Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What are the adjusting entries going to be in 2019? can you show steps as to how you got the numbers and what accounts you

What are the adjusting entries going to be in 2019? can you show steps as to how you got the numbers and what accounts you used so that I could understand. Thank you

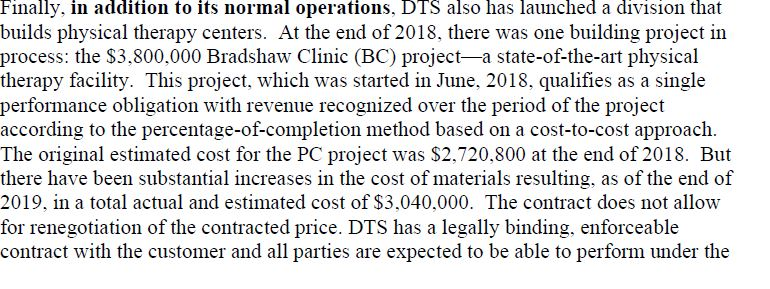

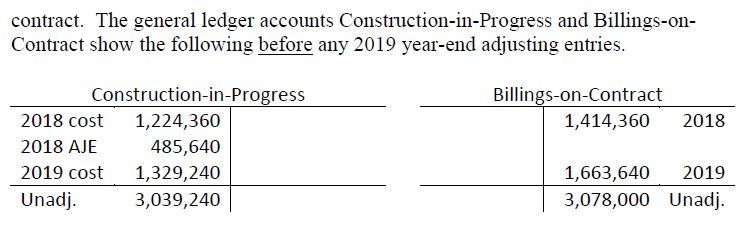

Finally, in addition to its normal operations, DTS also has launched a division that builds physical therapy centers. At the end of 2018, there was one building project in process: the $3,800,000 Bradshaw Clinic (BC) projecta state-of-the-art physical therapy facility. This project, which was started in June, 2018, qualifies as a single performance obligation with revenue recognized over the period of the project according to the percentage-of-completion method based on a cost-to-cost approach. The original estimated cost for the PC project was $2,720,800 at the end of 2018. But there have been substantial increases in the cost of materials resulting, as of the end of 2019, in a total actual and estimated cost of $3,040,000. The contract does not allow for renegotiation of the contracted price. DTS has a legally binding, enforceable contract with the customer and all parties are expected to be able to perform under the contract. The general ledger accounts Construction-in-Progress and Billings-on- Contract show the following before any 2019 year-end adjusting entries. Billings-on-Contract 1,414,360 2018 Construction-in-Progress 2018 cost 1,224,360 2018 AJE 485,640 2019 cost 1,329,240 Unadj. 3,039,240 1,663,640 2019 3,078,000 Unadj. Finally, in addition to its normal operations, DTS also has launched a division that builds physical therapy centers. At the end of 2018, there was one building project in process: the $3,800,000 Bradshaw Clinic (BC) projecta state-of-the-art physical therapy facility. This project, which was started in June, 2018, qualifies as a single performance obligation with revenue recognized over the period of the project according to the percentage-of-completion method based on a cost-to-cost approach. The original estimated cost for the PC project was $2,720,800 at the end of 2018. But there have been substantial increases in the cost of materials resulting, as of the end of 2019, in a total actual and estimated cost of $3,040,000. The contract does not allow for renegotiation of the contracted price. DTS has a legally binding, enforceable contract with the customer and all parties are expected to be able to perform under the contract. The general ledger accounts Construction-in-Progress and Billings-on- Contract show the following before any 2019 year-end adjusting entries. Billings-on-Contract 1,414,360 2018 Construction-in-Progress 2018 cost 1,224,360 2018 AJE 485,640 2019 cost 1,329,240 Unadj. 3,039,240 1,663,640 2019 3,078,000 UnadjStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started