Answered step by step

Verified Expert Solution

Question

1 Approved Answer

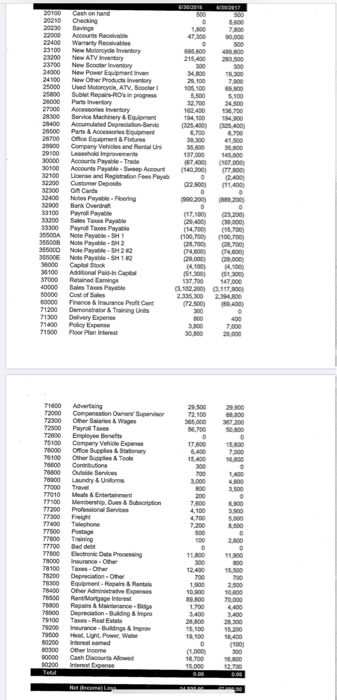

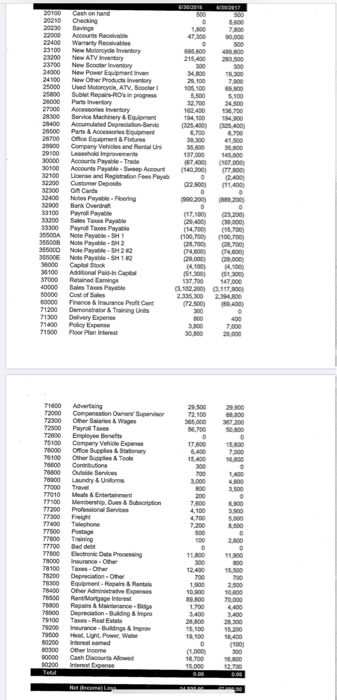

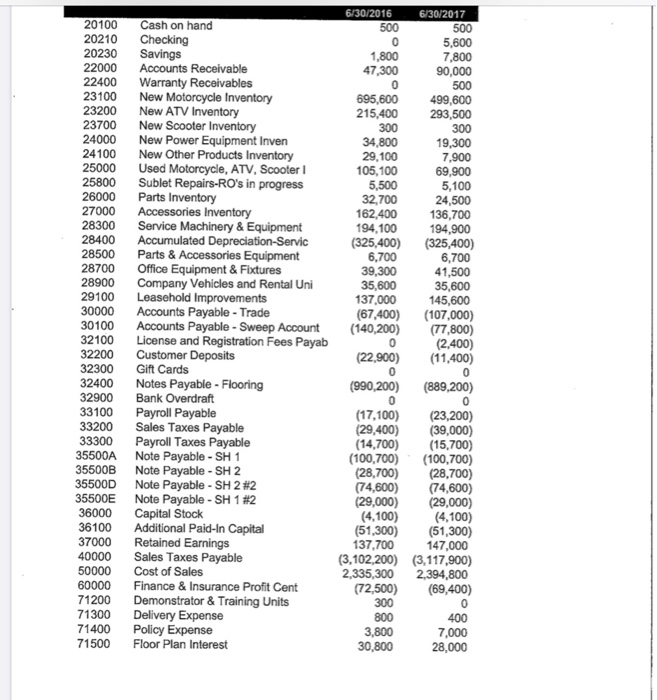

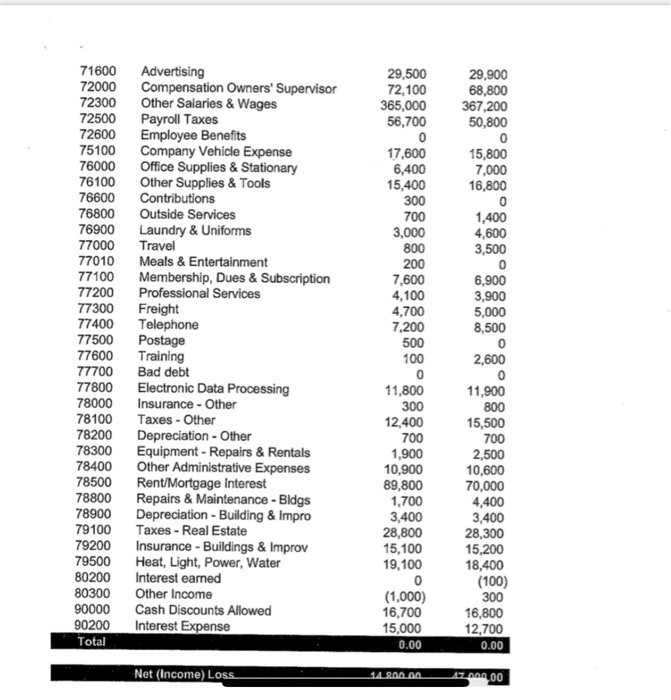

What are the adjusting entries? What are the adjusting entries for the attachment? 2016 2017 Warranty Robes Now Motocycle watory 215.400 34800 25000 162.400 25.400

What are the adjusting entries?

What are the adjusting entries for the attachment?

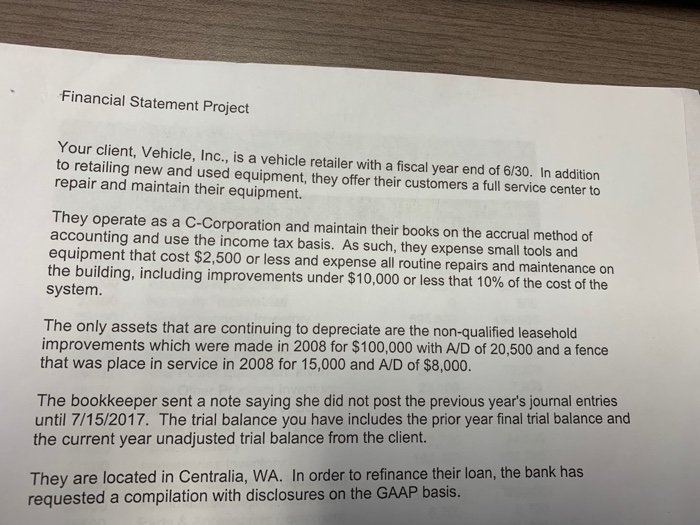

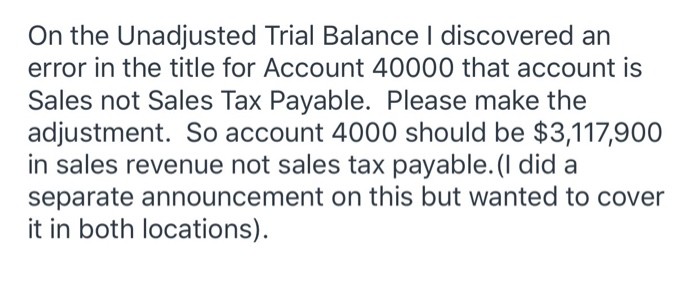

2016 2017 Warranty Robes Now Motocycle watory 215.400 34800 25000 162.400 25.400 Now Sooter inventory New Power antiven Now Other Products Inventory Used Motorcycle ATV. Soler Sub Regis in progress Parte vetory Service Machinery & Eger Accumulated Depression-Servie Parts & Accessories quipment Office Equipment & Futures Company Vehicles and Rentne provements Accounts Payable. Trade Accounts Payable Account Lion and Registration Fees Payab Customer Deposits G Cards Nos Payable Flooring Payroll Payable Sales Tax Payable Payroll Tees Payable 137.000 545 DO 107.000 (140.2003 (22.500) 11.4001 889.2001 1990.2009 23.200) (14,700 (100,1000 N 100,700 . Note Payable-SM 22 (14.600) 14.100 R Additional Paid in Capital ed Earnings Sales Tees Payable Cost of Finance & ProfCent Demonstrator & Training Units 147.000 (3,102,200) 117.00) 253002354 800 XE 71000 72000 72300 72500 72900 75100 718000 Advertising Compensation Owen Supervisor Omer Bar & Wings Payroll Taxes Employee Bents Company Vehicle Expense Office Supplies & Stationary Other Supplies & Tools 78800 Outside Services Laundry & Uniform Mats & Entertainment Membershi. Due & Subtion Bad del Electrone Data Processing Tro -Other Depreciation. Other Equipment Repair & Rentals Omer Admin Expenses Rene Mortgage rest Repair & Maintenance is Depreciation. Buting & Impro Taxes - Real Estate Insurance Building & ont Power. We 88.800 M 19.100 Cash Discounts Allowed 16.700 6/30/2016 500 1,800 47,300 695,600 215,400 300 34,800 29,100 105,100 5,500 32,700 162,400 194,100 (325,400) 6,700 39,300 35,600 137,000 (67,400) 20100 20210 20230 22000 22400 23100 23200 23700 24000 24100 25000 25800 26000 27000 28300 28400 28500 28700 28900 29100 30000 30100 32100 32200 32300 32400 32900 33100 33200 33300 35500A 35500B 35500D 35500E 36000 36100 37000 40000 50000 60000 71200 71300 71400 71500 Cash on hand Checking Savings Accounts Receivable Warranty Receivables New Motorcycle Inventory New ATV Inventory New Scooter Inventory New Power Equipment Inven New Other Products Inventory Used Motorcycle, ATV, Scooter Sublet Repairs-RO's in progress Parts Inventory Accessories Inventory Service Machinery & Equipment Accumulated Depreciation Servic Parts & Accessories Equipment Office Equipment & Fixtures Company Vehicles and Rental Uni Leasehold Improvements Accounts Payable - Trade Accounts Payable - Sweep Account License and Registration Fees Payab Customer Deposits Gift Cards Notes Payable - Flooring Bank Overdraft Payroll Payable Sales Taxes Payable Payroll Taxes Payable Note Payable - SH 1 Note Payable - SH 2 Note Payable - SH 2 #2 Note Payable - SH 1 #2 Capital Stock Additional Paid-In Capital Retained Earnings Sales Taxes Payable Cost of Sales Finance & Insurance Profit Cent Demonstrator & Training Units Delivery Expense Policy Expense Floor Plan Interest 6/30/2017 500 5,600 7,800 90,000 500 499,600 293,500 300 19,300 7,900 69,900 5,100 24,500 136,700 194,900 (325,400) 6,700 41,500 35,600 145,600 (107,000) (77,800) (2,400) (11,400) (22,900) 0 (889,200) 0 (990,200) 0 (17,100) (29,400) (14,700) (100,700) (28,700) (74,600) (29,000) (4.100) (51,300) 137,700 (3,102,200) 2,335,300 (72,500) 300 800 3,800 30,800 (23,200) (39,000) (15,700) (100,700) (28,700) (74,600) (29,000) (4.100) (51,300) 147,000 (3,117,900) 2,394,800 (69,400) 400 7,000 28,000 71600 29,500 72,100 365,000 56,700 29,900 68,800 367,200 50,800 72500 76000 15,800 7,000 16,800 1,400 4,600 3,500 Advertising Compensation Owners' Supervisor Other Salaries & Wages Payroll Taxes Employee Benefits Company Vehicle Expense Office Supplies & Stationary Other Supplies & Tools Contributions Outside Services Laundry & Uniforms Travel Meals & Entertainment Membership, Dues & Subscription Professional Services Freight Telephone Postage Training Bad debt Electronic Data Processing Insurance - Other Taxes - Other Depreciation - Other Equipment - Repairs & Rentals Other Administrative Expenses Rent/Mortgage interest Repairs & Maintenance - Bldgs Depreciation - Building & Impro Taxes - Real Estate Insurance - Buildings & Improv Heat, Light, Power, Water Interest eamed Other Income Cash Discounts Allowed Interest Expense 17,600 6,400 15,400 300 700 3,000 800 200 7,600 4,100 4,700 7,200 500 100 76600 76800 76900 77000 77010 77100 77200 77300 77400 77500 77600 77700 77800 78000 78100 78200 78300 78400 78500 78800 78900 79100 79200 79500 80200 80300 6.900 3,900 5,000 8,500 0 2,600 11,800 300 12,400 700 1,900 10.900 89,800 1,700 3,400 28,800 15,100 19,100 11,900 800 15,500 700 2,500 10,600 70,000 4,400 3,400 28,300 15.200 18,400 (100) 300 16,800 12,700 0.00 (1,000) 16,700 15,000 0.00 90200 Total Net (Income) Loss 34.800.00 43.000,00 Financial Statement Project Your client, Vehicle, Inc., is a vehicle retailer with a fiscal year end of 6/30. In addition to retailing new and used equipment, they offer their customers a full service center to repair and maintain their equipment. They operate as a C-Corporation and maintain their books on the accrual method of accounting and use the income tax basis. As such, they expense small tools and equipment that cost $2,500 or less and expense all routine repairs and maintenance on the building, including improvements under $10,000 or less that 10% of the cost of the system. The only assets that are continuing to depreciate are the non-qualified leasehold improvements which were made in 2008 for $100,000 with A/D of 20.500 and a fence that was place in service in 2008 for 15,000 and A/D of $8,000. The bookkeeper sent a note saying she did not post the previous year's journal entries until 7/15/2017. The trial balance you have includes the prior year final trial balance and the current year unadjusted trial balance from the client. They are located in Centralia, WA. In order to refinance their loan, the bank has requested a compilation with disclosures on the GAAP basis. On the Unadjusted Trial Balance I discovered an error in the title for Account 40000 that account is Sales not Sales Tax Payable. Please make the adjustment. So account 4000 should be $3,117,900 in sales revenue not sales tax payable. (I did a separate announcement on this but wanted to cover it in both locations). 2016 2017 Warranty Robes Now Motocycle watory 215.400 34800 25000 162.400 25.400 Now Sooter inventory New Power antiven Now Other Products Inventory Used Motorcycle ATV. Soler Sub Regis in progress Parte vetory Service Machinery & Eger Accumulated Depression-Servie Parts & Accessories quipment Office Equipment & Futures Company Vehicles and Rentne provements Accounts Payable. Trade Accounts Payable Account Lion and Registration Fees Payab Customer Deposits G Cards Nos Payable Flooring Payroll Payable Sales Tax Payable Payroll Tees Payable 137.000 545 DO 107.000 (140.2003 (22.500) 11.4001 889.2001 1990.2009 23.200) (14,700 (100,1000 N 100,700 . Note Payable-SM 22 (14.600) 14.100 R Additional Paid in Capital ed Earnings Sales Tees Payable Cost of Finance & ProfCent Demonstrator & Training Units 147.000 (3,102,200) 117.00) 253002354 800 XE 71000 72000 72300 72500 72900 75100 718000 Advertising Compensation Owen Supervisor Omer Bar & Wings Payroll Taxes Employee Bents Company Vehicle Expense Office Supplies & Stationary Other Supplies & Tools 78800 Outside Services Laundry & Uniform Mats & Entertainment Membershi. Due & Subtion Bad del Electrone Data Processing Tro -Other Depreciation. Other Equipment Repair & Rentals Omer Admin Expenses Rene Mortgage rest Repair & Maintenance is Depreciation. Buting & Impro Taxes - Real Estate Insurance Building & ont Power. We 88.800 M 19.100 Cash Discounts Allowed 16.700 6/30/2016 500 1,800 47,300 695,600 215,400 300 34,800 29,100 105,100 5,500 32,700 162,400 194,100 (325,400) 6,700 39,300 35,600 137,000 (67,400) 20100 20210 20230 22000 22400 23100 23200 23700 24000 24100 25000 25800 26000 27000 28300 28400 28500 28700 28900 29100 30000 30100 32100 32200 32300 32400 32900 33100 33200 33300 35500A 35500B 35500D 35500E 36000 36100 37000 40000 50000 60000 71200 71300 71400 71500 Cash on hand Checking Savings Accounts Receivable Warranty Receivables New Motorcycle Inventory New ATV Inventory New Scooter Inventory New Power Equipment Inven New Other Products Inventory Used Motorcycle, ATV, Scooter Sublet Repairs-RO's in progress Parts Inventory Accessories Inventory Service Machinery & Equipment Accumulated Depreciation Servic Parts & Accessories Equipment Office Equipment & Fixtures Company Vehicles and Rental Uni Leasehold Improvements Accounts Payable - Trade Accounts Payable - Sweep Account License and Registration Fees Payab Customer Deposits Gift Cards Notes Payable - Flooring Bank Overdraft Payroll Payable Sales Taxes Payable Payroll Taxes Payable Note Payable - SH 1 Note Payable - SH 2 Note Payable - SH 2 #2 Note Payable - SH 1 #2 Capital Stock Additional Paid-In Capital Retained Earnings Sales Taxes Payable Cost of Sales Finance & Insurance Profit Cent Demonstrator & Training Units Delivery Expense Policy Expense Floor Plan Interest 6/30/2017 500 5,600 7,800 90,000 500 499,600 293,500 300 19,300 7,900 69,900 5,100 24,500 136,700 194,900 (325,400) 6,700 41,500 35,600 145,600 (107,000) (77,800) (2,400) (11,400) (22,900) 0 (889,200) 0 (990,200) 0 (17,100) (29,400) (14,700) (100,700) (28,700) (74,600) (29,000) (4.100) (51,300) 137,700 (3,102,200) 2,335,300 (72,500) 300 800 3,800 30,800 (23,200) (39,000) (15,700) (100,700) (28,700) (74,600) (29,000) (4.100) (51,300) 147,000 (3,117,900) 2,394,800 (69,400) 400 7,000 28,000 71600 29,500 72,100 365,000 56,700 29,900 68,800 367,200 50,800 72500 76000 15,800 7,000 16,800 1,400 4,600 3,500 Advertising Compensation Owners' Supervisor Other Salaries & Wages Payroll Taxes Employee Benefits Company Vehicle Expense Office Supplies & Stationary Other Supplies & Tools Contributions Outside Services Laundry & Uniforms Travel Meals & Entertainment Membership, Dues & Subscription Professional Services Freight Telephone Postage Training Bad debt Electronic Data Processing Insurance - Other Taxes - Other Depreciation - Other Equipment - Repairs & Rentals Other Administrative Expenses Rent/Mortgage interest Repairs & Maintenance - Bldgs Depreciation - Building & Impro Taxes - Real Estate Insurance - Buildings & Improv Heat, Light, Power, Water Interest eamed Other Income Cash Discounts Allowed Interest Expense 17,600 6,400 15,400 300 700 3,000 800 200 7,600 4,100 4,700 7,200 500 100 76600 76800 76900 77000 77010 77100 77200 77300 77400 77500 77600 77700 77800 78000 78100 78200 78300 78400 78500 78800 78900 79100 79200 79500 80200 80300 6.900 3,900 5,000 8,500 0 2,600 11,800 300 12,400 700 1,900 10.900 89,800 1,700 3,400 28,800 15,100 19,100 11,900 800 15,500 700 2,500 10,600 70,000 4,400 3,400 28,300 15.200 18,400 (100) 300 16,800 12,700 0.00 (1,000) 16,700 15,000 0.00 90200 Total Net (Income) Loss 34.800.00 43.000,00 Financial Statement Project Your client, Vehicle, Inc., is a vehicle retailer with a fiscal year end of 6/30. In addition to retailing new and used equipment, they offer their customers a full service center to repair and maintain their equipment. They operate as a C-Corporation and maintain their books on the accrual method of accounting and use the income tax basis. As such, they expense small tools and equipment that cost $2,500 or less and expense all routine repairs and maintenance on the building, including improvements under $10,000 or less that 10% of the cost of the system. The only assets that are continuing to depreciate are the non-qualified leasehold improvements which were made in 2008 for $100,000 with A/D of 20.500 and a fence that was place in service in 2008 for 15,000 and A/D of $8,000. The bookkeeper sent a note saying she did not post the previous year's journal entries until 7/15/2017. The trial balance you have includes the prior year final trial balance and the current year unadjusted trial balance from the client. They are located in Centralia, WA. In order to refinance their loan, the bank has requested a compilation with disclosures on the GAAP basis. On the Unadjusted Trial Balance I discovered an error in the title for Account 40000 that account is Sales not Sales Tax Payable. Please make the adjustment. So account 4000 should be $3,117,900 in sales revenue not sales tax payable. (I did a separate announcement on this but wanted to cover it in both locations) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started