proceeds of a bank loan that matures in July 2018. 6. January 2018 cash disbursements entered as of December 2017 included payments of accounts payable in the amount of $6,900, on which a cash discount of 1% was taken. (al) Policy 2000.2010 John Wiley . Sone To All Dichte Deserved Division of lohn Wiley & Sons Inc Version 2016

What are the adjusted balances for Cash, Accounts Receivable, Inventory, Accounts Payable, Notes Payable, and Unearned Revenue?

What are the adjusted balances for Cash, Accounts Receivable, Inventory, Accounts Payable, Notes Payable, and Unearned Revenue?