Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what are the answers Question 16 (1 point) Limited partnerships... are limited to only three partners. must have at least one general partner. guarantee that

what are the answers

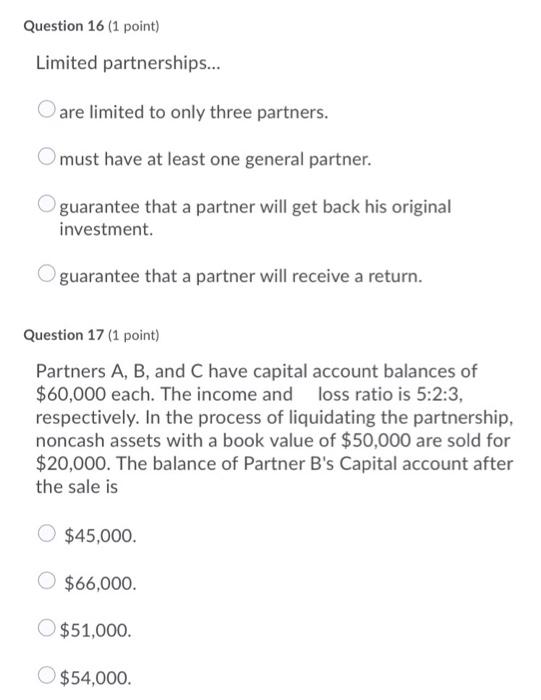

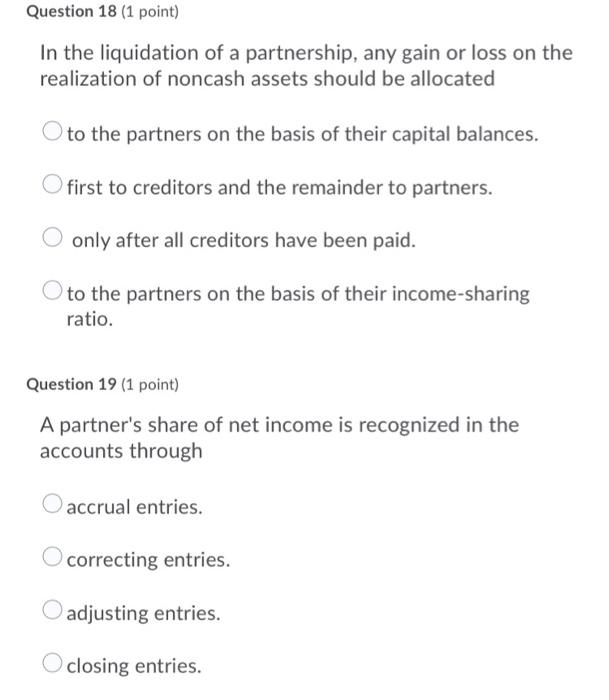

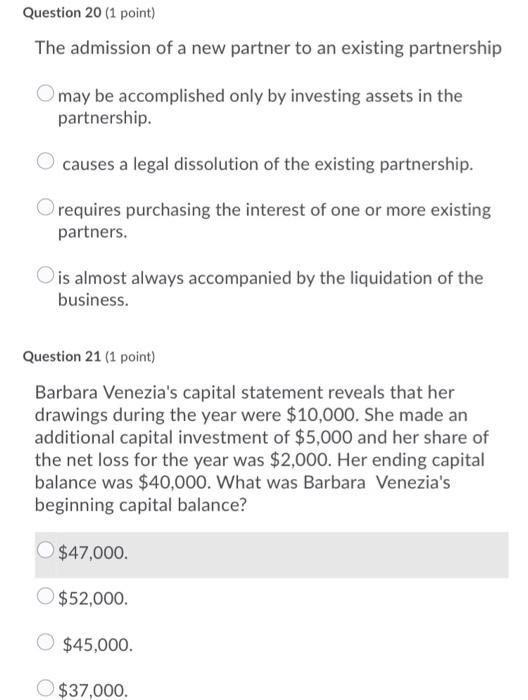

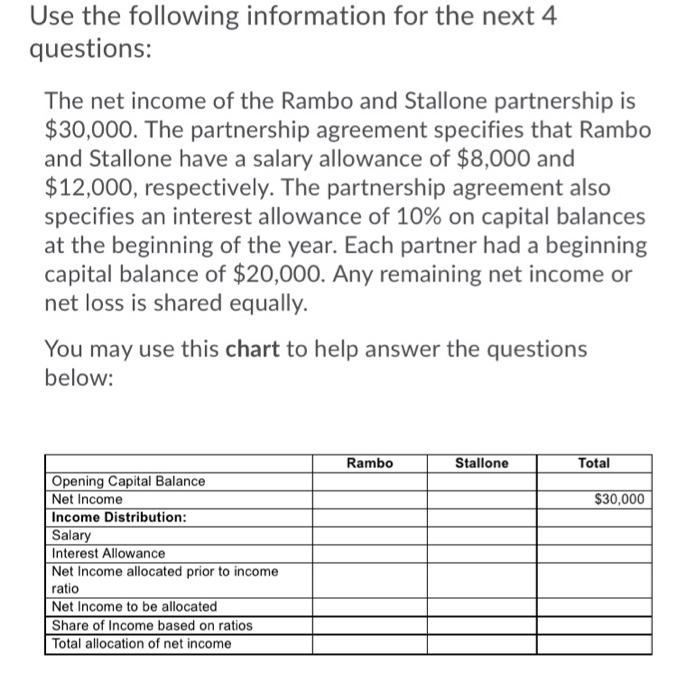

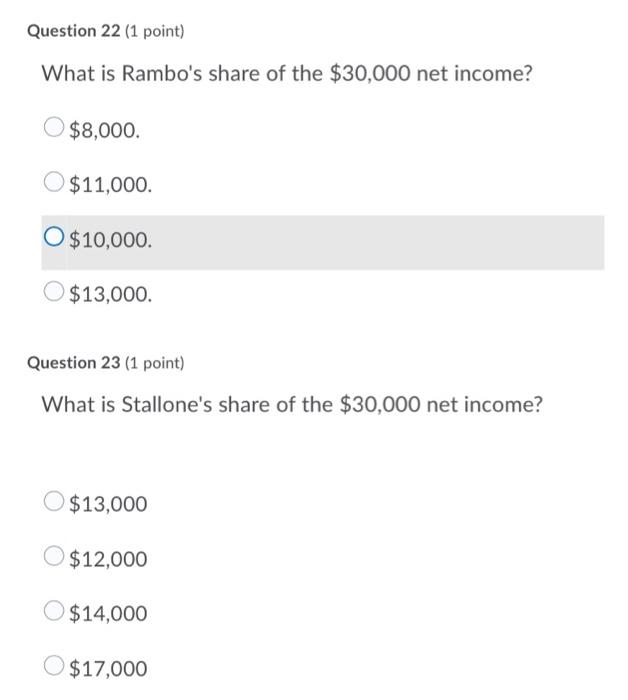

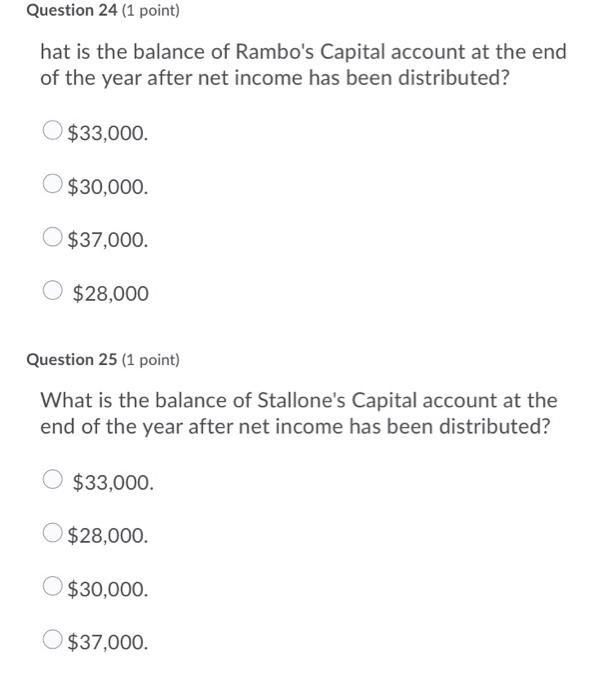

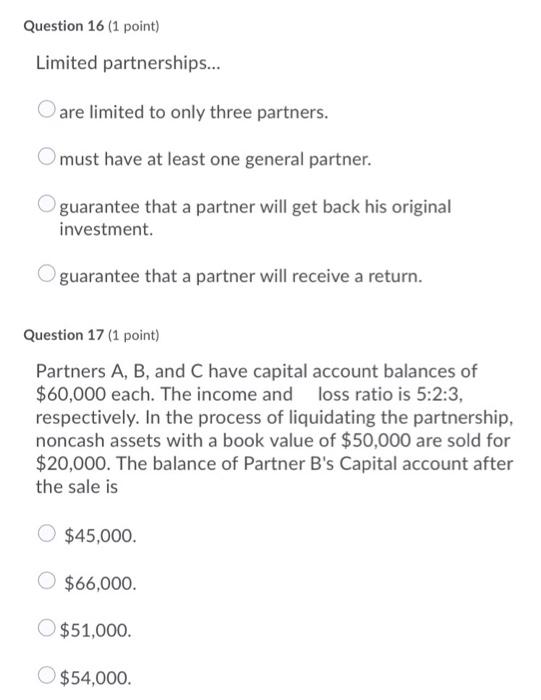

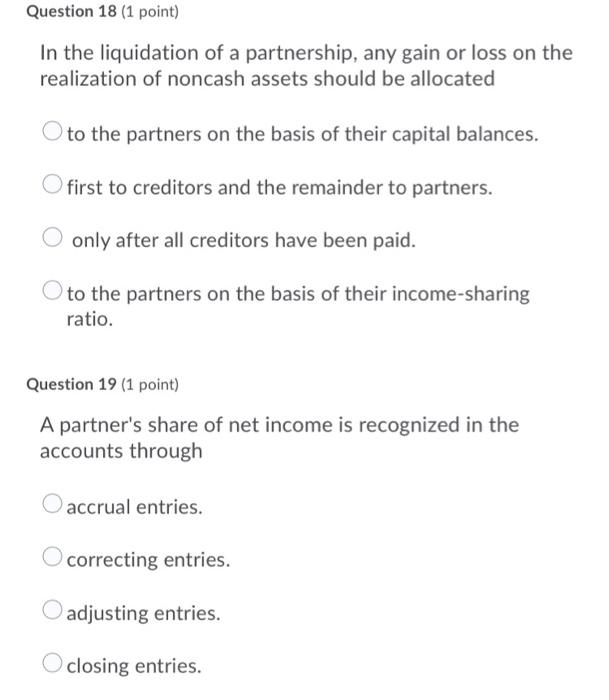

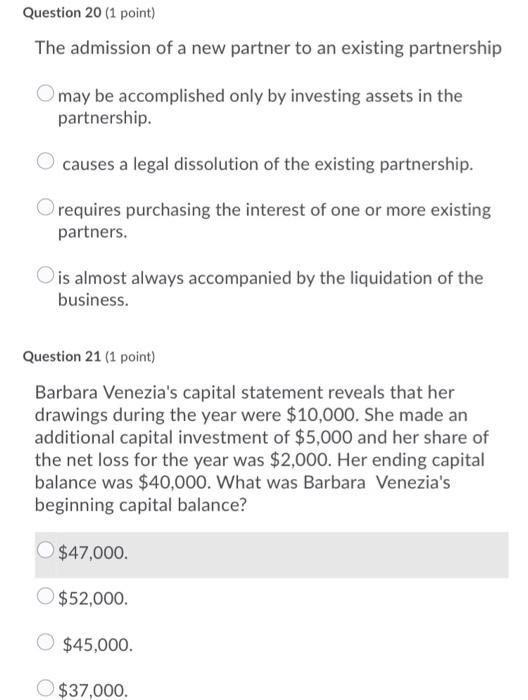

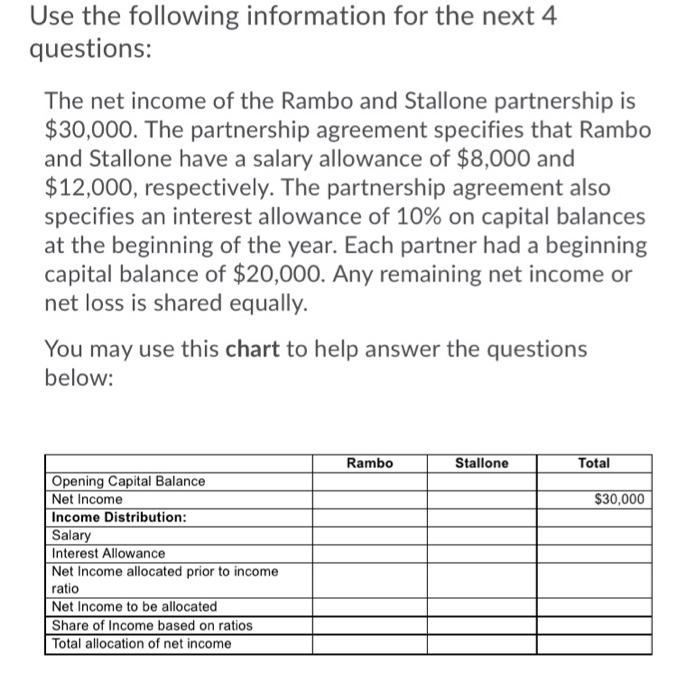

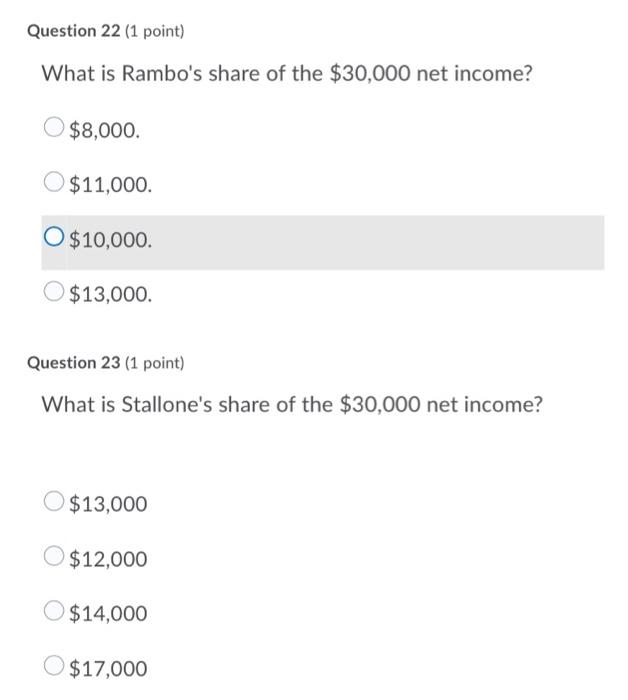

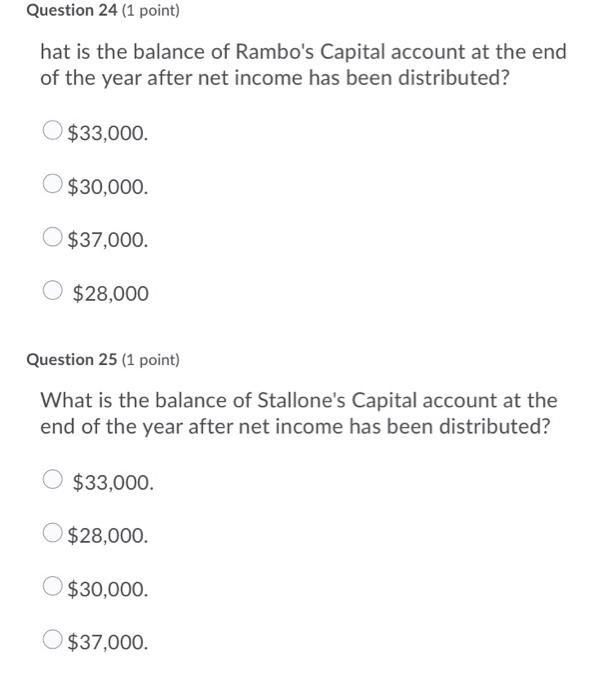

Question 16 (1 point) Limited partnerships... are limited to only three partners. must have at least one general partner. guarantee that a partner will get back his original investment. guarantee that a partner will receive a return. Question 17 (1 point) Partners A, B, and C have capital account balances of $60,000 each. The income and loss ratio is 5:2:3, respectively. In the process of liquidating the partnership, noncash assets with a book value of $50,000 are sold for $20,000. The balance of Partner B's Capital account after the sale is $45,000. $66,000. $51,000. $54,000. Question 18 (1 point) In the liquidation of a partnership, any gain or loss on the realization of noncash assets should be allocated to the partners on the basis of their capital balances. first to creditors and the remainder to partners. only after all creditors have been paid. to the partners on the basis of their income-sharing ratio. Question 19 (1 point) A partner's share of net income is recognized in the accounts through O accrual entries. correcting entries. adjusting entries. O closing entries. Question 20 (1 point) The admission of a new partner to an existing partnership O may be accomplished only by investing assets in the partnership. causes a legal dissolution of the existing partnership. O requires purchasing the interest of one or more existing partners. O is almost always accompanied by the liquidation of the business. Question 21 (1 point) Barbara Venezia's capital statement reveals that her drawings during the year were $10,000. She made an additional capital investment of $5,000 and her share of the net loss for the year was $2,000. Her ending capital balance was $40,000. What was Barbara Venezia's beginning capital balance? $47.000. $52,000. $45,000. $37,000. Use the following information for the next 4 questions: The net income of the Rambo and Stallone partnership is $30,000. The partnership agreement specifies that Rambo and Stallone have a salary allowance of $8,000 and $12,000, respectively. The partnership agreement also specifies an interest allowance of 10% on capital balances at the beginning of the year. Each partner had a beginning capital balance of $20,000. Any remaining net income or net loss is shared equally. You may use this chart to help answer the questions below: Rambo Stallone Total $30,000 Opening Capital Balance Net Income Income Distribution: Salary Interest Allowance Net Income allocated prior to income ratio Net Income to be allocated Share of Income based on ratios Total allocation of net income Question 22 (1 point) What is Rambo's share of the $30,000 net income? $8,000. $11,000. O $10,000. $13,000. Question 23 (1 point) What is Stallone's share of the $30,000 net income? $13,000 $12,000 $14,000 $17,000 Question 24 (1 point) hat is the balance of Rambo's Capital account at the end of the year after net income has been distributed? $33,000. $30,000. $37,000. $28,000 Question 25 (1 point) What is the balance of Stallone's Capital account at the end of the year after net income has been distributed? $33,000. $28,000. $30,000. $37,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started