Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What are the answers of empty fields? Sandhill Inc. had a bad year in 2021. For the first time in its history, it operated at

What are the answers of empty fields?

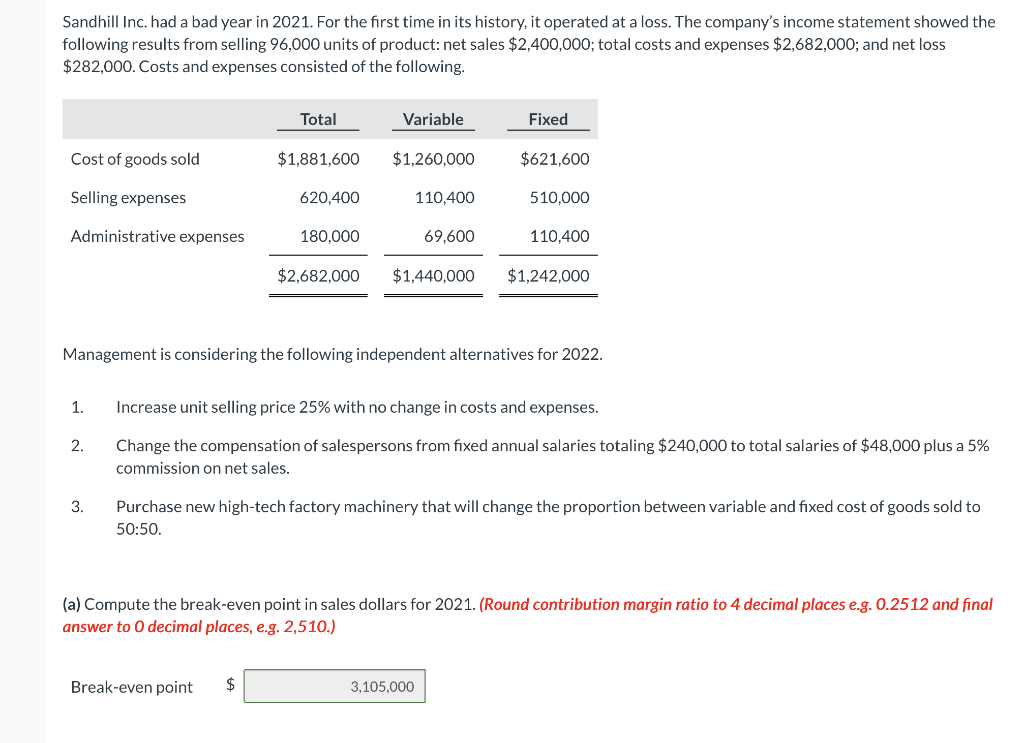

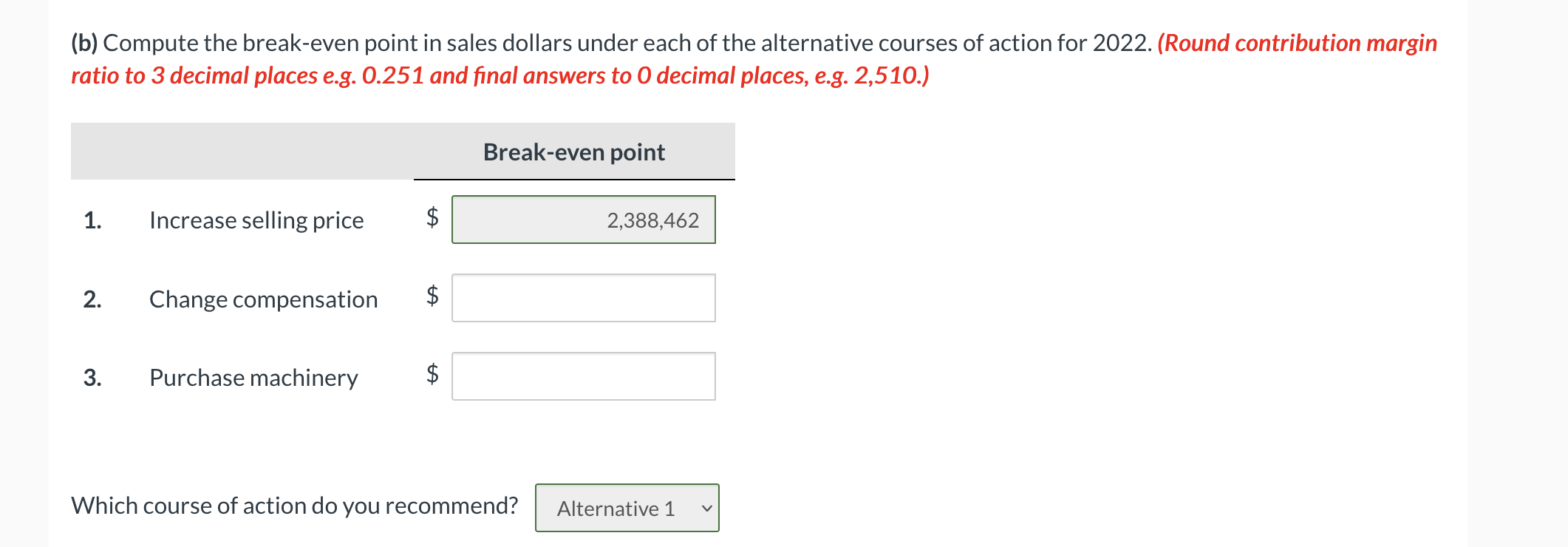

Sandhill Inc. had a bad year in 2021. For the first time in its history, it operated at a loss. The company's income statement showed the following results from selling 96,000 units of product: net sales $2,400,000; total costs and expenses $2,682,000; and net loss $282,000. Costs and expenses consisted of the following. Total Variable Fixed Cost of goods sold $1,881,600 $1,260,000 $621,600 Selling expenses 620,400 110,400 510,000 Administrative expenses 180,000 69,600 110,400 $2,682,000 $1,440,000 $1,242,000 Management is considering the following independent alternatives for 2022. 1. Increase unit selling price 25% with no change in costs and expenses. 2. Change the compensation of salespersons from fixed annual salaries totaling $240,000 to total salaries of $48,000 plus a 5% commission on net sales. 3. Purchase new high-tech factory machinery that will change the proportion between variable and fixed cost of goods sold to 50:50. (a) Compute the break-even point in sales dollars for 2021. (Round contribution margin ratio to 4 decimal places e.g. 0.2512 and final answer to 0 decimal places, e.g. 2,510.) Break-even point $ 3,105,000 (b) Compute the break-even point in sales dollars under each of the alternative courses of action for 2022. (Round contribution margin ratio to 3 decimal places e.g. 0.251 and final answers to O decimal places, e.g. 2,510.) Break-even point 1. Increase selling price $ 2,388,462 2. Change compensation $ 3. Purchase machinery $ ta Which course of action do you recommend? Alternative 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started