Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what are the answers? 1. A. Prepare a bank reconciliation for R.J. Baldwin & Sons as of December 31 based on the following information. (12

what are the answers?

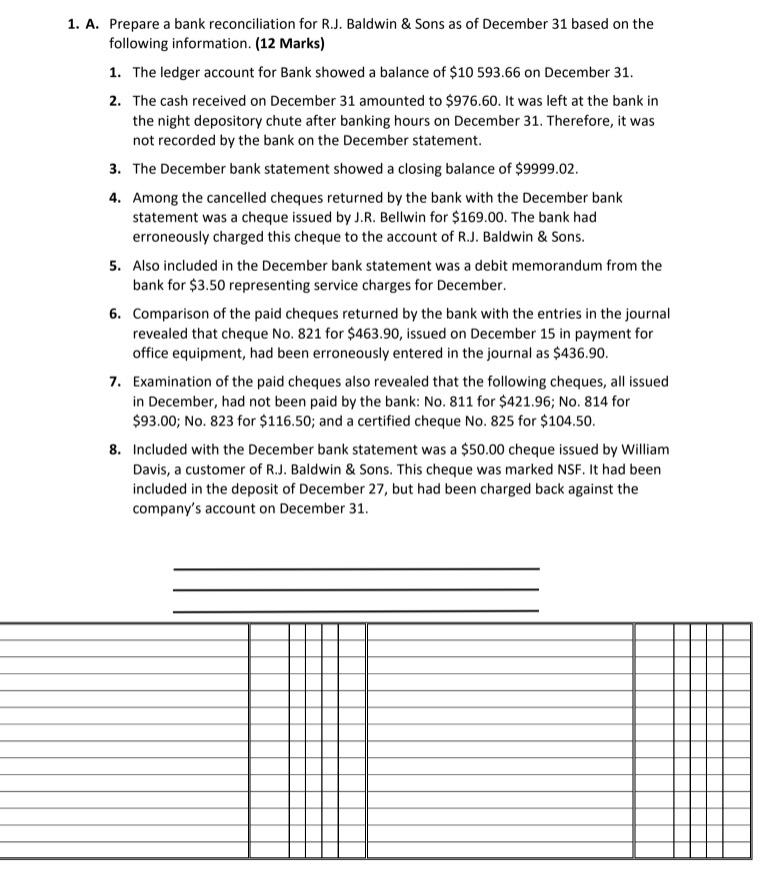

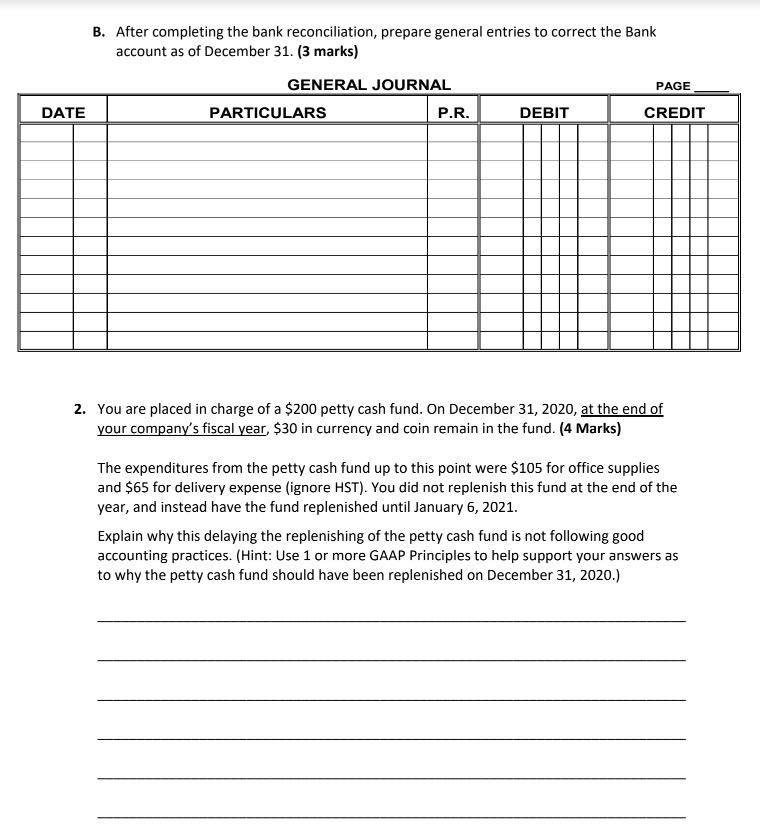

1. A. Prepare a bank reconciliation for R.J. Baldwin & Sons as of December 31 based on the following information. (12 Marks) 1. The ledger account for Bank showed a balance of $10 593.66 on December 31. 2. The cash received on December 31 amounted to $976.60. It was left at the bank in the night depository chute after banking hours on December 31. Therefore, it was not recorded by the bank on the December statement. 3. The December bank statement showed a closing balance of $9999.02. 4. Among the cancelled cheques returned by the bank with the December bank statement was a cheque issued by J.R. Bellwin for $169.00. The bank had erroneously charged this cheque to the account of R.J. Baldwin & Sons. 5. Also included in the December bank statement was a debit memorandum from the bank for $3.50 representing service charges for December. 6. Comparison of the paid cheques returned by the bank with the entries in the journal revealed that cheque No. 821 for $463.90, issued on December 15 in payment for office equipment, had been erroneously entered in the journal as $436.90. 7. Examination of the paid cheques also revealed that the following cheques, all issued in December, had not been paid by the bank: No. 811 for $421.96; No. 814 for $93.00; No. 823 for $116.50; and a certified cheque No. 825 for $104.50. 8. Included with the December bank statement was a $50.00 cheque issued by William Davis, a customer of R.J. Baldwin & Sons. This cheque was marked NSF. It had been included in the deposit of December 27, but had been charged back against the company's account on December 31. B. After completing the bank reconciliation, prepare general entries to correct the Bank account as of December 31. (3 marks) GENERAL JOURNAL DATE PARTICULARS P.R. DEBIT CREDIT PAGE 2. You are placed in charge of a $200 petty cash fund. On December 31, 2020, at the end of your company's fiscal year, $30 in currency and coin remain in the fund. (4 Marks) The expenditures from the petty cash fund up to this point were $105 for office supplies and $65 for delivery expense (ignore HST). You did not replenish this fund at the end of the year, and instead have the fund replenished until January 6, 2021. Explain why this delaying the replenishing of the petty cash fund is not following good accounting practices. (Hint: Use 1 or more GAAP Principles to help support your answers as to why the petty cash fund should have been replenished on December 31, 2020.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started